Immense Seasonal Buying Opportunity in Gold, Silver & Platinum Is Upon Us

Immense Seasonal Buying Opportunity in Gold, Silver & Platinum Is Upon Us

Historically Speaking the Seasonal Pattern Persists

By David Mitchell

The Outstanding Bull Market in Precious Metals is Vigorous and Structural

We often come across new clients who are of the opinion that all the world’s economic troubles have been caused by the impact of Covid-19. They believe that once we have a vaccine everything will return to normal. In our opinion, this assumption is wildly inaccurate and could not be any further from the actual truth.

We are all in the jaws of the largest global debt crisis in economic history, which has been turbo-boosted by the Covid-19 outbreak that is in the process of bringing down the world’s economies in devastating unison. Mathematically, we are in a dire state, with global debt to GDP rapidly surpassing 340%, while debt in mature markets has surpassed 392% of GDP. Our global governments are now actively planning to instigate a truly enormous debt-laden fiscal expansion in 2021 onwards of truly historical proportions.

Debt is a double-edged sword, historically it is often used in political circles as a vote-soliciting policy argument to stimulate future growth, however fiscal discipline through the economic cycle is of paramount importance to the long-term health of the economic system. Persistently running ever-growing deficits year after year (as per the last 20 years) means that sooner or later the default point will be crossed whereby the snowballing cost of financing debt becomes an unaffordable burden for society.

I think it’s extremely important for investors (our clients in-particular) to fully appreciate that all political parties across the globe favour quantitative easing (QE), debt and deficits, as well as artificially low interest rates. These policies are leading us into an eventual outright debt monetisation that will have horrendous eventual repercussions.

The truth is, no matter how you spin the narrative, no matter how the banks, the political parties or the media attempt to reinvigorate your optimism, the simple arithmetic behind the inexorable decline of the purchasing power of fiat-denominated assets is leading us all into complete ruin.

As Goldman Sachs Investment bank recently asserted, …”the gold rally is just getting started – and sees a surge of more than +20% next year (2021)”…READ HERE. Dated 13th November 2020, analysts Mikhail Sprogis and Jeffrey Currie stated:

“The structural bull market for Gold is not over and will resume next year as inflation expectations move higher, the US dollar weakens, and EM retail demand continues to recover, and the Gold market will likely follow the same path as it did after the global financial crisis in 2008”.

Historically Speaking the Seasonal Pattern Persists

Big profits can be made in buying Gold, Silver & Platinum in November and into the December timeframe.

Without sounding too repetitive I have written exhaustively and advised my clients on the importance of taking the ‘added’ advantage of timing opportunities when investing into precious metals. There are highly distinguished, seasonally-driven cycle-buying occasions throughout the year. We have now walked directly into one of the most important and optimal buying opportunities of the calendar year, i.e. mid-November into mid-December.

But, investors, please understand we are in a very dynamic secular bull market in gold and the precious metals therefore once invested, we advise that our clients should firmly stay away from trying to time rallies and dips.

What I focus upon is helping new clients to understand the optimal times to enter this investment class and provide them an overlay of the macro-fundamentals that drive each metal. Over the next few years the revaluations in metal prices will become a lot more dynamic the further into this secular bull market we get, so timing buy opportunities becomes a lot less relevant.

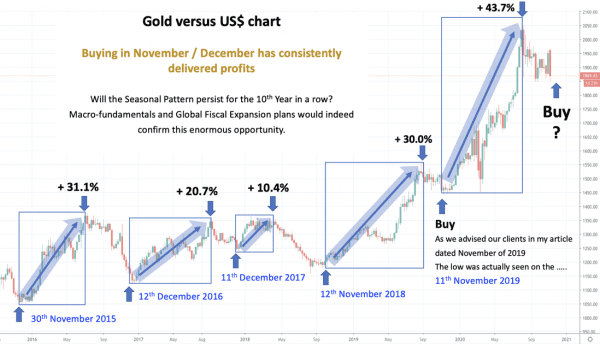

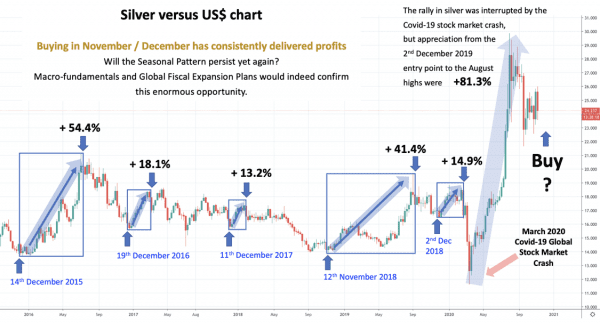

As you can see clearly from the gold chart highlighting the last 5 years on page 2 and the silver chart below, an opportune time to purchase gold (and other precious metals) is from mid to late November into December. The exact same picture can be seen consistently in each of the last 10 years which is further exemplified on the next few pages.

Pattern Recognition

Recognising seasonal trading patterns in precious metals helps our clients maximise their investment prospects, by simply looking for well-defined cycle-low opportunities. Whilst these are most definitely ‘not’ written in stone, with the benefit of hindsight we can very convincingly ascertain seasonal patterns which we have come to expect to repeat consistently .

Let’s look at what drives metal prices and the present undercurrents facing us, to confirm if these patterns will indeed likely repeat themselves. Again we cannot stress enough that we believe we are at the beginning of a bull market and those with a long term investment approach can follow the present bullish trend and

top up where possible.

Now the argument can be made of course that gold has been in a secular bull market since December 2015, but silver has technically been a bear market from 2011 into 2019 and only now, I would suggest, is entering into its new multi-year secular bull market phase. Platinum is very exciting indeed as hard material evidence is building dramatically that the bear market of platinum from 2008 to 2020 has ended, and we are now entering a new trend reversal in price and a very dynamic price bull market; coinciding with the expected major super-cycle bull market in commodities.

So I thought I would look at the historical metal price performances when they were in clear bear market downtrends and see if the seasonal pattern in buying at the end of the calendar year persisted.

| Mid-Nov into Dec | Date of Rally | % | Secular Market | |

| Low Price | High | Gain | Status | |

| SILVER | 1st Dec 2014 – US$ 14.16 | 26th Jan 2015 – US$ 18.48 | + 30.5 % | BEAR |

| SILVER | 4th Dec 2013 – US$ 18.91 | 24th Feb 2014 – US$ 22.17 | + 17.2 % | BEAR |

| SILVER | 20th Dec 2012 – US$ 29.60 | 22nd Jan 2013 – US$ 32.28 | + 9.1 % | BEAR |

| SILVER | 29th Dec 2011 – US$ 26.19 | 229th Feb 2012 – US$ 37.49 | + 43.1 % | BEAR |

| SILVER | 16th Nov 2010 – US$ 25.01 | 25th April 2011 – US$ 49.83 | + 99.2 % | BULL |

| SILVER | 22nd Dec 2009 – US$ 16.78 | 20th Jan 2010 – US$ 18.83 | + 12.2% | BULL |

| GOLD | 7th Nov 2014 – US$ 1,132.08 | 22nd Jan 2015 – US$ 1307.59 | + 20.7 % | BEAR |

| GOLD | 31st Dec 2013 – US$ 1,182.70 | 17th March 2014 – US$ 1,392.08 | + 17.7 % | BEAR |

| GOLD | From November 2012 into year 2013 it moved lower. | Lower | BEAR | |

| GOLD | 29th Dec 2011 – US$ 1,522.93 | 29th Feb 2012 – US$ 1,790.66 | + 17.6 % | BEAR |

| GOLD | 28th January 2011 was the actual low and moves higher in Sept 2011 | + 47.04 % | BULL | |

| PLATINUM | 13th Nov 2019 – US$ 865.50 | 16th Jan 2020 – US$ 1,041.45 | + 20.3 % | BEAR |

| PLATINUM | 10th Dec 2018 – US$ 778.77 | 8th April 2019 – US$ 915.50 | + 17.6 % | BEAR |

| PLATINUM | 13th Dec 2017 – US$ 873.78 | 25th Jan 2018 – US$ 1,028.61 | + 17.7 % | BEAR |

| PLATINUM | 15th Dec 2016 – US$ 890.37 | 27th Feb 2017 – US$ 1,044.72 | + 17.3 % | BEAR |

| PLATINUM | 21st January 2016 – US$ 811.57 | 10th August 2016 – US$ 1,194.04 | + 47.1 % | BEAR |

Platinum Price Performance Also Delivers

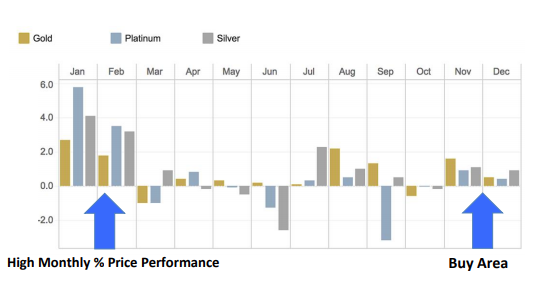

The same buying opportunity can be said for platinum, I have included a simple bar chart to demonstrate the historical price performances of all three metals over the last 20 years.

Monthly % Price Change, year 2000 to 2019

Undercurrents Driving Gold & Precious Metals Higher

Gold is often misunderstood, generally speaking gold is NOT an inflation hedge and should not be considered so. This precious metal is in fact a crisis hedge. An uncorrelated asset class with zero third party liability that is used as an active part of portfolio management.

In fact global Central Banks continue to invest in gold as diversification remains the most important perceived benefit, reflecting the negative connotations of the high concentration of US dollar exposure, primarily in US Treasury, mortgage and high-quality corporate debt. The use of gold in official international reserve portfolios has continued to rise, even after the recent price surge. Most central banks plan to maintain or further increase gold allocations, read here.

Gold is predominantly a hedge against developments such as a currency crisis, banking crisis, debt crisis, stock and asset market crisis, sovereign debt crisis and war (to name just a few).

In a healthy economy that has sustainable growth patterns (or where there is an investment cycle driving funds into stock markets and property markets) then gold is generally not required.

In this particular cycle (from 2021 onward), we are staring down the barrel of outright debt expansion over and above an already unsustainable global debt picture, which leads us directly into the throes of outright debt monetisation.

Governments of major economies have already declared their intentions to engender massive infrastructure spend policies, to not only support the new power generation plans (hydrogen, wind, solar and significant upgrading of electricity grid systems) but to also reduce the catastrophic levels of unemployment.

This is extremely bullish for the precious metals sector and clearly indicates where we are in this particular cycle.

In Conclusion

As the old investment mantra dictates, 80% of the move happens in the last 20% of the cycle and hence we are incredibly excited about the price prospects and witnessing first-hand the expected revaluations higher in the precious metals over the next 3 to 4 years, leading us into a very dynamic and powerful super-cycle in the commodity complex.

Over the last 20 years as an optimal buying opportunity in gold, silver and platinum have proven to be excellent buys in November & December, even within the larger bear market of 2011 to 2015.

The global debt picture is deteriorating rapidly with deficit control being ignored with the newly-found passion for embracing Modern Monetary Theory (MMT) by governments and monetary authorities. MMT is in effect debt monetisation which is now on its way with unknown consequences (however well recorded historical past experiments in debt monetisation culminated in disastrous currency value destruction).

Contact Us

Telephone: 1300 754 602 | Email: [email protected]

Web: www.goldbullionaustralia.com.au

Disclaimer:

The information contained in our website and this report should be used as general information only. It does not take into account the particular circumstances, investment objectives and needs for investment of any investor, or purport to be comprehensive or constitute investment advice, and should not be relied upon as such. You should consult a financial adviser to help you form your own opinion of the information, and on whether the information is suitable for your individual needs and aims as an investor. You should consult appropriate professional advisers on any legal, taxation and accounting implications before making an investment.