METALS, STOCKS & BONDS

Update from David Mitchell

With the global debt bubble expanding exponentially faster than global wealth numbers or global growth metrics we have to re-evaluate asset prices on a near daily basis to discover where we are and what are the immediate risks and pitfalls.

The U.S. bond market has been in a 38-year bull market. During this time, the 10-year yield had oscillated about its falling trend with amazing consistency and a standard deviation around this trend has provided excellent counsel surrounding whether yields were too high or too low. Moreover, the “trend” of bond yields has also been useful in assessing whether the stock market was too high or too low. That is, perhaps the “trend” can help warn equity investors when yields near a level which may bite?

Since 1980, when the 10-year bond yield was more than one standard deviation below its trend, the S&P 500 average annualized gain in the ensuing year was a robust 14.25%! When the 10-year yield was within either one standard deviation above or below trend, the stock market’s average annualized gain in the subsequent year was still a healthy almost 10%. However, when the bond yield was more than one standard deviation above its trend, the stock, market in the following year only provided a paltry 2.71% average annualized gains. Moreover, whenever yields were higher than one standard deviation above trend, the stock market declined in the ensuing year 43% of the time compared to only about 19% the rest of the time!

Within the last month, the 10-year Treasury bond yield has risen beyond one standard deviation above trend (currently at 2.44%). Consequently, despite ongoing strength in equity prices, the recent rise in yields may already be starting to pressure the stock market. Although few perceive bond yields are yet problematic for stocks, the bond market’s historic “trend” suggests they could pack a Bite!

or …..

Daily Sentiment Index in the NASDAQ 100 this week (as at 19 Jan 2018) was 96% which means there were just 4% bears. That is an all-time high in the history of DSI .The March 2000 high was 92%.

Presently the stock markets are richly valued beyond imagine breaking historical metrics right left and centre.

Meanwhile inflation is picking up very strongly, debt markets are cracking and the global sovereign debt crisis is the ever-present looming shadow slowly blocking out the light.

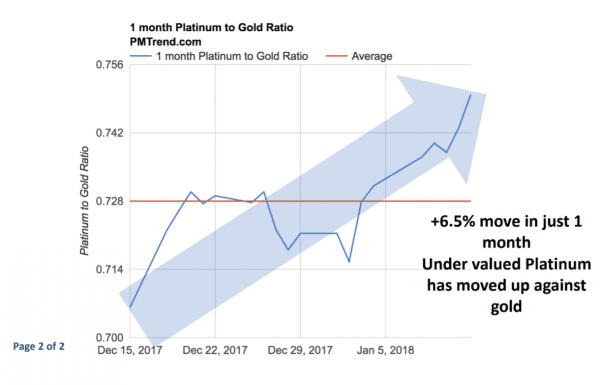

Meta ls are performing as expected, Platinum has outperformed the other metals as I predicted and warned our client base. Platinum could double in price without gold moving and still look cheap based on historical ratios !!

ls are performing as expected, Platinum has outperformed the other metals as I predicted and warned our client base. Platinum could double in price without gold moving and still look cheap based on historical ratios !!

DOWNLOAD my “Why Buy Platinum” eBook

Rhodium, Indium and Ruthenium are extremely tight and prices at these new levels (after significant appreciations that my client base has caught the benefits directly from buying the lows on our advice) are presently holding extremely well. Market is getting used to these new levels psychologically before the next upsurge in prices based on continued real demand and market shortages.

Silver is an exceptional investment at these levels, I understand completely the frustration of price movement this last 12 months, but recognising this market potential for future prices is paramount. I find this market very exciting presently as far as opportunity is concerned, the downside is literally non-existent and upside price appreciation is huge.

Technically, silver is ripe for a major breakout to the upside in 2018. The CFTC figures Managed Money positions show that COMEX silver has been in a net short for three straight weeks since 12th December. This is not unheard of but is relatively rare for silver; the last time COMEX silver was net short was between the end of June and the first week of August 2015. As investment sentiment can swing from one extreme to another, and given silver’s innate volatility, this net short position should point to the possibility of a sharp short-covering rally. Looking back at the corresponding period in 2015, silver price was trading at $15.61/oz on the 7th July, and it was the third consecutive week recording a net short position. Approximately a year later, silver was trading over $20/oz in July 2016… [T]he current poor sentiment does suggest that silver could be one of the better performing precious metals in 2018, barring any crisis that could trump most of the commodities but gold.

ABOUT DAVID MITCHELL

David Mitchell – Managing Director

David Mitchell is a friend and respected colleague of Gold Bullion Australia.

David has nearly three decades of experience and expertise in the financial markets working for some of the world’s leading international banks, some of his most notable roles have been as Head of Proprietary Trading Europe and Head of Spot Trading Asia-Pacific at HypoVereinsbank AG, Chief Dealer and Manager of the G10 Desk at HSBC, and Chief Dealer of the forex Desk at NationsBank Group Singapore. David brings his knowledge and energy to the role of Managing Director of Baird & Co Asia and is a Founder and Non-Executive Director of Indigo Precious Metals

IPM Group indigopreciousmetals.com, trade in the physical precious metals and is primarily focused on the supply and physical delivery of investment grade precious metals directly to customers.

IPM and GBA work closely in offering solutions for investors to trade and store precious metals including offshore vaulting of Palladium and Rhodium.

IPM Group has a presence in Singapore and Malaysia; where they are the official distributor of Baird & Co of London and hence a partner of GBA who is an official distributor of Baird & Co in Australia.

Indigo Precious Metals

We are not tax advisers and we would always recommend you seek out independent tax advice. This guide is only meant to be used as an aid and an introduction to physical precious metals investment.

Disclaimers :

IPM Group Pte Ltd. 30 Cecil Street, #19-08 Prudential Tower, Singapore, 049712, Company Registration No: 201428070N. All rights reserved. Any reproduction, copying, or redistribution, in whole or in part, is prohibited without written permission from the publisher.

The information contained herein is believed to be reliable, but its accuracy cannot be guaranteed. It is not designed to meet your personal situation – we are not financial advisors, nor do we give personalized advice.

The opinions expressed herein are those of the publisher and are subject to change without notice. It does not take into account the particular circumstances, investment objectives and needs for the investment of any investor, or purport to be comprehensive or constitute investment advice and should not be relied upon as such. You should consult a financial adviser to help you form your own opinion of the information, and on whether the information is suitable for your individual needs and aims as an investor. You should consult appropriate professional advisers on any legal, taxation and accounting implications before making an investment.