Immediate Time Horizon For Precious Metals Into

The Next Major Cycle Target : April / May 2021

The Hare and The Tortoise Story

By David Mitchell

I wrote an article a few weeks ago demonstrating the optimal seasonal buying opportunity from mid to late November and into December; This period has empirically delivered a consistent and profitable investment time into precious metals. It is literally the best buying time frame throughout the year to purchase precious metals and has proved as such over the last 10+ years of recorded price action.

I am using the analogy of The Hare and the Tortoise story to describe what I expect in price action from two particular metals moving forward, Platinum and Silver.

The present seasonal buying opportunity ( late 2020 ) is particularly dynamic based on a number of pertinent facts, which include the Covid-19 ravaged economies, global debt moving parabolically higher, record unemployment numbers being supported by government debt largesse, fiscal debt expansion policies being announced weekly to support broken economies and active money printing being the only foundation lever left to governments and central banks. Which explains the huge unaccountable policies which directly lend themselves to outright currency debasement.

Added to this bonfire of dry tinder is the fact that we are now facing new and dramatic supply-demand crunches (deficits) in several key precious metals that are structural and are expected to considerably worsen over the next few years.

This really is the perfect storm insofar as it will lead to substantial price valuations of these metals and the commodity sector as whole.

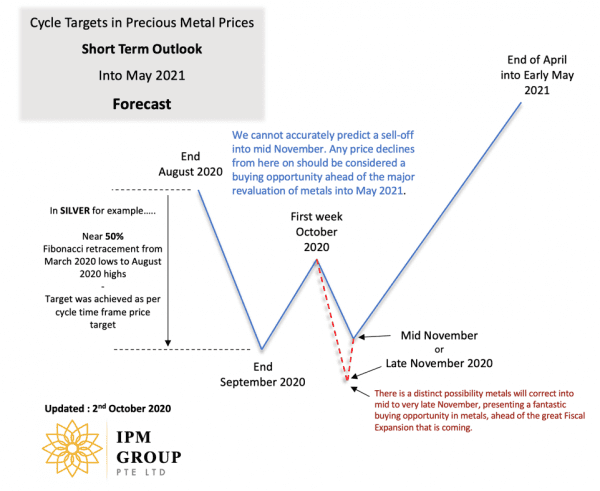

I released the projected price action chart on 2nd October 2020 (see picture below) to help guide our clients in identifying the distinct buying opportunities from the end of September into the end of November 2020.

In fact, the 30th November delivered the lows in Gold at US$1,764.50/oz and Silver at US$21.88/oz. and as of today the 8th December, Gold is trading at US$1,863.85/oz (+ 5.6%) and Silver is US$24.54/oz (+12.15%). Platinum saw a low in early November and is currently up +26% in the last month.

Now I do believe there is a slight chance we could see one last price dip into mid to late December and if this does indeed materialize, I will be again increasing my own personal positions in platinum and silver from my earlier purchases in late November.

Using varying forms of technical analysis alongside cycle wave analysis all combined with the expected significant uptick in metal prices into April – May 2021, this move is merely a short-term cycle within the much greater bullish cycle we expect into 2024 and beyond. This produces a price map of what we can all expect.

In this story, Silver is The Hare while Platinum is The Tortoise.

From my extensive research and analysis I am expecting silver to initially race-off at speed from late December 2020 into April 2021, as its technical picture is extremely dynamic. In fact, I am looking for Silver to test US$40/oz and above, in effect, a near doubling from its 30th November lows.

At which point, Silver (The Hare) will be exhausted and require another price consolidation period (a good restful sleep to rebuild its energies up again), while Platinum will just continue to plod on higher and gradually over the next 3 to 4 years. This is based exclusively on the incredible investment story that has developed as a function of its ongoing structural supply-demand deficit.

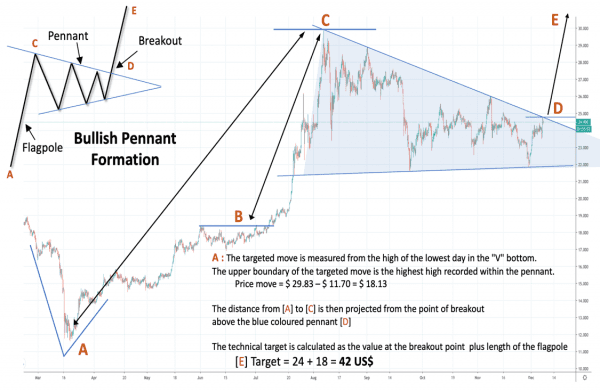

The reason for the dynamic price outlook in Silver is the extremely bullish technical picture, which, using my technical pricing analysis (see next page), calls for at least US$42/oz during this short time frame.

Pennants are really short-term triangles. They form with lower highs and higher lows. The line through the peaks and the line through the troughs converge and the pattern is completed by a break outside of the converging lines. Flags and pennants are congestion patterns that form in overall trends. They represent pauses while a trend consolidates and gathers energy. They are reliable continuation signals of a strong trend pattern.

I strongly believe that whilst ‘The Hare’ [silver] will be a significant out-performer in percentage terms in the short term, ‘The Tortoise’ [platinum] will ultimately win the overall race (into 2024 and beyond) in terms of outright final percentage gains, due to the very sizeable macroeconomic landscape that is the driving the price fundamentals for this particular precious metal.

We do have specific price targets and time frames in focus, although we do re-visit our analysis on a constant basis.

This article is written as a simple guide for our client base of metals investors and should serve only as an opinion piece. It does not take into account the particular circumstances, investment objectives and needs of any individual investor, or purport to be comprehensive or constitute investment advice and should not therefore be relied upon as such.