A Confluence of Events Leading to Silver Price Rise

At GBA there are many trends we witness as we assist our clients to trade their precious metals on a daily basis. Our team facilitates just as much buying as selling, and we also enjoy strategic and joint arrangements with our global colleagues including Baird & Co of London, Baird & Co Asia and Indigo Precious Metals.

While many Australian customers are currently selling their gold and purchasing platinum to diversify their portfolios, globally we are seeing clients adding silver and platinum to their portfolios. CLICK HERE to view our video about Diversifying your Precious Metals Portfolio.

You may have noticed we have been quite bullish about silver in recent times; even though silver spot pricing has not moved in any spectacular fashion for over 12 months there are still many factors leading to a significant price rise over the next 12 to 24 months.

Below is an update from David Mitchell to step through this confluence of events leading to a silver price rise.

Monday 26 February 2018 – Report by David Mitchell of IPM Group

Its presently widely reported in the market of the healthy supply of silver sitting idly, slowly being absorbed by long-term buyers, jewellery industry, India, China and strategic long-term buying.

But historically silver is presenting a number of seriously undervalued messages, a longer-term stance and recognition of this opportunity are merited and deserved.

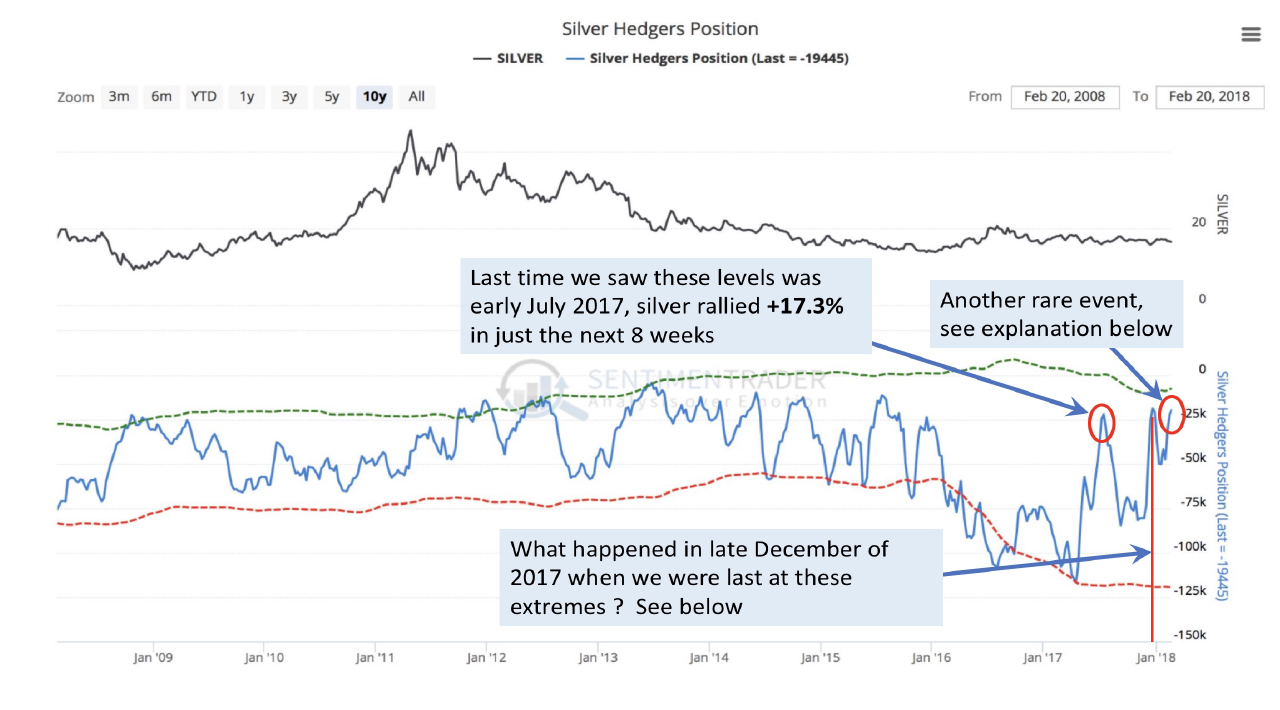

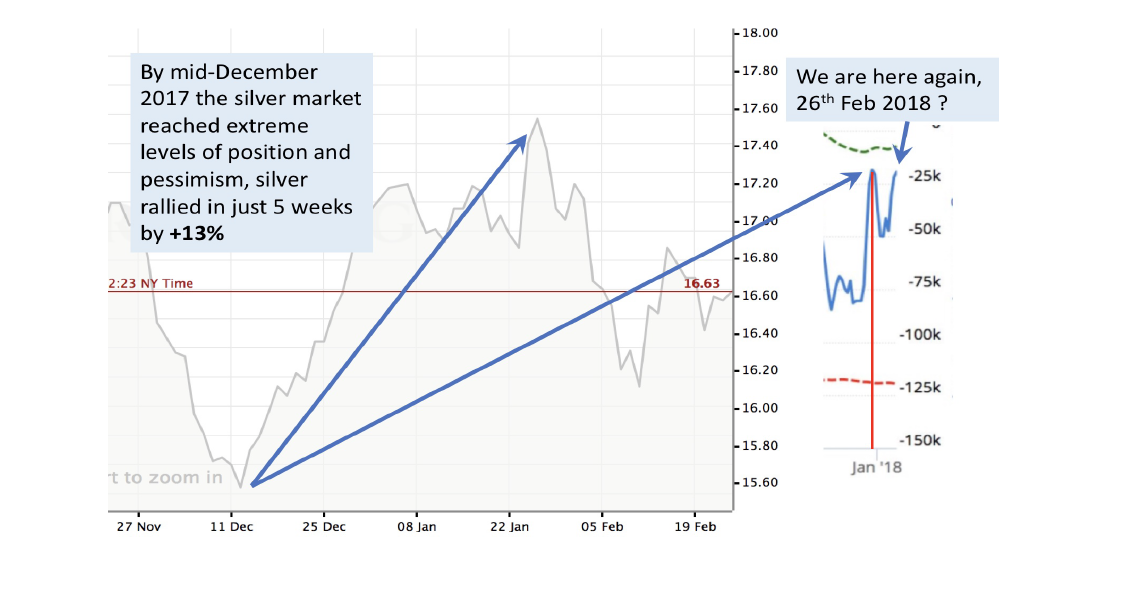

Let’s start simply with the following, Commercial (bank short positions) at historical lows …

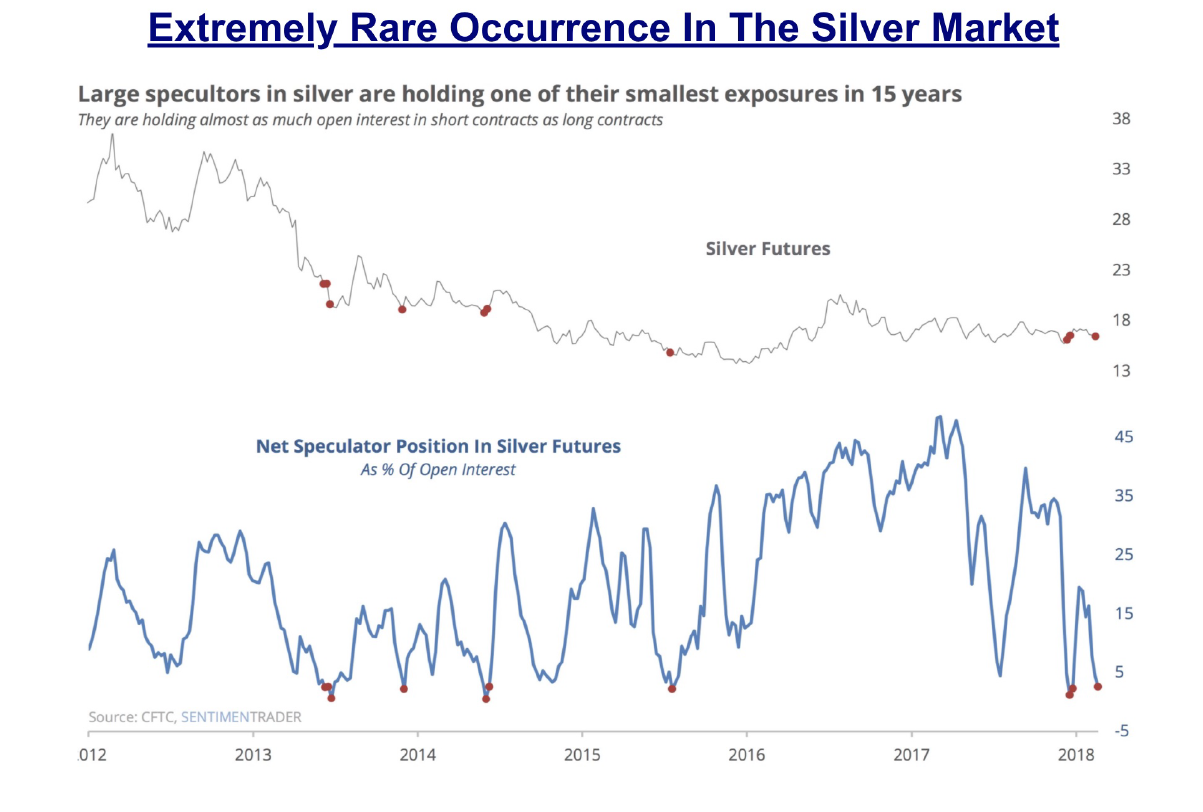

Or let us look at speculators, the smallest position in 15 years!!

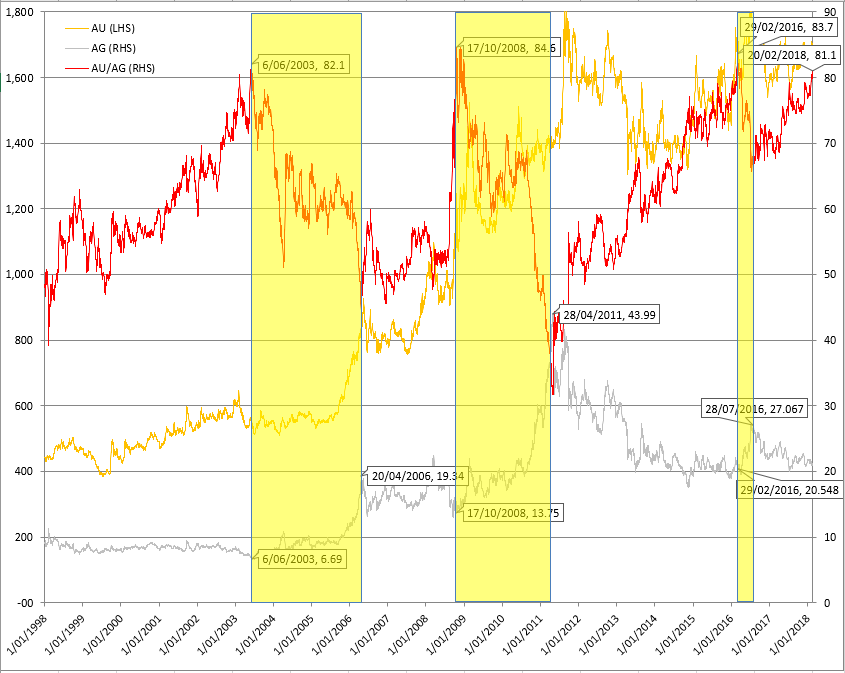

What about the Gold Silver Ratio – What is that telling us?

Or a more detailed look at the Gold Silver Ratio ….

Or a more detailed look at the Gold Silver Ratio ….

So, in the three yellow boxes above, each time Silver reached this important level of approximately 81 to 1 price ratio of gold to silver:

- 1st box – Silver rallied near 3 times in value or + 290 %

- 2nd box – Silver rallied over 3 times in value or + 320 %

- 3rd box – Silver rallied but only + 32 % for this particular event.

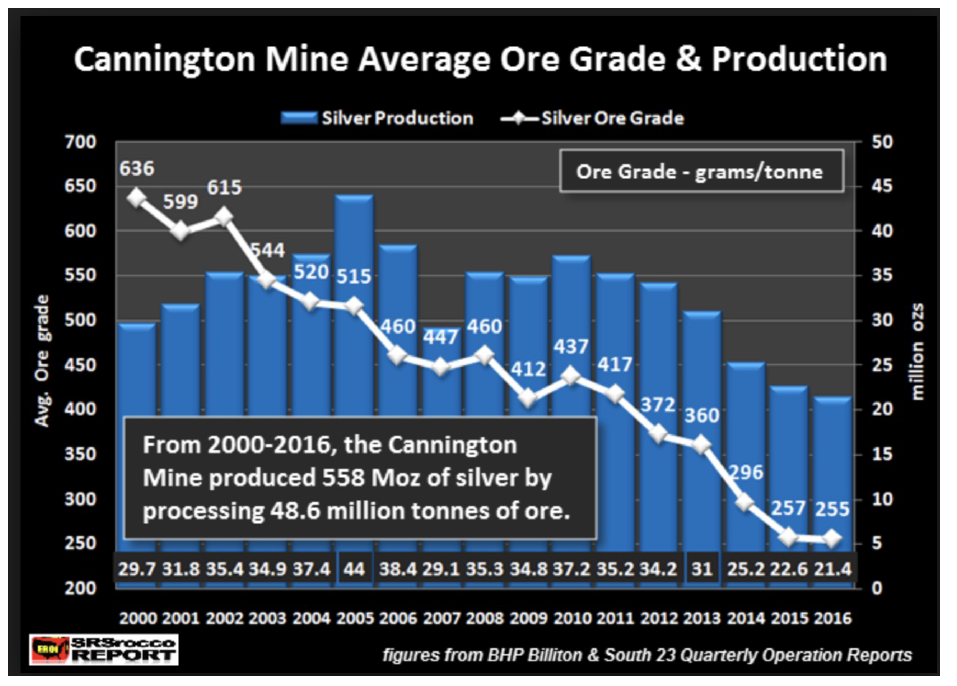

What about mining and cost of production?

The changes that have taken place in the world’s two largest silver mines, the Cannington Mine in Australia and the Fresnillo Mine in Mexico. Falling ore grades and rising energy costs have contributed to the doubling and tripling of production costs at many silver mining companies. Investors who believe it still only costs $5 an ounce to produce silver, as it did in 1999, fail to grasp what is actually taking place in the silver mining industry, with full primary mine silver production closer to 17 US$ levels.

See below for Cannington mine. ……

Wow….. – ore grade degradation of 20.45 oz per tonne to presently 8.20 oz, a – 60% fall in ore grades with an obviously massive increase in cost production.

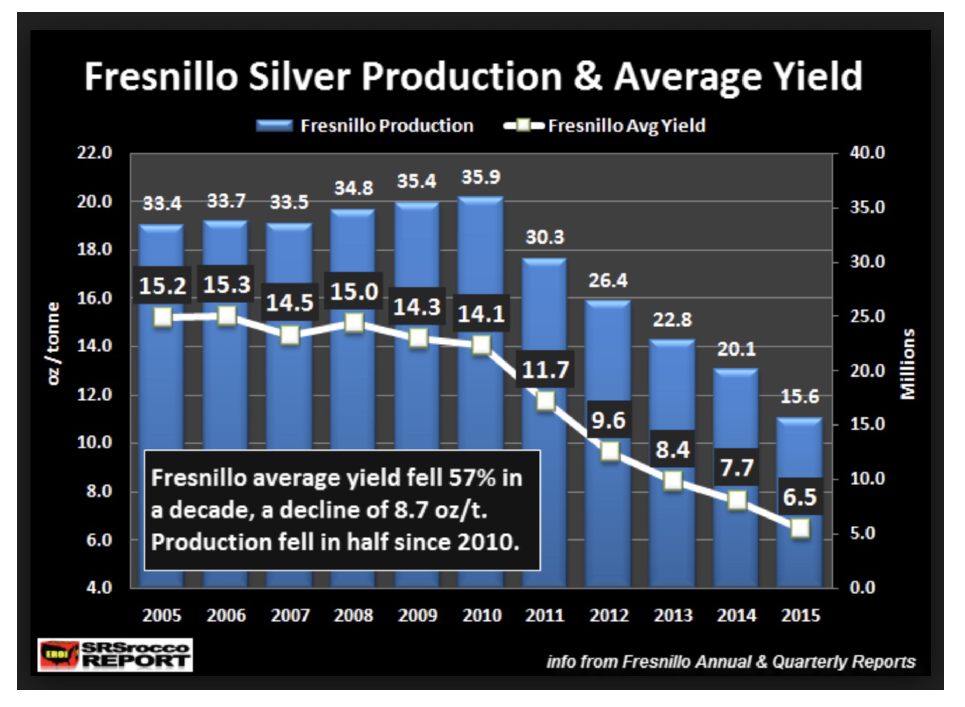

Fresnillo ….. – ore grade degradation of 15.2 oz per tonne to presently 6.5 oz, a – 58% fall in ore grades with an obviously massive increase in cost production.

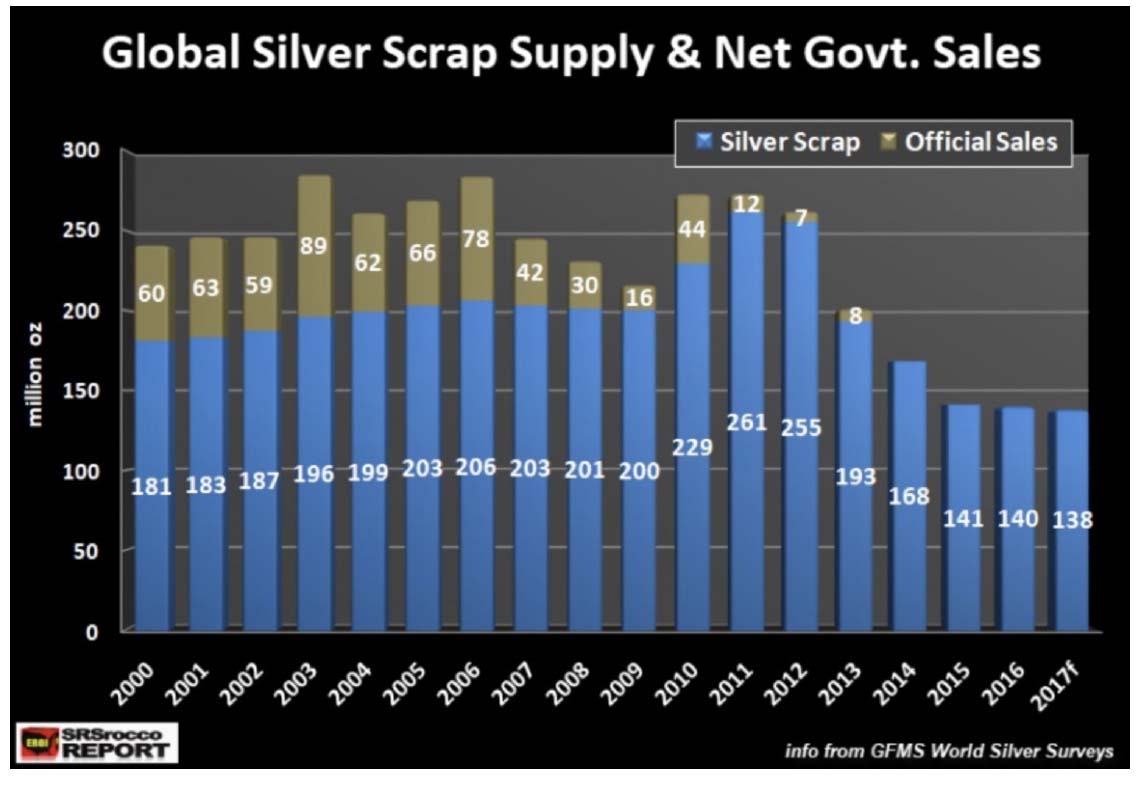

What about global silver scrap and net government sales?

Scrap silver sales globally has fallen dramatically from the highs of year 2011 and 2012, but more importantly is -30% lower than in the early of the millennium years when silver was trading around 5 US$, todays its 17 US$ and yet silver scrap supply has fallen dramatically.

Government sales have vanished altogether from the year 2014 onwards, confirming what we already know that official holdings of silver have sold down to near zero already.

An opportunity Indeed!

For more updates from David Mitchell visit THE BULLION BULLETIN