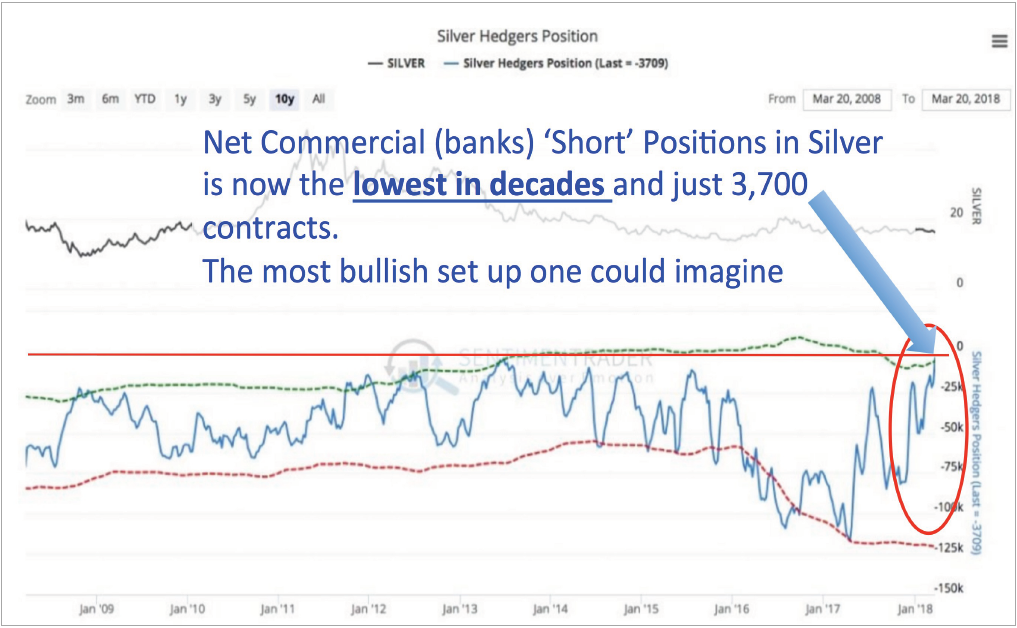

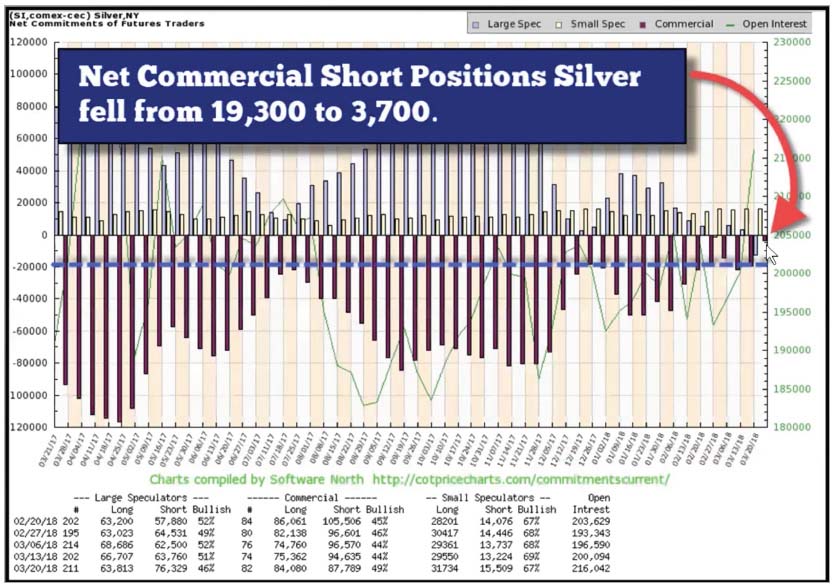

Bullion Banks ARE Now the Most Bullish on Silver in Decades!

They Continue to Buy Silver Futures

25th March 2018 – By D Mitchell

Commodity markets price discovery generally are driven by yearly supply-demand metrics, above ground stockpiles, cost production numbers, geopolitical events, mine flooding and stoppages, global production peaks etc etc…

This is simply not the case with Silver, the commercial banks have had an overwhelming control on pricing of silver (price discovery) through enormous paper trading on the futures exchanges since the year 2011 they have carried simply colossal short paper silver positions to force lower prices on the market.

Well, that was the case, until now…

I will demonstrate in further charts just how bullish this structure is, see below…

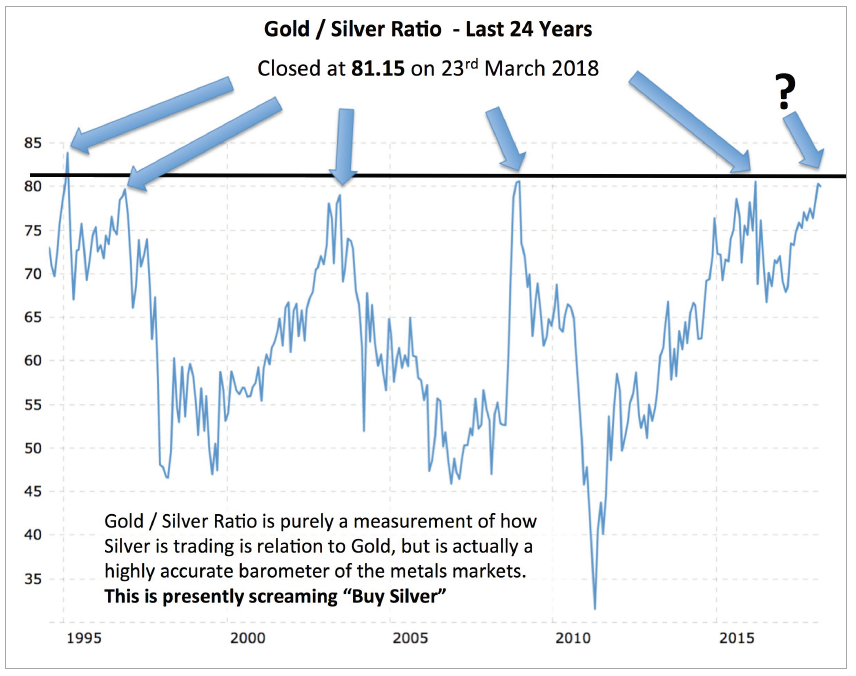

What about the Gold Silver Ratio? What is that telling us? Please see below…

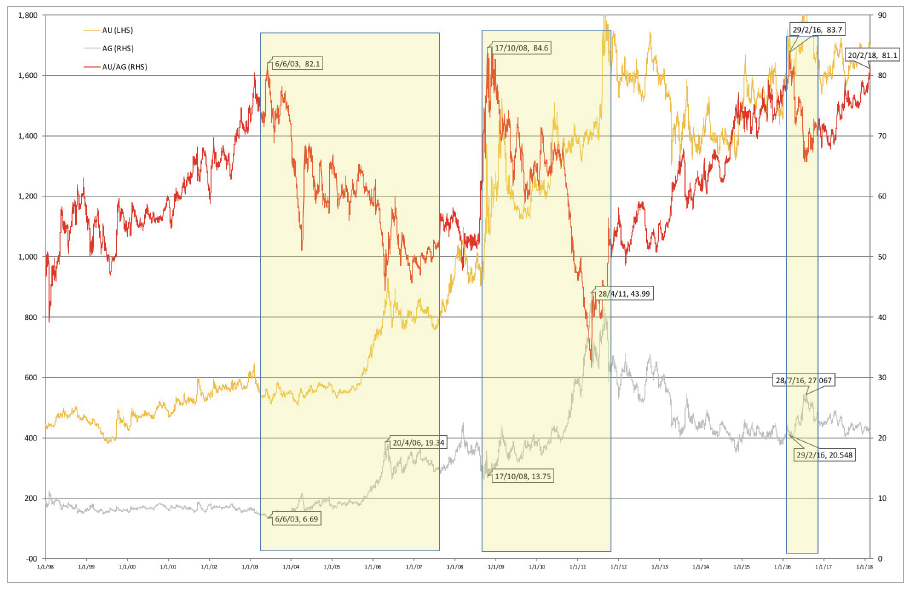

Or a more detailed look of the Gold Silver Ratio…

So in the three yellow boxes above, each time Silver reached this important level of approximately 81 to 1 price ratio of gold to silver.

1st box – Silver rallied near 3 times in value or + 290 %6th June 2003 to 20th April 2006

2nd box – Silver rallied over 3 times in value or + 320 %17th October 2008 to 28th April 2011

3rd box – Silver rallied but only + 32 % on this particular event. 29th February 2016 to 28th July 2016

Silver is the most unloved of all the metals presently, a high degree of cynicism and disinterest is extremely prevalent. However, selling exhaustion in any market is actually an extremely exciting prospective counter investment strategy.

A historical investment opportunity presents itself?

Disclaimers: IPM Group Pte Ltd. 30 Cecil Street, #19-08 Prudential Tower, Singapore, 049712, Company Registration No: 201428070N. All rights reserved. Any reproduction, copying, or redistribution, in whole or in part, is prohibited without written permission from the publisher.

The information contained herein is believed to be reliable, but its accuracy cannot be guaranteed. It is not designed to meet your personal situation – we are not financial advisors, nor do we give personalized advice.

The opinions expressed herein are those of the publisher and are subject to change without notice. It does not take into account the particular circumstances, investment objectives and needs for the investment of any investor, or purport to be comprehensive or constitute investment advice and should not be relied upon as such. You should consult a financial adviser to help you form your own opinion of the information, and on whether the information is suitable for your individual needs and aims as an investor. You should consult appropriate professional advisers on any legal, taxation and accounting implications before making an investment.