The Herd is on the Move!

The Herd is on The Move

Being one of the largest retail precious metals dealers in Australia, we are very fortunate to be in a position where we have access to valuable data that can help identify market trends and current market conditions.

We are always looking to see how we can help our customers to make informed decisions with their investments, so we have been working on worthwhile ways to share some of this information.

As a result, we are introducing what we affectionately call the Herdmeter.

Although we readily trade all precious metals including the platinum group metals of platinum, palladium and rhodium, primarily our main volume metals are gold and silver.

Of these 2 metals, we can break retail transactions down into 2 categories; buybacks or Purchases and Sales.

Analysing these metal categories individually, if we look at the history of aggregated weekly volumes over a very long period, we can plot a probability distribution for each category.

A probability distribution is a statistical function that describes all the possible values and likelihoods that a random variable can take within a given range and can be very useful to identify where current conditions are at relative to the norm.

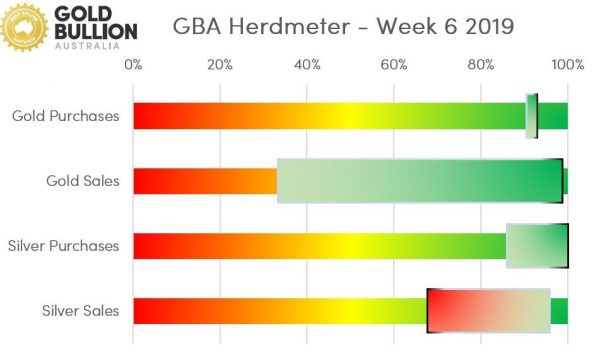

By looking at where the last weeks volumes sit in relation to the overall curve, we can determine how unique (or not) current conditions are compared to the norm. The closer the conditions are to the yellow zone, the more common or average the market conditions are.

Conversely, the further current markets are to both extremes on the charts, the rarer the market conditions are.

Current market conditions per category are indicated on the chart by the vertical dark lines.

The green or red zones indicate where it has moved from the previous week; green indicating an increased move and red indicating a decreased move.

Below is the chart of last week’s market conditions for each of the 4 categories:

Looking at the chart, we are seeing market conditions well above the norm in all categories, with silver oz purchases at record levels. Gold purchases are well within the top 10% of all

trading weeks while gold sales are well within the top 5% of all trading weeks. Silver buybacks were particularly large but have moved up sharply from the previous week, while silver sales dropped backed to still slightly higher than normal from being within the top 5% of all trades the previous week.

All categories are indicating significantly higher activity to the norm, which typically occurs when markets start to move.

We are hoping that depending on where you are placed within your investment cycle, this information may act as a guide to indicate what the market is doing relative to the norm to give you a little more confidence in your decision process. We will look to publish this data weekly and hope it can provide some assistance when making your precious metal investment decisions.

Please call us on 1300 754 602 if you have any feedback or other questions regarding investing in precious metals.

We look forward to hearing from you.