Anglo Platinum

Anglo Platinum declares force majeure following an explosion at converter operations in Rustenburg

Source: Anglo Platinum

March 2020

Dr David Davis PhD. MSc. MBL. CEng. CChem. FIMMM. FSAIMM. FRIC.

Precious Metals Consultant

In this note, I review the implications for the market following the announcement by Anglo American Platinum (Amplats) that it temporarily shutdown the entire Anglo Converter Plant (ACP), together with the chain of processing facilities at its Waterfall processing facility in Rustenburg on 10 February.

The impact of this shutdown, in my view, is considerable as the company has had to declare “force majeure” to its customers, suppliers of third-party purchase of concentrate and suppliers of tolling material as it us unable to complete the processing of material during the converter repair. Production from own mines, as well as third-party material, will not be able to be converted and refined.

Amplats estimates the repairs to ACP phase A will be completed during the second quarter of 2021. It is anticipated that repairs to the ACP phase B unit will take approximately 80 days. In my view, the “normalisation” of the ACP and the treatment of suppliers of third-party purchases of concentrate will likely take longer than Amplats anticipates and may well extend into 2022. If this turns out to be the case, the outcome will likely put upward pressure on the platinum price.

Given that the market is of the view that there is an increasing risk of a decline in supply from South African PGM mines, I am of the view that these risks, particularly electricity outages, will not abate for at least five years. Under these circumstances, the risk to the supply of PGMs from South African mines is to the downside. In this regard, the negative impact on supply will put upward pressure on PGM prices (repeating past experience).

Impact on production

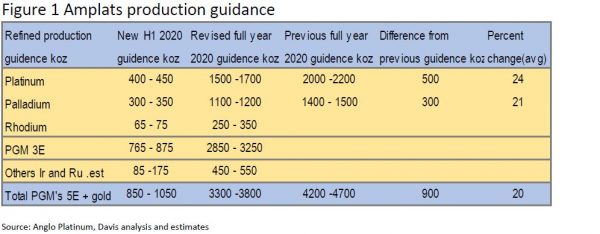

As a result of the impact of this shutdown and repairs to the ACP, the company has also had to revise production guidance down for 2020 (PGM 5E +Au).

Amplats cut its refined platinum production by 0.5moz to between 1.5moz and 1.7moz, which represents a 24% drop. Refined palladium production was reduced by 500kz to between 1.1moz and 1.2moz, which represents a 21% drop.

Overall, PGM 5E + gold production, which includes platinum, palladium, rhodium, iridium and ruthenium, was cut to between 3.3moz and 3.8moz from 4.2moz and 4.7moz respectively. This results in some 900,000oz (PGM 5E +gold) that would be cut initially from the market. This number, however, does not include third-party tolling arrangements; Amplats did not guide for rhodium in its previous guidance statement.

It is important to note that the metal is not lost to the market. Amplats chief executive, Chris Griffith, has indicated that “As it stands now the plan is still to continue mining as much as possible so that the metal is not lost to the market, and we will catch up as quickly as we can ”.

Third party purchases

Amplats purchases concentrate from a number of other companies, including Royal Bafokeng Platinum, Siyanda-Union, the Modikwa facilities of African Rainbow Minerals and Sibanye-Stillwater’s Kroondal mine and Platinum Mile.

Sibanye-Stillwater in a Market Release notes, “Amplats’ statement regarding the temporary shutdown of its converter plants and confirms that it has received written notification of force majeure regarding the toll agreement between Amplats and Sibanye-Stillwater’s Rustenburg operation and the Purchase of Concentrate (PoC) agreement with Sibanye-Stillwater’s Kroondal and Platinum Mile operations”.

Sibanye-Stillwater indicated that Marikana and US PGM operations are not affected and will benefit from the commensurate short-term commodity price increases due to the Anglo Platinum supply disruption. Furthermore, “Sibanye-Stillwater has significant spare PGM processing capacity at the Marikana operations and at the Precious Metal Refinery in Brakpan and will be assessing how best to utilise this capacity”.

Amplats has three producing mines in Limpopo: Mogalakwena, Tumela and Dishaba. It also has the Unki mine in Zimbabwe.

Amplats has indicated that production from own mines will continue, and the concentrate from the mines will continue to be smelted at one of the four smelter complexes.

Amplats anticipates that repairs to the phase B unit will take approximately 80 days when production from own mines, as well as third-party material, will not be able to be converted to refined production.

Market impact

Some observations:

The financial consequences are significant. According to Amplats CFO, Craig Miller, the impact on earnings before interest, depreciation and amortisation will be R18bn ($1.1bn) for the full-year and R24bn or $1.6bn at the half-year before mitigation takes place. (Reported by Mining mx.)

The market reports that Anglo American shares fell l 8.7%t to 1,692p after its 80% owned subsidiary Amplats declared force majeure.

Spot platinum added about USD40/oz and traded above USD900/oz after Amplats announcement; a level not seen since 2018. Spot rhodium traded up 12% to USD 11,200/oz. Palladium briefly traded above $2,500/oz before falling (Kitco).

Supply and demand

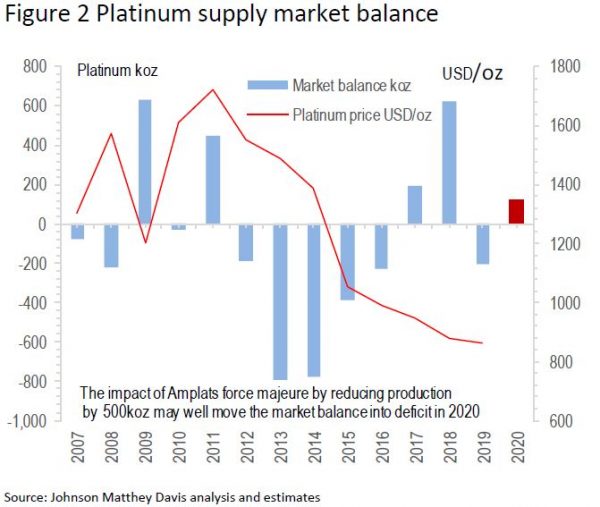

As indicated in my review on platinum, it is important to understand the supply and demand market balance trends over the long term. See Figure 2 below. Platinum has exhibited an average annual net market balance deficit of c.110koz and a total deficit of c.1.45moz between 2007 and 2019 respectively (JM data). Significant deficits are noted between 2013 and 2016. In 2013, the market deficit increased to

c.800koz, mainly due to an increase in investment and gross platinum demand. In 2014, a deficit of c.700koz was recorded due mainly to a loss in supply of c.1.3moz of platinum production following a five-month strike at major South African mines. In 2015, the market deficit decreased to c.400koz, mainly due to growth in autocatalyst and investment demand.

Dieselgate precipitated a backlash against diesel resulting in a loss of diesel market share, which, in turn, had an impact on platinum demand and as a result the market balance went into surplus in 2016 and 2017 of c.194oz and 620oz respectively. JM and WIPC indicate that unless investor appetites are sustained into 2020, the platinum market could move back into surplus.

I am of the view that the impact of Amplats declaring force majeure by reducing production by 500koz may well move the market balance into deficit in 2020, Furthermore, this reduction reinforces South Africa’s dependence on the primary supply of PGMs. Some facts and figures:

• South Africa produces c.4.5moz of the c.6.1moz of global production.

• South Africa supplies some 73%, 37% and 82% of global platinum, palladium and rhodium respectively.

• Amplats produces c.2.1moz, c.1.45moz and c.0.28moz or 48%, 55% and 44 % of South Africa’s mine supply of platinum, palladium and rhodium respectively.

• Amplats produces 35%, 21% and 28% of global mine supply of platinum, palladium and rhodium respectively.

Waterfall processing facility at Rustenburg

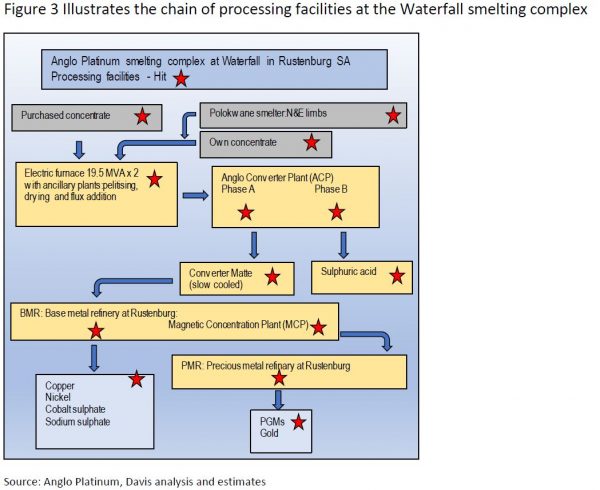

I am of the view that it is important to know just “what’s at stake” when Amplats refers to the chain of processing facilities at its Waterfall processing facility in Rustenburg.

The process diagram, Figure 3 below, illustrates the chain of processing facilities at the Waterfall processing facility in Rustenburg. Central to these facilities is the ACP, which is a key part of the PGM production process, treating furnace matte from the company’s smelters (Rustenburg and Polokwane smelter in Limpopo province). The processes and production that will have to be shut down as a resultof the temporary closure of the ACP have been identified by a “red star”. It is apparent from the number of red stars that the chain of processing facilities will have to be stopped, as indicated by Amplats.

It should be noted that starting-up these operations is not like flicking a “light switch”. These facilities have to be started-up slowly.

At the ACP plant, sulphur and iron contained in the furnace matte from the smelters is converted to sulphur dioxide and slag. The ACP has two converters, phase A and phase B. The resulting converter matte is then slow-cooled to concentrate PGMs into a metallic fraction.

From the ACP, material moves to the magnetic concentration plant (MCP) where the converter matte is milled and the PGM fraction is separated magnetically. The PGM-bearing material then moves from the MCP to the precious metals refinery (PMR) where the PGMs are separated and purified to yield platinum, palladium, iridium, rhodium, ruthenium and gold.

Copper, nickel, cobalt sulphate and sodium sulphate are produced as by-products at the base metal refinery (BMR).

Chain of events

Amplats’ ACP phase A converter plant was damaged following an explosion within the converter on 10 February, which resulted in its temporary closure while repairs take place. Amplats estimates the repairs will take around six months and should be complete in the second quarter of 2021. Nobody was injured in the incident.

As per “normal business procedure”, the ACP phase B unit was commissioned to take over from the ACP phase A plant and was in the process of ramping up to steady state when water was detected in the furnace. Notwithstanding extensive testing being conducted to determine the source of the water and a number of circuits being isolated, water continued to be observed in the furnace. This posed a high risk of explosion and Amplats determined that it had no other option but to temporarily shut down the phase B unit to ensure the safety of all employees and avoid a catastrophic event. It is anticipated that the repairs to the phase B unit will take approximately 80 days.

Amplats chief executive, Chris Griffith, admitted on a call after the announcement: “If we have an explosion in the ACP phase B then we’ll be out for a year with no production from Anglo American Platinum”.

In this regard, it is important to note that the second ACP phase 2 converter was found to be faulty. Without knowing the full facts, it is difficult to suggest, in my view, that Amplats possibly has a maintenance problem.

Summary

In summary, no operator of this size and complexity would want to face such a failure of its ACP, which has resulted in the declaration of force majeure to customers, suppliers of third-party purchase of concentrate and suppliers of tolling material.

The impact on production is disastrous for Amplats and its third-party suppliers.

The market will be “rattled” by this incident. Supply-and-demand fundamentals have been moved considerably towards a deficit in supply.

The reduction in Amplats production reinforces the risk associated with South African mine production dependency on the primary supply of PGMs.

I am of the view that the impact of Amplats declaring force majeure by reducing production by 500koz may well move the market balance into deficit in 2020. This, combined with the progressive substitution of palladium for platinum in petrol applications within 18 months together with global environmental “climate change” pressures will ultimately lead to a continuous market deficit from 2022 and an upward trend in the platinum price. Notwithstanding the significant headwinds yet to be faced as a result of the outbreak of the coronavirus COVID-19 in China.

About Dr David Davis PhD. MSc. MBL. CEng. CChem. FIMMM. FSAIMM. FRIC.

David has been associated with the South African mining industry and mining investment industry for the past 43 years (mainly PGM, gold and uranium). At present, David is working as an independent precious metal consultant. David’s PhD involved: “Studies in the catalytic reduction and decomposition of nitric oxide 1976”.

Important Notice

General Disclosures, Disclaimers and Warnings

This Report (“the report”) in respect of the global Rhodium Industry is directed at and is being issued on a strictly private and confidential basis to, and only to, Professional Clients and Eligible Counterparties (“Relevant Persons”) as defined under the Investment Research Regulatory Rules and is not directed at Retail Clients. This report must not be acted on or relied on by persons who are not Relevant Persons. Any investment or investment activity to which this Report relates is available only to Relevant Persons and will be engaged in only with Relevant Persons.

The Report does not constitute or form part of any invitation or offer for sale or subscription or any solicitation for any offer to buy or subscribe for any securities in any Company discussed nor shall it or any part of it form the basis of or be relied upon in connection with any contract or commitment whatsoever.

The opinions, estimates (and where included) projections, forecasts and expectations in this report are entirely those of Dr David Davis as at the time of the publication of this report, and are given as part of his normal research activity, and should not be relied upon as having been authorised or approved by any other person, and are subject to change without notice. There can be no assurance that future results or events will be consistent with such opinions, estimates (where included) projections, forecasts and expectations. No reliance may be placed for any purpose whatsoever on the information or opinions contained in this Report or on its completeness and no liability whatsoever is accepted for any loss howsoever arising from any use of this Report or its contents or otherwise in connection therewith. Accordingly, neither Dr David Davis nor any person connected to him, nor any of his respective Consultants make any representations or warranty in respect of the contents of the Report. Prospective investors are encouraged to obtain separate and independent verification of information and opinions contained in the Report as part of their own due diligence. The value of securities and the income from them may fluctuate. It should be remembered that past performance is not necessarily a guide to future performance.

Dr David Davis has produced this report independently of the companies that may be named in this report except for verification of factual elements. Any opinions, forecasts, projections, or estimates or other forward-looking information or any expectations in this Report constitute the independent judgement or view of Dr David Davis who has produced this report (independent of any company discussed or mentioned in the Report or any member of its group).

The Report is being supplied to you for your own information and may not be reproduced, further distributed to any other person or published, in whole or in part, for any purpose whatsoever, including (but not limited to) the press and the media. The distribution of the Report in certain jurisdictions may be restricted by law and therefore any person into whose possession it comes should inform themselves about and observe any such restriction.

The Report has been prepared with all reasonable care and is not knowingly misleading in whole or in part. The information herein is obtained from sources that Dr David Davis considers to be reliable but its accuracy and completeness cannot be guaranteed.

Dr David Davis Certification

Dr David Davis attests that the views expressed in this report accurately reflect his personal views about the Anglo Platinum. Dr David Davis does not hold any interest or trading positions in any of the Companies mentioned in the report.