Big Profits in Buying Gold, Silver & Platinum in December

Big Profits in Buying Gold, Silver & Platinum in December

Historically Speaking the Seasonal Pattern Persists

By David Mitchell

I have written many times stressing the importance of timing opportunities when investing into precious metals.

We have now walked directly into the optimal buying opportunity of the year- late November into mid-December.

Historically speaking this has proven to be an incredibly profitable trade, which I will clearly demonstrate in the next 3 charts (gold, silver & platinum), see below.

Buying Gold in late November to early December

You can see from the chart above, the dates in each of the last 4 years which proved that the most opportune time to purchase gold is from mid to late November and into early December, and the size of the upwards moves thereafter.

In fact this buying opportunity was also prevalent over the last 20 years, for example……..

• 30th December 2013 to 17th March 2014 = + 17.7 %

• 1st December 2014 to 19th January 2015 = + 14.5 %

While Silver below has proven to be even more dramatic …..

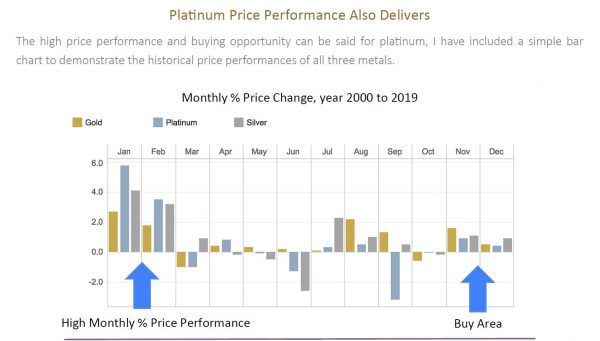

Platinum Price Performance Also Delivers

The high price performance and buying opportunity can be said for platinum, I have included a simple bar chart to demonstrate the historical price performances of all three metals.

Pattern Recognition

Recognising seasonal trading patterns helps maximise clients’ investment prospects when looking for well-defined cycle lows.

These are obviously not written in stone, however with the benefit of hindsight we get to see if the seasonal pattern we have come to expect is repeating itself.

Let’s take a look at what drives metals ( and the present undercurrents facing us), to confirm these patterns will indeed repeat themselves.

Undercurrents Driving Gold Higher

Gold is often misunderstood- generally speaking gold is NOT an inflation hedge and should not be considered so, the precious metal is actually a crisis hedge.

Physical gold is an uncorrelated asset class with no 3rd party liability that is used as an active part of portfolio management.

Gold is predominately a hedge against developments such as a currency crisis, banking crisis, debt crisis, stock market and asset market crisis , sovereign debt crisis and wars (but to name just a few).

In a healthy economy that has sustainable growth patterns (or there is an investment cycle drive into stock markets and property markets) then gold is considered no longer required.

So let us look forward to the relevant risks apparent to asset market valuations ….

Stock Markets & Debt Yields ?

For the institutional investor and pension fund manager and their prospective investment returns moving forward; considering the present zero bound interest environment.

Sovereign debt markets do not furnish them with any yield plays, and capital appreciation at this stage of the game is not on the table considering where rates are.

Your USA 10 Year bonds pay exactly +1.77% each year for the coming 10yrs, while

the Switzerland 10Y Government Bond has a – 0.649% yield. The Germany 10Y Government Bond has a –0.368% yield. Gulp !

And what of stock market valuations ?

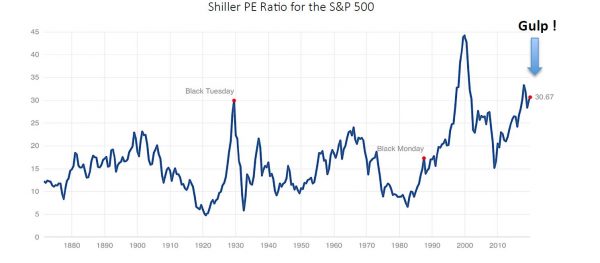

The USA S&P 500 Shiller Price-to-Earnings Ratio is 30.67 (overvalued territory) which implies over a -2% compound annual return over the coming 8yrs to return the ratio to its 16.67 mean. Not all things return to mean of course.

If the Shiller P/E is 50% above mean in 8yrs, it implies a nearly +3% annualized S&P 500 return. And if it falls 50% below mean, stocks annualize at roughly – 10% per annum for the coming 8yrs.

Of course, it’s possible a new bull market has begun (as some investors believe). But in the last 150 years, only secular bear (falling) markets have started with the Shiller P/E above 30 (as of now), while secular bulls (rising) all began with the Shiller P/E between 5-10 ( again compared to today’s valuation – Gulp ! ).

Although the vast money printing policies and zero interest rates starting in year 2010 to 2011 started the bull market in stocks, it started from a PE of just below median of 15.

* Note: Price earnings ratio is based on average inflation-adjusted earnings from the previous 10 years, known as the Cyclically Adjusted PE Ratio (CAPE Ratio), Shiller PE Ratio, or PE 10. see Here

We have a global debt crisis and stock markets are very richly valued indeed presently – how does one hedge their portfolio considering these market conditions I wonder, precious metals ?

The large successful portfolio managers are making big plays in their positioning not only in long gold, but …..

Ray Dalio Founder of Bridgewater Fund Makes $1.5 Billion Options Bet on Falling Stock Markets

World’s largest hedge fund takes in a big bearish trade; the fund is using options to wager that either S&P 500, Euro Stoxx 50 — or both — fall by March 2020

See articles here and here…

The 2020’s are set to be an economic turning point, says global banking giant Bank of

America Merrill Lynch (BAML)

The 2020s are set to be a decade of dramatic economic and social upheaval, reversing many of the trends of the past 40 years, according to one of the world’s largest banks.

Key points:

Bank of America Merrill Lynch says the era of globalisation from 1981-2016 has ended and is now reversing.

The bank’s analysts expect inflation and interest rates to increase from their current 5,000-year lows.

The bank is expecting wealth inequality to fall next decade as voters demand redistribution and taxes rise in what it describes as “the decade of peak”, BAML analysts say a range of economic and social challenges are “all heading to a boiling point” next decade.

“We enter the next decade with interest rates at 5,000-year lows, the largest asset bubble in history, a planet that is heating up, and a deflationary profile of debt, disruption and demographics,” the report warns

In Conclusion

Over the last 20 years November & December have proven to be excellent buying opportunity months for gold, platinum and silver, even within the larger bear market of 2011 to 2015.

Also there is more than a compelling macro-economic environment supporting further investment demand and flow into the precious metals, and hence exceptional price appreciation.

Global debt picture is deteriorating rapidly with deficit control being ignored with the newly found passion for embracing Modern Monetary Theory (MMT) by governments and monetary authorities.

MMT is in effect debt monetisation which is now on its way with unknown consequences (however, well-recorded historical past experiments in debt monetisation culminated in disastrous currency value destruction).

It may indeed be a great time to give our team a call.

I have taken a snapshot of an article written by Doug Casey below, he expresses himself quite eloquently….

Inflation is the work of government alone, since governments alone control the creation of currency.

In a true free-market society, the only way a person or organization can legitimately obtain wealth is through production. “Making money” is no different from “creating wealth,” and money is nothing but a certificate of production.

In our world, however, the government can create currency at trivial cost, and spend it at full value in the marketplace. If taxation is the expropriation of wealth by force, then inflation is its expropriation by fraud.

To inflate, a government needs complete control of a country’s legal money. This has the widest possible implications, since money is much more than just a medium of exchange. Money is the means by which all other material goods are valued.

It represents, in an objective way, the hours of one’s life spent acquiring it.

And if enough money allows one to live life as one wishes, it represents freedom as well. It represents all the good things one hopes to have, do, and provide for others. Money is life concentrated.

As the state becomes more powerful and is expected to provide more resources to selected groups, its demand for funds escalates.

Government naturally prefers to avoid imposing more taxes as people become less able (or willing) to pay them.

It runs greater budget deficits, choosing to borrow what it needs. As the market becomes less able (or willing) to lend it money, it turns to inflation, selling ever greater amounts of its debt to its central bank, which pays for the debt by printing more money.

As the supply of currency rises, it loses value relative to other things, and prices rise.

The process is vastly more destructive than taxation, which merely dissipates wealth. Inflation undermines and destroys the basis for valuing all goods relative to others and the basis for allocating resources intelligently.

It creates the business cycle and causes the resulting misallocations and distortions in the economy.

Whether it’s groceries, medical care, tuition or rent, it seems the cost of everything is rising. It’s an established trend in motion that is accelerating, and now approaching a breaking point.

At the same time, the world is facing a severe crisis on multiple fronts.

Gold is just about the only place to be. Gold tends to do well during periods of turmoil—for both wealth preservation and speculative gains.