A Confluence of Events in Silver Are Coming Together

By David Mitchell, March 2018

Industrial Metal Pricing Surges Higher

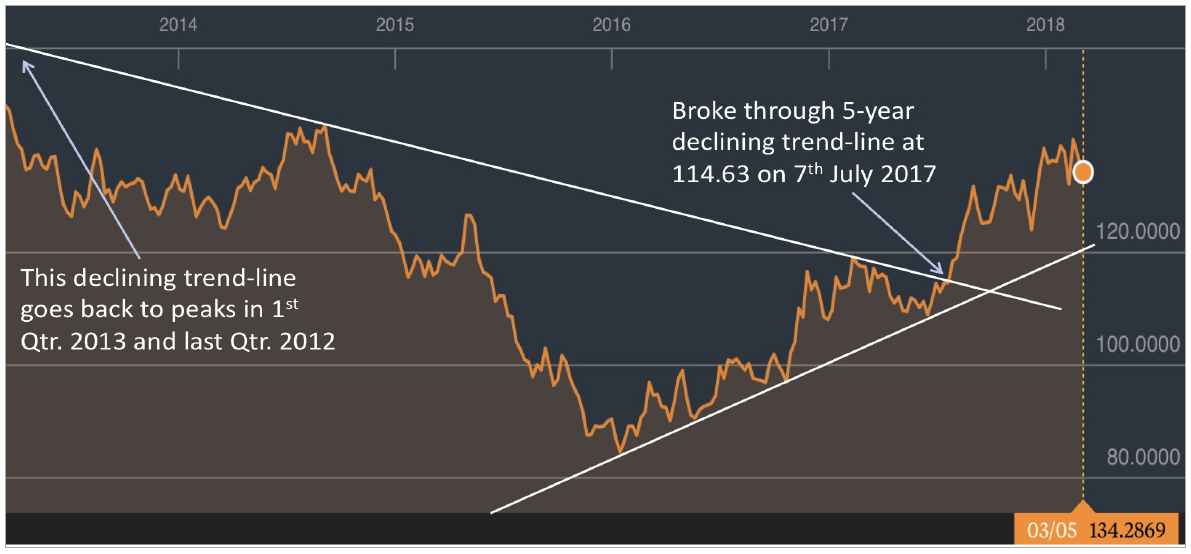

Industrial metals broke higher through an important five-year downtrend line as of 7th July 2017 and is solidly within a significant uptrend. Copper has been one of the driving forces with futures trading on the Comex market raced higher as global supply disruptions come back into view and large-scale speculators place huge bets on rising prices.

The price chart below is a Bloomberg index BCOMIN:IND

Formerly known as Dow Jones-UBS Industrial Metals Subindex (DJUBSIN), the index is composed of futures contracts on aluminium, copper, nickel and zinc. It reflects the return of underlying commodity futures price movements only. It is quoted in USD.

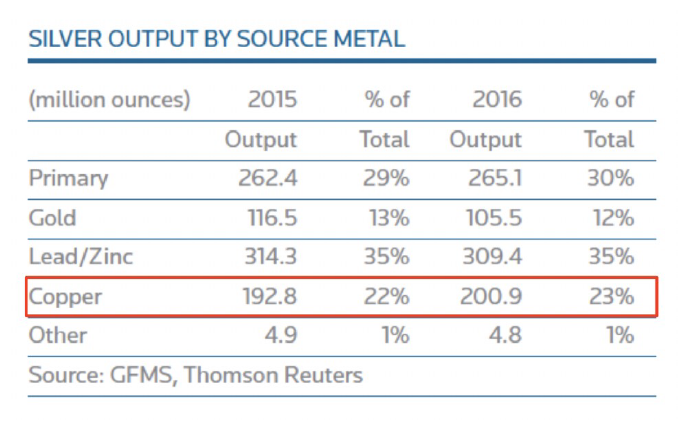

So why am I concentrating on this particular index and metals group? Quite simply, apart from 30% of silver production coming from primary mining and 12% from gold mining, near 57% of silver production comes from the bi-product mining of Lead, Zinc and Copper.

This index has surged +65.6 % since its lows on 15th January 2016 of 84.5825, presently trading at 134.31 or +58.8% from January lows.

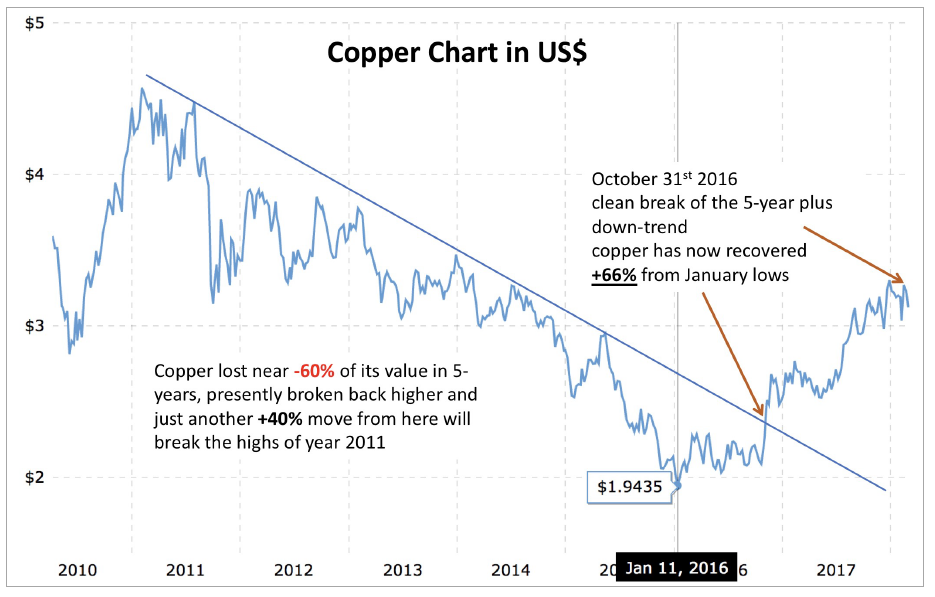

Copper Prices

Copper’s 2018 year to date gains in percentage terms now top +25% and the red metal has recovered +66% in value after falling to six-year lows below $2.00 a pound in January 2016.

So how well has silver done since its January 2016 low, as of today US$ 16.57 it’s trading at only + 21 %.

So why do silver investors care what copper or the industrial metals are doing?

Well just as a little reminder….

Global Copper, Silver & Gold Mining Production Ratios For 2016:

Copper = 19,400,000 metric tons (704 times silver)

Silver = 27,551 metric metric tons (8.5 times gold)

Gold = 3,236 metric tons (Copper / Gold mining ratio is 6,000 times)

Source: USGS, WGC, GFMS & Thompson Reuters(Information: 32,150.75 troy ounce in 1 metric ton)

As we can see, the world produces over 700 times more copper than silver. The premise that the price of gold and silver should be based upon their production ratio of 8.5 to 1, is not currently true as the price ratio is closer to 80 to 1 … nearly nine times higher.

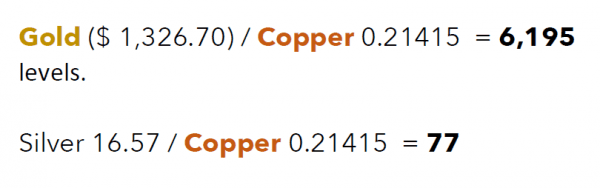

Well, let’s have a look at what the price ratio’s are telling us?

The price of copper as 5th March 2018 is 3.122 US$ per Ib, to covert this to grams you have to divide by 453.5923 (Avoir-Pounds) and then multiply by 31.1035 to derive the price per oz which is 0.21415.

Nearly spot on to global production

Over 9 times undervalued compared to global production levels!

In fact, the low in 2008 of Silver on 16th October after the enormous capitulation of silver before the 500% plus move into 2011, saw a low of US$ 9 and a price of 1.6750 Ib in copper on the same day.

(1.6750 / 453.5923 * 31.1035 = 0.11485)

Silver 9.00 / Copper 0.11485 = 78.36

Conclusion

Now if I have completely lost you, then please let me bullet point as this is a huge point and historical…

- Gold / Copper price ratio matches the mine production ratio near spot on.

- Silver / Copper price ratio effectively under-values silver by over 900% compared to mine production.

- The enormous near -60% capitulation of silver in 2008 before the enormous revaluation higher in 2011 saw a low of the Silver / Copper ratio of 78.36 and today’s it’s 77!!!

- The key industrial metals all involved in the bi-product production of silver have broken a significant long-term downtrend and have made significant moves higher, silver is a vital strategic industrial metal – this cannot be ignored and clearly gives us lead indicators.

It does not get much better than this as a long-term buying opportunity.

Its presently widely reported in the market of the healthy supply of silver sitting idly, slowly being absorbed by long-term buyers, jewellery industry, India, China and strategic long-term buying.

But historically silver is presenting a number of seriously undervalued messages, a longer-term stance and recognition of this opportunity is merited and deserved.

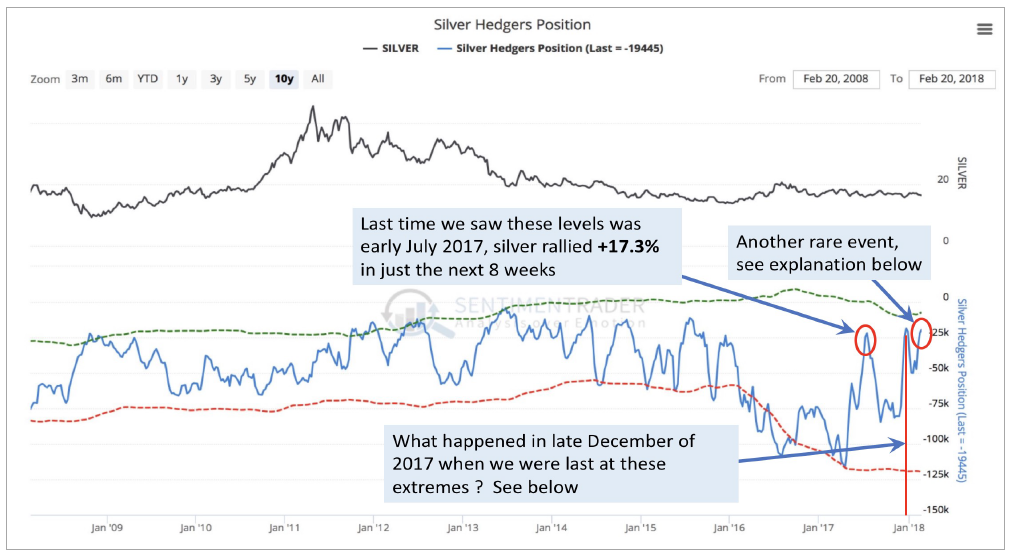

Let’s start simply with the following, Commercial (bank short positions) at historical lows…

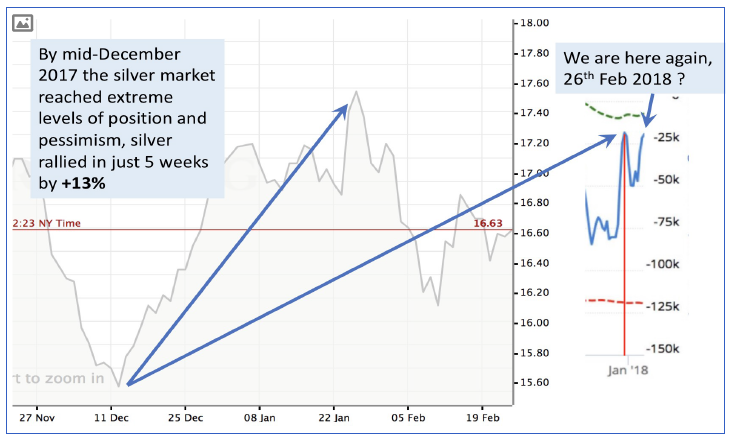

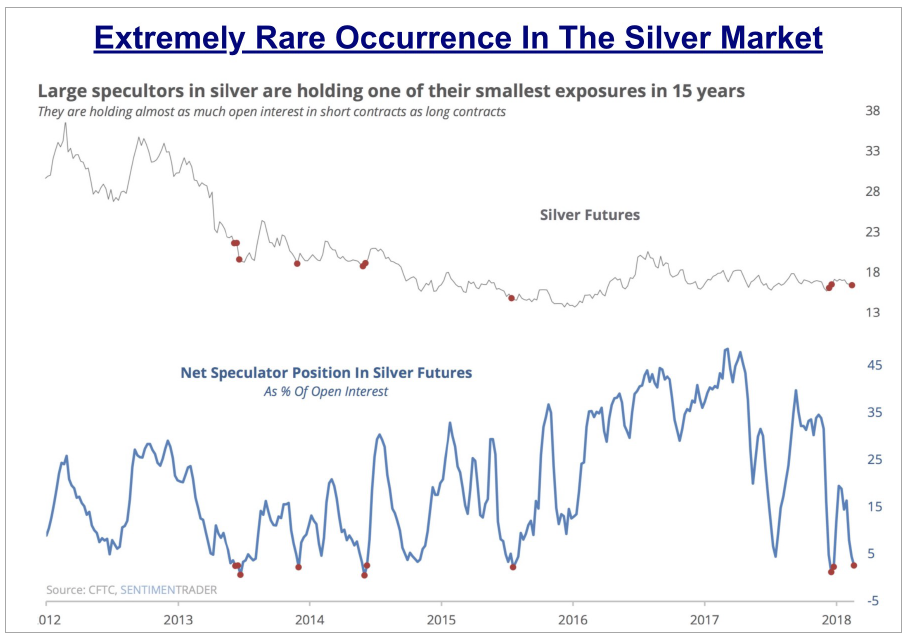

Or let us look at speculators, the smallest position in 15 years!!

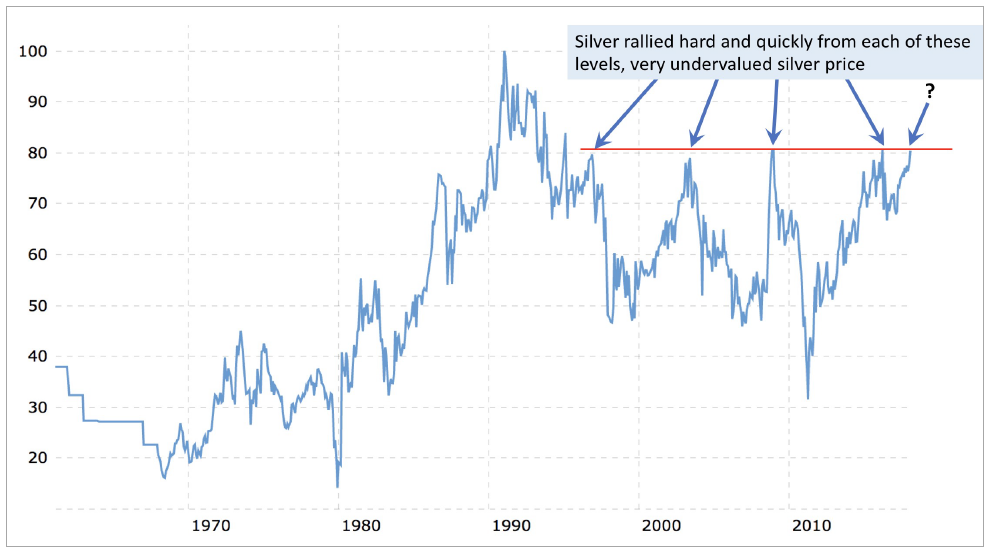

What about the Gold Silver Ratio – What is that telling us?

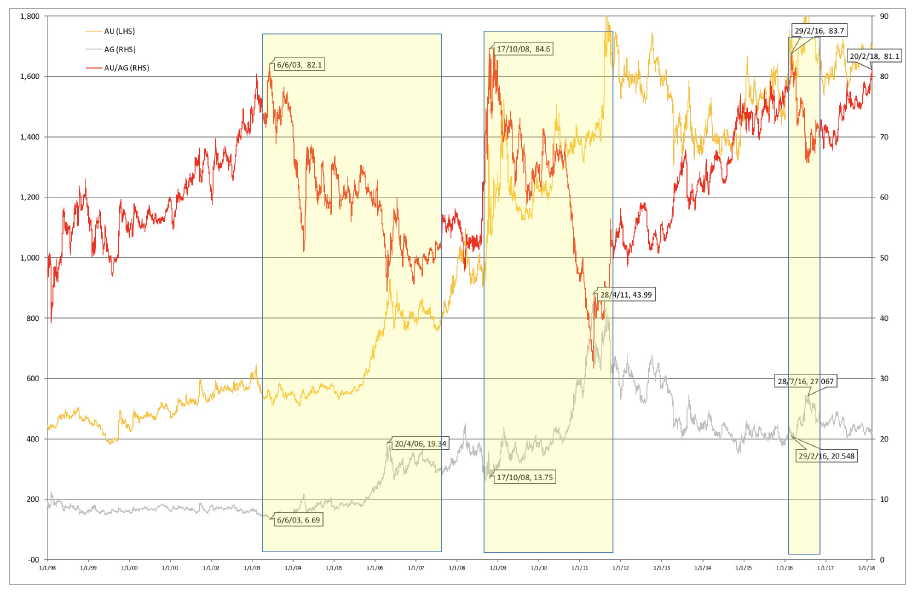

Or a more detailed look at the Gold Silver Ratio ….

So in the three yellow boxes above, each time Silver reached this important level of approximately 81 to 1 price ratio of gold to silver.

- 1st box – Silver rallied near 3 times in value or + 290 %

- 2nd box – Silver rallied over 3 times in value or + 320 %

- 3rd box – Silver rallied but only + 32 % in this particular event

What about mining and cost of production?

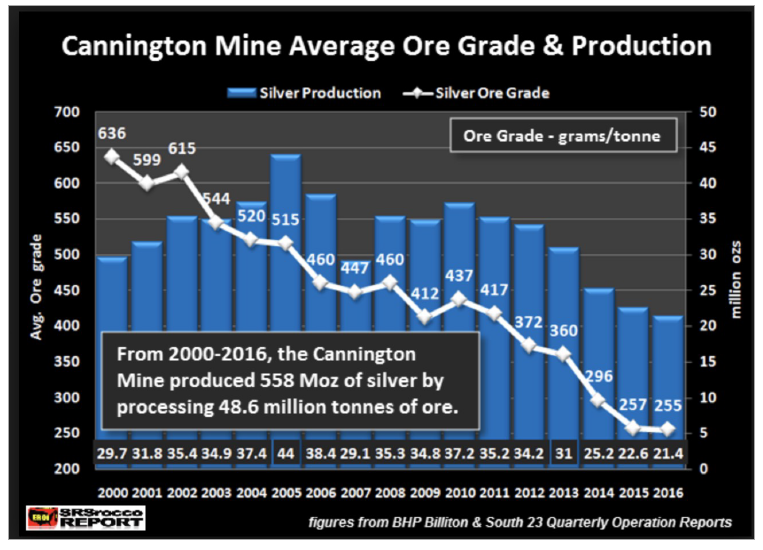

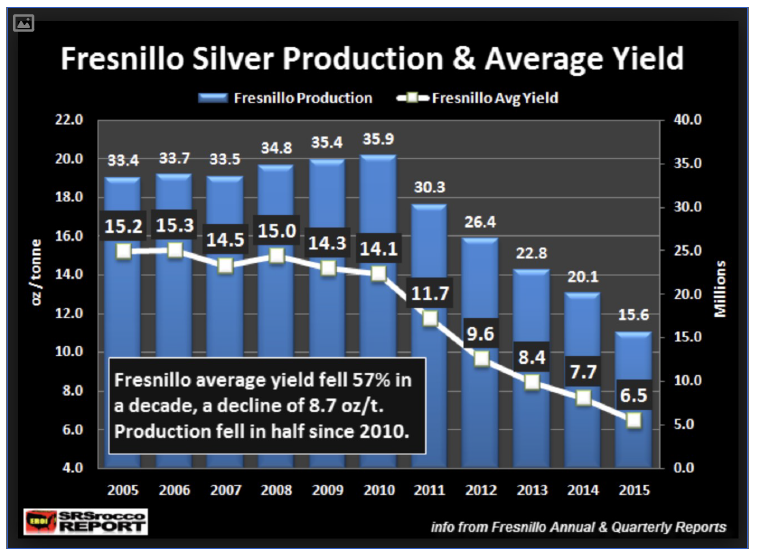

The changes that have taken place in the world’s two largest silver mines, the Cannington Mine in Australia and the Fresnillo Mine in Mexico. Falling ore grades and rising energy costs have contributed to the doubling and tripling of production costs at many silver mining

companies. Investors who believe it still only costs $5 an ounce to produce silver, as it did in 1999, fail to grasp what is actually taking place in the silver mining industry, with full primary mine silver production closer to 17 US$ levels.

See below for Cannington mine…

Wow….. – ore grade degradation of 20.45 oz per tonne to presently 8.20 oz, a – 60% fall in ore grades with an obviously massive increase in cost production.

Fresnillo… – ore grade degradation of 15.2 oz per tonne to presently 6.5 oz, a – 58% fall in ore grades with an obviously massive increase in cost production.

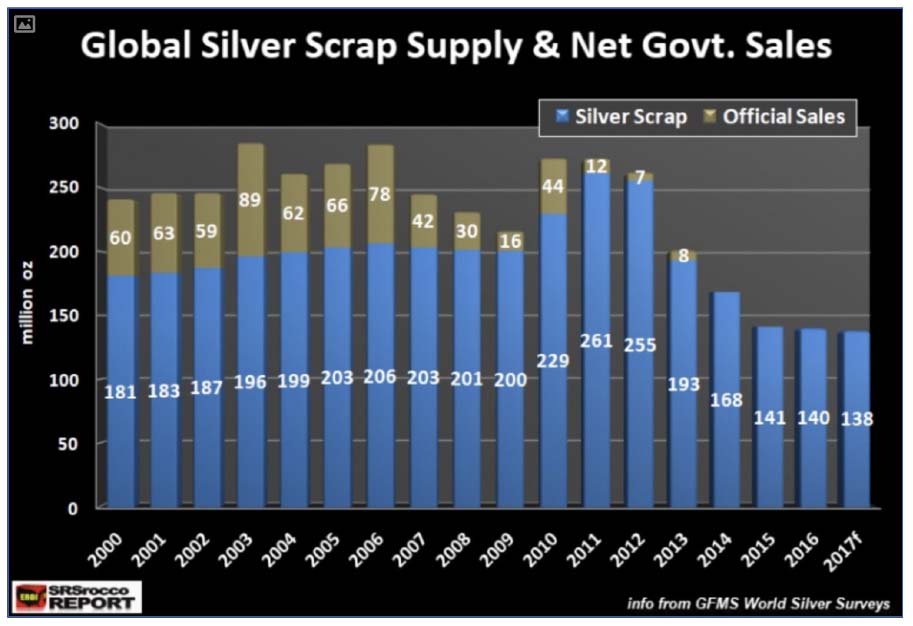

What about global silver scrap and net government sales?

Scrap silver sales globally have fallen dramatically from the highs of year 2011 and 2012, but more importantly is -30% lower than in the early part of the millennium years when silver was trading around 5 US$, today it’s 17 US$ and yet silver scrap supply has fallen dramatically.

Government sales have vanished altogether from the year 2014 onwards, confirming what we already know that official holdings of silver have sold down to near zero already.

Cycle analysis is pointing very clearly to the GSR (Gold/Silver Ratio) dropping to below 30 over the next few years, mix that with 17 years of consecutive global yearly supply / demand deficits in silver (which net government sales have filled the gap the deficit gap previously, but not anymore) and the fact that ‘real’ mine production is running a global Gold Silver Ratio of just below 8 to 1, and of course the fact silver cost production is rising very quickly.

Well you get the picture! Yes, gold is going to appreciate dramatically over the next few years driven by the global debt crisis and counterparty liability crisis, but platinum and silver are clearly looking to outperform percentage wise any gold moves.

An opportunity indeed!

Why Indeed Silver?

The Critical Strategic Metal

Pharmaceuticals

Silver is leading a revolution in technology and medicine. The white metal’s unique bacteria-fighting qualities are becoming more and more critical in healing conditions ranging from severe burns to Legionnaires Disease. In fact, the most powerful treatment for burns is silver sulfadiazine, which is used in every hospital in North America to promote healing and reduce infection. Everything from surgical threads to bandages and dressings to doctors’ coats and catheters are utilizing silver. In hospitals and homes, silver in ductwork provides maximum sterile atmosphere.

Electrical

Silver is the best electrical conductor of all metals. Because it does not corrode, its use in electrical and motor control switches is universal. A fully-equipped automobile may have over 40 silver-tipped switches to start the engine, activate power steering, brakes, windows, mirrors, locks and other electrical accessories

Chemical Catalyst

Silver is also one of the few elements that improve the efficiency of chemical reactions. It is the only catalyst that will oxidize ethylene gas into ethylene oxide, the building block for polyester textiles used for clothing and speciality fabrics, and melded items like computer keyboards, electrical control knobs, domestic appliance components and Mylar tape used for all audio, VCR and recording tapes. Nanotechnology applications using silver are growing — in computers, communications, miniature motors and switches.

Reflectants

Silvered windshields in homes, cars and office buildings reflect away some 70% of the solar energy that would otherwise pass through, thus reducing the load on air conditioners. The U.S. Department of Energy’s Energy Star Program has spurred 50% increase in silver-coated glass in past six years, translating to 350 million square feet of glass, or five million ounces of silver per year.

Industrial

Silver is the ideal industrial material. No other metal has silver’s combined strength, malleability and ductility, or facilitates electrical and thermal conductivity as well, or can reflect light and endure such extreme temperature changes. Jet engines of today and tomorrow can depend on silver-coated bearings for their performance and safety. All major jet engine manufacturers utilize these high-performance silver bearings, which provide critical fail-safe lubrication required by the Federal Aviation Administration.

Printed Circuitry

Printed circuit boards (PCBs) use silver for connecting paths of electronic circuitry. PCBs are essential to the electronics that control the operation of aircraft, automobile engines, electrical appliances, security systems, telecommunication networks, mobile telephones, television receivers. Most computer keyboards use silver membrane switches.

Superconductors

These low-current switches are also found in control panels of cable television, telephones, and devices using digital electronics. Superconductivity is the power transmission of the future and silver makes it faster and more effective. Silver-jacketed superconducting oxide wires can carry more than 140 times the electric load of copper wire with less than 1 percent of the weight. This wire utilizes about 1,000 ounces of silver per mile. Silver already improves performance at lighter weights and size in cables, motors, generators and transformers. Silver oxide-zinc batteries provide higher voltages and longer life for such consumer goods as quartz watches, cameras, and electronic tools.

Electroplating

The ease of electrodeposition of silver accounts for silver’s widespread use in coating. The plating thickness of some items, such as fuse caps, is less than one micron although the silver then tarnishes more easily. Coatings of two to seven microns are normal for heavy-duty electrical equipment. Silver plating is used in a wide variety of applications from Christmas Tree ornaments to cutlery and hollowware.

Brazing & Soldering

Silver facilitates the joining of materials (called brazing when done at temperatures above 600oCelsius and soldering when below) and produces naturally smooth, leak-tight and corrosion-resistant joints. Silver brazing alloys are used widely in applications ranging from air-conditioning and refrigeration equipment to power distribution equipment in the electrical engineering sector. It is also used in the automobile and aerospace industries.

Coins

Silver, being a rare and noble metal, was a more desirable medium of exchange than beads, feathers, shells, and the like. Its use as a medium of exchange is known throughout all recorded history. Coins, in the sense of having an authenticating stamp on them, began to appear in the eastern Mediterranean during 550 B.C. By 269 B.C. Rome adopted silver as part of its standard coinage. Silver became the trading medium for merchants throughout the civilized world. (Gold being reserved for governments and the wealthy.) Today silver coins continue to be the medium of exchange wherever paper is not acceptable, for example, in parts of Africa and the Middle East. One example of a trade coin is the Empress Maria Theresia Taler, first minted in Austria in 1741. It was standardized in 1780 as 28 grams and 833/1000 silver (the remainder copper). Some 370 million of these 1780 dated coins have been minted up to 1996 and a large proportion remain in circulation today.

Photography

Although a wide variety of other technology is available, silver-based photography will retain its pre-eminence due to its superior definition and low cost. From its very outset, silver halide has been the material that records what is to be seen in the photograph. As little as 4 photons of light activate silver halides which amplify that incident light by a factor of one billion times. In today’s photography, silver halides are coupled with dyes that bring the colour of the world around us into a permanent record. An estimated 196 million troy ounces of silver were used worldwide in 2003 for photographic purpose.

Silverware & Jewelry

Silver possesses working qualities similar to gold but enjoys greater reflectivity and can achieve the most brilliant polish of any metal. To make it durable for jewellery, however, pure silver (999 fineness) is often alloyed with small quantities of copper. In many countries, Sterling Silver (92.5% silver, 7.5%copper) is the standard for silverware and has been since the 14th century.

Mirrors & Coatings

Silver’s unique optical reflectivity, and its property of being virtually 100% reflective after polishing allows it to be used both in mirrors and in coatings for glass, cellophane or metals. Everyone is accustomed to silvered mirrors. What is new is invisible silver, a transparent coating of silver on double pane thermal windows. This coating not only rejects the hot summer sun, but also reflects inward internal house heat. A new double layer of silver on glass marketed as “low E squared” is sweeping the window market as it reflects away almost 95% of the hot rays of the sun, creating a new level of household energy savings. Over 250 million square feet of silver- coated glass is used for domestic windows in the U.S. yearly and much more for silver coated polyester sheet for retrofitting windows.

Solar Energy

Silver paste is used in 90 percent of all crystalline silicon photovoltaic cells, which are the most common solar cell, according to the Photovoltaic Technology Division of the U.S. Department of Energy. And all silicon cells used in space to power satellites use silver in the form of evaporated metal to make the electrical contact. The electricity generated by photovoltaic cells is highly reliable. As soon as sunlight strikes, power begins to flow. Sunlight striking silicon cells generates electrons, which the silver conductors collect to become a useful electric current. The conductive silver, which also enhances reflection of the sunlight, is applied in the form of a glass paste with a minimum of 90 percent silver along the top and across the bottom of the silicon crystal. When fired, the silver forms a complete circuit collecting solar energy and conducting it to the power supply line. A group of roofing-tile solar cells can generate sufficient power to provide a house and also fill batteries to supply power after dark. Silver plays yet another role in the collection of solar energy: an efficient reflection of solar heat. Silver is the best reflector of thermal energy (after gold).

Water Purification

An increasing trend is the millions of on-the-counter and under-the-counter water purifiers that are sold each year in the United States to rid drinking water of bacteria, chlorine, trihalomethanes, lead, particulates, and odour. Here silver is used to prevent the buildup of bacteria and algae in the filters. Of the billions of dollars spent yearly in the U.S. for drinking water purification systems, over half make advantageous use of the bactericidal properties of silver. New research has shown that the catalytic action of silver, in concert with oxygen, provides a powerful sanitizer, virtually eliminating the need for the use of corrosive chlorine.

SOURCE: www.silverinstitute.org

ABOUT THE AUTHOR – DAVID MITCHELL

GENERAL ADVICE WARNING – The information contained in this report is of a general nature only and you need to seek professional advice based upon your own personal circumstances before acting. Although we consider this material reliable, no warranty is given, and no liability is accepted for any statement or opinion or for any error or omission.

Disclaimers:

Gold Bullion Australia – National Office – Public Trading Office and Vault, 1 Avalon Parade, Miami QLD 4220. ABN 20 606 576 989

IPM Group Pte Ltd. 30 Cecil Street, #19-08 Prudential Tower, Singapore, 049712, Company Registration No: 201428070N. All rights reserved. Any reproduction, copying, or redistribution, in whole or in part, is prohibited without written permission from the publisher.

The information contained herein is believed to be reliable, but its accuracy cannot be guaranteed. It is not designed to meet your personal situation – we are not financial advisors, nor do we give personalized advice.

We are not tax advisers and we would always recommend you seek out independent tax advice. This guide is only meant to be used as an aid and an introduction to physical precious metals investment.

The opinions expressed herein are those of the publisher and are subject to change without notice. It does not take into account the particular circumstances, investment objectives and needs for investment of any investor, or purport to be comprehensive or constitute investment advice and should not be relied upon as such. You should consult a financial adviser to help you form your own opinion of the information, and on whether the information is suitable for your individual needs and aims as an investor. You should consult appropriate professional advisers on any legal, taxation and accounting implications before making an investment