25 January 2021

AUCTUS METAL PORTFOLIOS 2021

PLATINUM (Pt) UPDATE

As you know from our regular correspondence, Auctus Metal Portfolios’ two Provectus Models have both achieved exceptional net returns in 2020 following on from our previous 4 years of outstanding growth and client returns. Our research and analysis team fully expect our stellar performances to continue through 2021 and 2022, due to fundamental and very dynamic global supply/demand imbalances in the metals.

HOW DOES YOUR RESEARCH & ANALYSIS PREDICT SUCH GROWTH?

What many of our existing and prospective clients may not know, is that the Auctus Metal Portfolios team does an enormous amount of fundamental research on a daily basis, that helps to provide us and our clients with surety around the weightings determined by our algorithmic models. To be clear, our research on fundamentals does not override our algorithms but serves to corroborate our findings and strengthens the rationales we provide to our clients to invest. Ascertaining these insights into the fundamentals that support the conclusions made by the algorithms allows us to determine whether a particular year will outperform our standard performance or not.

This course takes into account our standard 20-Year Average Performance of 24.26% CAGR (Compound Annual Growth Rate) for Provectus Model 2 and 21.52% CAGR for Provectus Model 1.

Both of these results are net of all transaction fees, vaulting fees and our token management fee.

WHAT CAUSED 2020 TO BE SO SUCCESSFUL FOR AUCTUS METAL PORTFOLIOS AND WHAT IS YOUR ALGORITHM TELLING US TO INVEST IN THROUGHOUT 2021?

2020 began with the divestment of our client’s holdings in Rhodium following the formidable rise in pricing from 2016. In early 2020 the algorithms signalled to sell down Rhodium and concurrently increase our client’s holdings of Silver considerably; which we did. At the end of the Q3 2020 we received a 2nd price trigger signal. This was a very powerful and dynamic signal highlighting that it was time to immediately reduce Silver holdings (which had doubled in price since the re-weighting exercise in Q1 2020) and invest the lion’s share of the portfolios into Platinum, which was successfully done for all clients.

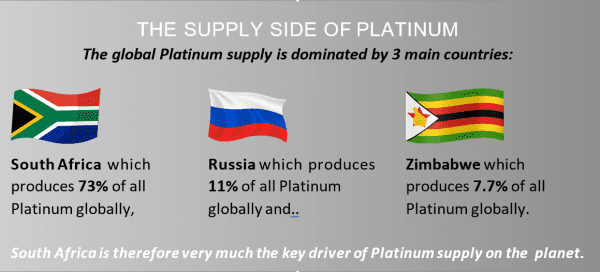

One of the most respected Platinum Group Metals (PGMs) researchers in the world Dr David Davis, is a researcher for Auctus Metal Portfolios on the ground in South Africa (where circa.75% of PGMs are mined). We challenged Dr Davis to thoroughly investigate what makes investments into Platinum so appealing at this time and he has spent several months researching all of the fundamentals behind the supply and demand of Platinum. Dr Davis has generated several ground-breaking conclusions that support our price outlook for Platinum over the next few years.

We would like to share with our Auctus Metal Portfolios clients the most salient points of Dr David Davis’ thesis on Platinum (which ran to over 50 pages) and in particular the definitive conclusions that he has arrived at.

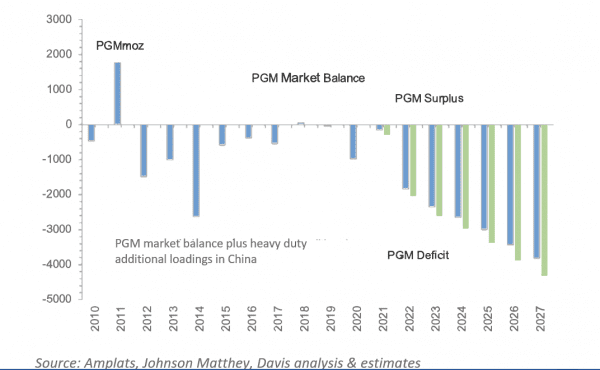

Dr Davis concludes that there will indeed be a substantial supply/demand imbalance in Platinum that will increase from 2021 and structural deficits all the way into 2030 as a result of many varying factors which we will summarize below.

This rarefied imbalance will result in significant upward pressure on the price of Platinum. Dr Davis believes that the larger research houses, as well as Anglo-American Platinum (one of the largest producers of Platinum in the world) have significantly over-estimated Platinum production and underestimated the global increase in demand over the same period. Dr Davis asserts…

“ PGM demand will continuously outstrip stagnant supply and overwhelm the balance in as little as two to three years ”

![]()

These reports have been most challenging as they focus on the forward-looking supply/demand of PGMs. There are many intriguing questions that I have attempted to answer. This anticipated upward movement in the price will likely be supported by a combination of a number of market indicators characterized by strong consumer demand and tight physical availability, coupled with a continuous supply/demand market balance deficit. The objective of this review is to provide evidence and timing to support this scenario. Dr Davis continues…

“What then is the future of PGMs given the scenario described above? The market balance for Palladium has been in deficit for at least 9 years and Rhodium is about to follow suit. In both cases, the supply imbalance has been the main driver of sky-rocketing price. In my view, Platinum will be next to board the price rocket.”

It is for the reasons outlined below, as well as the fact that the Platinum price has been a laggard in the PGM complex for the last few years, that we at Auctus Metal Portfolios recognize the asymmetrical investment opportunity for investing in Platinum in 2021. We are therefore sharing this proprietary research and analysis with our investors so that they can continue to take advantage of this extremely attractive investment opportunity.

From a detailed analysis of the 3 largest miners and producers of Platinum in South Africa; Impala Platinum, Sibanye-Stillwater and Anglo-American Platinum,

it appears that the supply of Platinum mined and produced will decline (possibly significantly) over the next 10 years.

Dr Davis surmises that these 3 key producers are chasing the seams of PGMs with the highest price and in the largest supply deficits, i.e. Palladium and Rhodium. The problem is however, that these Palladium and Rhodium-rich mine shafts (reefs) are yielding lower and lower amounts of Platinum as time progresses.

Dr Davis also analyses significant upgrades taking place at Nornickel in Russia and the Darwendale project in Zimbabwe – a joint venture between Zimbabwean firm Pen East Investments and Russia’s JCS Afronet called Great Dyke Investments (GDI). He concludes that whilst significant upgrades in production could occur in these countries, due to the Palladium rich seams located within their existing mine resources, their incremental contribution to total global Platinum production will be largely insignificant.

The structural supply issues that are affecting South Africa in the short term, from the direct and unrelenting impact on mine production of the Covid pandemic will all impact Platinum production forecasts in the future to the downside. This is as a result of necessary and forced social distancing at mine operations as well as the great difficulties suffered by miners as a result of the ongoing power supply disruptions with ESCOM.

ABOVE GROUND STOCKS

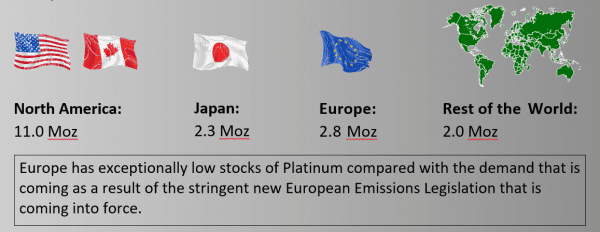

Whilst above ground stocks make a significant difference to the supply/ demand equation each year, there are several significant structural problems with above ground Platinum stocks that investors should be aware of.

At present, there are approximately 33 Moz (million ounces) of above ground stocks of Platinum. The real structural issue with this supply, is that approximately half of these stocks (14.6 Moz) are currently held in China who have been accumulating Platinum since 2010 and are not selling this product internationally. The rest of these stockpiles are held as follows:

THE DEMAND SIDE FOR PLATINUM

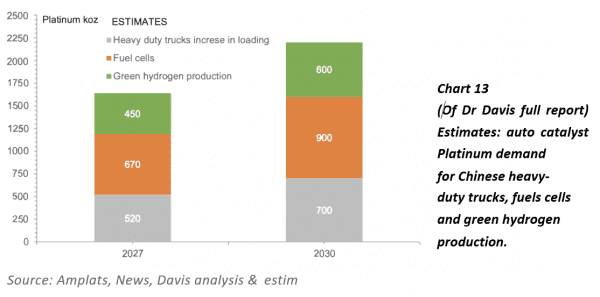

Dr Davis has also spent considerable time reviewing Anglo-American Platinum’s global demand calculations for Platinum from 2021 to 2030.

From a review of these assumptions, Dr Davis concludes that the industrial demand figures for Platinum are on the low side.

He concludes that Anglo-American has underestimated the amount of Platinum that will be needed for Auto Catalysts by about 3.7 Moz or about 30% (from the present estimates of 12.3 Moz) and that 16 Moz is likely to be required. This is a very sizeable underestimation for the industrial demand.

Dr Davis believes that the loadings of Platinum required in Europe, China and the USA will result in significantly higher Platinum usage. He further believes that Anglo-American figures significantly underestimate the Platinum loadings in light-duty vehicles up to 2027.

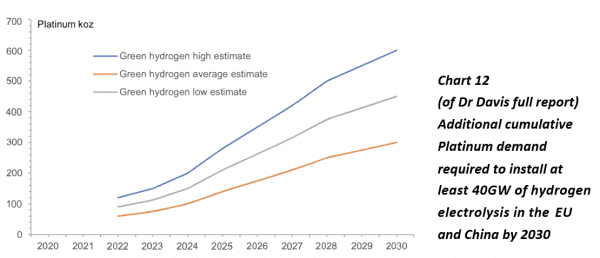

The above shortcomings in projections, coupled with more significant uptake of Platinum to be used in hydrogen fuel cells (used in drive trains in both heavy and light-duty vehicles and particularly in buses and trucks in China) could materialise much sooner than Anglo-American Platinum has forecast.

One is able to draw these conclusions based off the new mandates for zero carbon emissions in countries like the UK that have been brought forward from 2050 to 2030. There is a global push for emissions free transport. The EU is similarly signalling its intention to reduce such emissions as soon as possibly feasible. The same applies to Biden and a Democrat-controlled USA. This should indeed result in a re-signing of the Paris Protocol on climate change and a gargantuan infrastructure spend that lends itself to a cleaner and greener US economy.

As a function of the items above, it is quite easy to draw a firm conclusion that Platinum demand could indeed be significantly higher than that which was estimated only a few months ago.

WHAT DOES THIS MEAN FOR INVESTORS?

Auctus Metal Portfolios’ algorithms are informing us that our client portfolios should have a very heavy weighting in Platinum and it is therefore expected to deliver the highest returns when compared with the other metals (Gold, Silver, Palladium and Rhodium). Our in-house research also confirms that the supply/ demand dynamic predicts a combination of lower future supply in conjunction with a growth in demand.

We always love a great asymmetrical investment with limited downside and lots of upside. This is a great opportunity for our Auctus Metal Portfolio investors to enjoy several years of fantastic returns. If you are not invested or have been holding back on a portion of your future allocation to metals, we encourage you to do so now in anticipation of generating exceptional returns on your portfolio of metals through 2021 into 2022 and beyond.

It is our view that the best precious metal to invest in at present, for investors with a clear 3 to 5-year investment horizon, will be Platinum. We will continue to share more of our in-house research with our investors throughout the year.

If you would like to discuss further, please do not hesitate to contact our Sales Director Sarah Hogwood: [email protected]

ABOUT Dr DAVID DAVIS PhD. MSc. MBL. CEng. CChem. FIMMM. FSAIMM. FRIC.

Important Notice General Disclosures, Disclaimers and Warnings

This Report (“the report”) in respect of the global Platinum Industry is directed at and is being issued on a strictly private and confidential basis to, and only to, Professional Clients and Eligible Counterparties (“Relevant Persons”) as defined under the Investment Research Regulatory Rules and is not directed at Retail Clients. This report must not be acted on or relied on by persons who are not Relevant Persons. Any investment or investment activity to which this Report relates is available only to Relevant Persons and will be engaged in only with Relevant Persons.

The opinions, estimates (and where included) projections, forecasts and expectations in this report are entirely those of Dr David Davis as at the time of the publication of this report and are given as part of his normal research activity and should not be relied upon as having been authorized or approved by any other person, and are subject to change without notice. There can be no assurance that future results or events will be consistent with such opinions, estimates (where included) projections, forecasts and expectations. No reliance may be placed for any purpose whatsoever on the information or opinions contained in this Report or on its completeness and no liability whatsoever is accepted for any loss howsoever arising from any use of this Report or its contents or otherwise in connection therewith. Accordingly, neither Dr David Davis nor any person connected to him, nor any of his respective Consultants make any representations or warranty in respect of the contents of the Report.

Prospective investors are encouraged to obtain separate and independent verification of information and opinions contained in the Report as part of their own due diligence. The value of securities and the income from them may fluctuate. It should be remembered that past performance is not necessarily a guide to future performance.

The Report has been prepared with all reasonable care and is not knowingly misleading in whole or in part. The information herein is obtained from sources that Dr David Davis considers to be reliable but its accuracy and completeness cannot be guaranteed.

Dr David Davis Certification

Dr David Davis attests that the views expressed in this report accurately reflect his personal views about the Companies mentioned in the report. Dr David Davis does not hold any interest or trading positions in any of the Companies mentioned in the report.