The impact of the COVID-19 pandemic on South African PGM supply, on global supply and ultimately on the price of platinum, palladium and rhodium. – Part 2

PGM forecast 2020

Primary supply

In the COVID-19 environment, the complexity of any y-on-y 2020 forecasting is heightened and fraught with a myriad of changing global economics, demand destruction and environmental dynamics to name but a few. Even China has indicated that it will not publish its 2020 GDP forecast.

In this section of this conversation, I discuss the latest published research from Johnson Matthey, Metal Focus and SA Oxford y-on-y (2019 to 2020) forecasts, together with forecasts published by mining companies and compare and contrast them with my forecast where possible. It should be noted that the research organisations’ forecasts come with warnings of high variance and possible downgrades. Johnson Matthey, for example, has elected not to publish forecasts for 2020 as industry demand forecasts for 2020 are undergoing regular downgrades. Furthermore, JM indicated that it is unclear to what extent primary and secondary supplies will be disrupted and therefore did not believe that it was possible to make a meaningful prediction of market balance forecasts for platinum, palladium and rhodium obtained from the industry and from risk-adjusted forecasts.

In this comparison, I focus initially on supply attributed to South African PGM production forecasts and then comment on the secondary and global supply of PGMs. In my calculations, I considered a range of forecasts for platinum, palladium and rhodium to give the reader a sense of the likely magnitude of the impact the COVID-19 pandemic will possibly have on South African mine supply in 2020. Furthermore, a range of forecasts, rather than a single figure seems sensible given the complexity and variance in forecasting.

For comparison purposes, I have rounded all the forecasts, given the high degree of variability placed on them. In this regard, the figures may not exactly correspond to the published figures. Furthermore, I have used SFA Oxfords published 2019 data for South African platinum, palladium and rhodium supply and demand as a base case for y-on-y comparison.

Impact of COVID-19 and ACP explosion

South African PGM supply, to date, has been severely impacted by two major incidences: 1) An explosion occurred at a converter at one of Amplats’ Waterfall processing facilities in Rustenburg in early February. Amplats reduced its production guidance downward as the repairs to this converter impact production. I have interpreted, from Amplats guidance, that the reduction in PGM supply is likely to amount to around c.500koz, c.250koz and c.60koz of refined platinum, palladium and rhodium respectively produced in 2020.

2) The onset of the COVID-19 pandemic. Above, I have I briefly discussed the likely impact on PGM supply surrounding of some of many complex tasks, hurdles and operational changes the South African PGM mining industry will likely have to face in a COVID 19 environment.

Comparison with industry y-on-y 2020 forecasts

South African mine supply

Heraeus in collaboration with SFA Oxford recently published “The Platinum Standard”, May 2020 which, among other presentations, contained a comprehensive series of platinum supply-and-demand tables, which included 2020 platinum, palladium and rhodium supply forecasts.

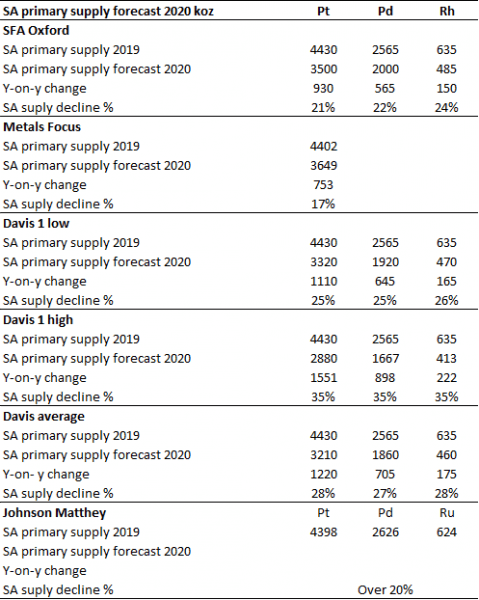

These research organisations, as I have mentioned above, indicated the difficulty of forecasting as a result of the impact of working in a COVID-19 environment and expressed a likely risk to the downside of their forecast numbers. Figure 1 illustrates a comparison of South African PGM supply forecasts. Figure 1 also illustrates the impact of a set of high-low-and average forecasts that cover my downside expectations should the risk to the downside occur. The range covers the potential decline in PGM supply of between -25% and -35%. It should be noted that my figures include an average figure between this range. This average figure should not be interpreted as a “preferred figure”.

I believe that the potential y-on-y range of the decline of between -25% and -35% is not unreasonable as it is in line with Northam Platinum’s calendar year expectations that primary South African supply will likely be down around 30% in 2020, and with Impala Platinum’s latest guideline which forecasts production rates of between 30% and 40% for May and June. Furthermore, Statistics South Africa has reported (11 June) that the COVID-19 pandemic and lockdown regulations since 27 March have had an extensive impact on economic activity. The production and sales of PGMs for April fell -62% and -34.6% respectively.

Figure 1: A comparison of South African PGM supply forecasts

Source: SFA Oxford, Johnson Matthey, Metals Focus, Davis analysis and estimates

SA Oxford expects mine supply will decline y-on-y by around c. -21%, c.-22% and -24% for platinum, palladium and rhodium. In this regard, the significant decline in the y-on-y forecast for rhodium supply stands out and will, in my view, tighten the supply side of the market.

Metals Focus expects platinum supply to decline by- 17%. Johnson Matthey expects PGM supplies could fall by over -20%.

With regard to the primary supply forecast for 2020, I am of the view that the industry forecasts are over optimistic with regard to the decline in PGM mine supply and similarly, over optimistic with regard to the implied timing and return to a “new normal” of PGM supply. In this regard, and taking into account the downside risks described above, I believe that mine supply will decline y-on-y by between -25% and -35%, at least.

Figure 1 illustrates a range of forecasts for platinum, palladium and rhodium listed as: Davis low, Davis high and Davis average, which I believe take into account the additional downside risk associated with PGM supply. It should be noted that these forecasts are limited to my judgment.

Under these circumstances, the risk to the supply of PGMs from South African mines is to the downside, which will tighten the supply side of market fundamentals and most importantly the decline in rhodium is substantial. For example, the “Davis average” downside risk to mine supply may well be a decline of around 28%, 27% and 28% for platinum, palladium and rhodium respectively.

Under these circumstances, the risk to the supply of PGMs from South African mines will tighten the supply side of market fundamentals, especially the supply of rhodium.

Company annual reporting date

It is important to note that the downside risk to mine supply described above refers to a full calendar year (January to December). At least two large South African mining companies have financial years ending June 2020. In this regard, these companies have yet to report the impact of COVID-19 for a full 12 months. I note, however, that Implats, which has a June FY end, has revised its production guidance to take into account the production losses suffered in March and April 2020. The new guidance also assumes average production rates of between 30% and 40%, for May and June 2020 for their South African operations.

It should be also be noted that the market is expecting the majority South African PGM mining companies are likely to report substantial declines in PGM production and consequently poor financials for Q2 2020. The reduction in supply may squarely be attributed to a full quarter of COVID-19 lockdown and partial temporary startup, which aimed to achieve 50% of underground mine capacity. Notwithstanding, in my view, the Q2 2020 results are likely to rattle the market to some degree.

Russia

JM reports that to date (May), Russian supply has been relatively unaffected. SFA Oxford forecast a -3% decline in supply of both platinum and palladium y-on-y for 2020.

Possible impact of COVID-19 on South African PGM mines

As indicated, South African PGM supply, to date, has been severely impacted by two major incidences: An explosion at Amplats’ Waterfall ACP processing facility in Rustenburg and the onset of the COVID-19 pandemic, which resulted in a national lockdown in South Africa.

I have interpreted the reduction in PGM supply due to the explosion at the ACP plant will likely amount to around c.500koz, c.250koz and c.60koz of refined platinum, palladium and rhodium respectively produced in 2020.

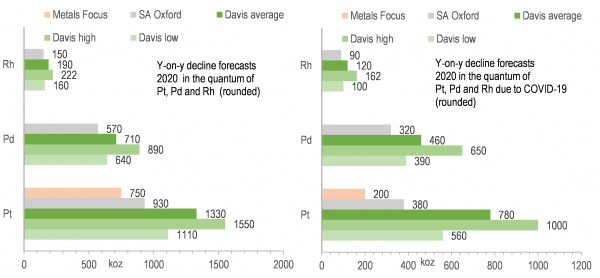

Figure 2 below, illustrates the expected y-on-y decline forecast in the quantum of platinum, palladium and rhodium as a result of the combined downgrading incidences. Figure 2 also illustrates the y-on-y decline in the quantum of platinum, palladium and rhodium as a result of the incidences associated with COVID-19 only. Note, that these figures should be used as a trend to obtain a sense of what may lie ahead for South African PGM mine supply in 2020. Figure 2 also illustrates the impact of a set of high-low-and average forecasts, which cover my downside expectations should the risk to the downside occur.

The potential loss of production in 2020 due to COVID-19 will likely have an order of magnitude between 560koz and 1000koz for platinum, between 390koz and 660koz for palladium and between 100koz and 162koz for rhodium.

Figure 2: Y-on-y decline forecast in the quantum of platinum, palladium and rhodium as a result of the

combined downgrading incidences of COVID-19 and Amplats’ ACP processing facility shutdown

Source: SFA Oxford, Johnson Matthey, Metals Focus, Davis analysis and estimates

Secondary supply

Autocatalyst recycling

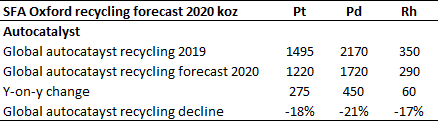

The advent of COVID-19 has caused a severe disruption to global secondary refining operations. JM

reports that the industry has had to grapple with scrap transport issues during lockdown which in turn

restricted the collection and movement of scrap, lower scrap volumes, lower scrap grades and financial

constraints. JM warns of the possibility of a steep drop in secondary PGM supplies should some scrap

collectors be unable to fund the purchase of scrap. Should this occur, PGM supply will likely tighten

further.

SFA Oxford and expects autocatalyst recycling to decline y-on-y by -18%, -21% and -17% for platinum,

palladium and rhodium. Metals Focus expects autocatalyst recycling to decline y-on-y by -7% for

platinum, which is a significant difference between SFA Oxford’s forecast – Figure 3.

I am of the view that PGM autocatalyst recycling could decline y-on-y by up to -25%.

Figure 3: SFA Oxford autocatalyst recycling forecast y-on-y 2020.

Source: SFA Oxford, Davis analysis

Jewellery

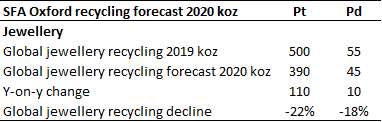

SFA Oxford expects jewellery recycling to decline y-on-y by -22%, and -18% for platinum and palladium.

Metals Focus expects platinum jewellery recycling to decline y-on-y by -28% – Figure 4.

Figure 4: SFA Oxford jewellery recycling forecast y-on-y 2020

Source: SFA Oxford, Davis analysis

Global PGM supply

In this section, I discuss the likely impact of COVID-19 on the global supply of PGMs. In this regard, I have used SFA Oxford’s published 2019 and 2020 forecast data for platinum, palladium and rhodium supply as a base case. The base-case data represents global primary and secondary supply.

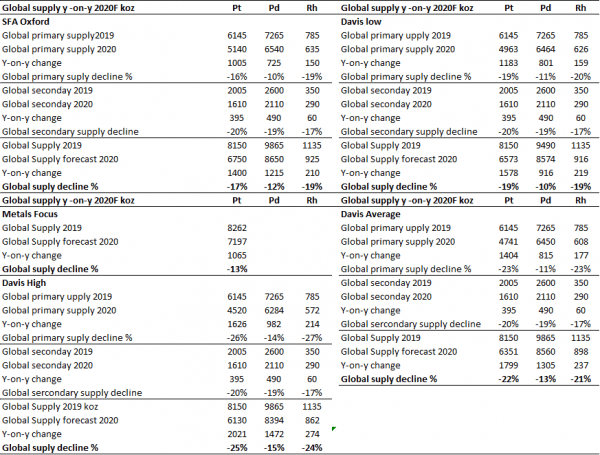

In order to take into account the additional downside risk of South African primary supply on global PGM supply, the base-case South African supply component was replaced respectively to coincide with the range of supply forecasts as described above and listed as: Davis low, Davis high and Davis average. The results of this exercise are illustrated in Figure 5 below. SFA Oxford forecasts a y-on-y decline in global supply of -17%, -12% and -19%, which amounts to a decline in total supply of around c.1,400koz, c.1,215koz and c.210koz for platinum, palladium and rhodium respectively.

Metals Focus forecasts a y-on-y decline in global supply of -13%, which amounts to a decline of total supply of around c.1,065koz for platinum. It should be noted the Metals Focus forecasts are based on a view that the COVID-19 crisis is brought under control in key markets in a timely manner and a stimulus-driven economic recovery occurs. Metals Focus indicates, however, “uncertainties of course still abound” so there are “significant risks” to the forecast.

The risk-adjusted average figure implies that global supply of -22%, -13% and -21% amounts to a decline in total supply of around c.1,799koz, c.1,305koz and c.237koz for platinum, palladium and rhodium respectively

Given the risk to the downside, the risk-adjusted global supply figures imply that platinum and rhodium supplies are likely to be more heavily impacted than palladium.

Source: SFA Oxford, Metals Focus, Davis analysis and estimates