How Cheap is Gold Presently ?

Gold is Presently Cheaper Than in Both 1971 and 2001

By David J Mitchell 27th April 2020

Retail investors, wealth managers and portfolio managers seem to be somewhat perplexed about gold and precious metals’ actual role and why the metals are such an extremely important and essential part of any investment portfolio, but particularly their prospective valuations. Some even believe it is expensive or fully-valued as of today. This perspective is wholly inaccurate and has no basis in fact when using simple mathematics.

I tend to come at the “real” future valuations of gold and precious metals from many different directions, but let’s look at the most obvious valuation metric……

How does one measure the price of gold – how do you recognise when it’s severely undervalued, cost effective, fairly valued or overvalued ?

I have always suggested through analysis that recognising which part of the longer term macro-economic cycle we are in is very much part of that equation, but rather than over-complicating it for our readers, let us recognise as of today how cheap is gold ?

The fact of the matter is I believe I can prove as of today that gold is cheaper that it was in 1971 (40 US$ then), and in year 2001 (260 US$ then), using common sense valuation metrics.

Firstly how do you measure the value of an asset ?

- You measure the value of an asset in how many US$ currency units it will take to buy that asset.

- Now if you reduce the “value” of the currency unit (US$ for example) by over-printing and vastly expanding the monetary base then the US$ currency loses its value against that same asset, which rises in US$ terms (or more commonly referred to as inflation).

Ok so that’s easy enough to understand – so what is gold ? It’s MONEY folks, the US$ is a currency – recognise the definitions.

Do not take my word for it ….

- Gold has been correctly re-classified as a ‘Tier-1 asset’ class last year 2019, by The Bank of International Settlement (BIS), which now recognises central banks’ holdings of physical gold as a reserve Tier-1 asset equal to cash currency, which also affects the classification of gold within the entire global banking system as a whole.

- Gold is the money of last resort as stated recently by the US Federal Reserve, BIS and World Bank, Goldmans, JPMorgan etc… (amongst many others). Gold is predominantly a monetary metal recognised as, and equivalent to real money.

So if gold is real money, then measuring it against the currency in circulation is the only true way of analysing the valuation of the money in currency terms….

If you sum up the total currency monetary base and divide it by physical gold we are looking at the best buying opportunity in 50 years, versus currency units.

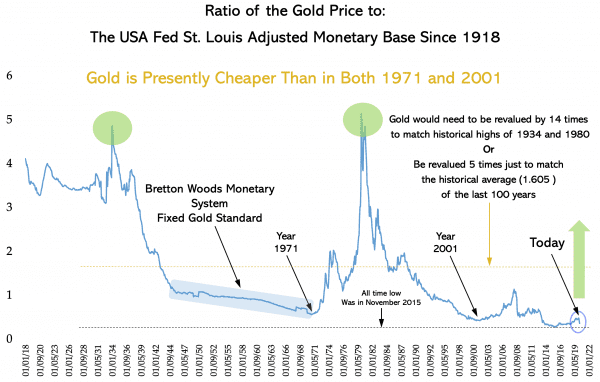

This chart below shows the ratio of the gold price to the USA Adjusted Monetary Base back to 1918. The monetary base

roughly matches the size of the Federal Reserve balance sheet, which indicates the level of new money creation.

Now if I had taken the global measurement of the currency monetary base versus all gold above ground then that chart

would demonstrate an even greater understanding of how undervalued gold is presently.

But obtaining accurate data is very difficult, but for this exercise the USA amply proves the point.

It is estimated that all the gold ever mined above ground is 190,000 metric tonnes, and as of today’s price that is approximately US$10.46 trillion.

Now over the last 2 months when the global pandemic Covid-19 started governments, treasuries, central banks around the world have dramatically expanded the monetary base. We have seen approximately US$8 trillion in new quantitative easing and fiscal expansion globally in the last 8 weeks alone.

This eye-popping monetary debasement will likely fall woefully short of what the actual overall currency debasement will be within the next 12 months.

Across the globe, we are seeing exponential money supply growth thanks to a combination of central bank money printing,politically-directed expansion in bank lending and direct government fiscal expansion all in the guise of MMT (Modern Monetary Theory).

For now, inflation is the least of our worries, but further out, we will lose control of the currency debasement and the inflation dragon will blow flames across our monetary system which has the tallest pile of tinder (debt pile) ever built in all of history.

As of today how undervalued is gold ?….

(but remember as the world continues to debase their currency, the number below rise)

* Gold would need to be revalued 14-times from today’s levels to match the 1934 and 1980 valuation (US$ 24,080 in today’s cash $terms)

* A 5-times revaluation from today’s level to match the historical average of over 100 years (US$ 8,600 in today’s cash $terms)

* A revaluation from today’s level of over 3-times to match year 2008 highs (US$ 5,555 in today’s cash terms).

* Gold is presently trading at the October 2018 lows in ‘monetary base terms’ when it was in fact trading in the market at US$ 1,210 compared to today’s level of US$ 1,720.

* And finally compared to the “all-time” historical lows of 2015 versus the currency monetary base, gold is required to fall to just US$ 1,300 approximately in today’s price to match that extreme low.

Covid-19 has triggered the implementation of MMT (Modern Monetary Theory), which is a process of enormous global

currency and monetary debasement.

I believe that Gold is on the verge of a powerful multi-year cyclical revaluation as it will predominantly be used as hard

physical capital during the re-balancing of the monetary system and debt cycles.

We ‘will’ lose control of the currency debasement and the inflation dragon will blow flames across our monetary system at some point in the future. Be prepared.