The impact of the COVID-19 pandemic on South African PGM supply, on global supply and ultimately on the price of platinum, palladium and rhodium. – Part 3

Global demand

The COVID-19 pandemic has caused severe PGM demand destruction in all sectors of the industry: Auto vehicle manufacture, autocatalyst manufacture, industrial use, jewellery and the financial and investment sector, ETF, bars and coins to name but a few.

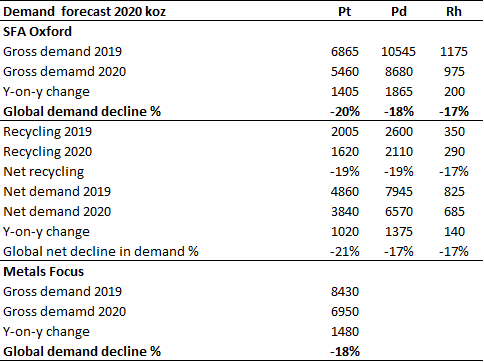

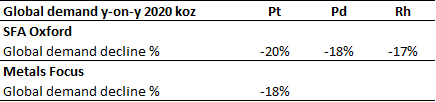

SFA Oxford reports a likely reduction in gross demand and y-on-y decline in global demand of -20%, -18% and -17%, which amounts to a decline in total supply of around c.1,405koz, c.1,865koz and c.200koz for platinum, palladium and rhodium respectively.

Net demand is likely to decline by 21%, -17% and -17%, which amounts to a decline in total demand of around c.1,020koz, c.1,375koz and c.140koz for platinum, palladium and rhodium respectively- Figure 6 below.

Metals Focus forecasts a y-on-y decline in global platinum demand of -18%, which amounts to a decline in total platinum demand of around c.1,480koz – Figure 6 below.

Figure 6: Global demand forecasts y-on-y 2020

Source: SFA Oxford, Metals Focus, Davis analysis

Auto vehicle manufacture and sales

The Market reports that light-duty vehicle production is expected to fall by around 20% y-on-y in 2020

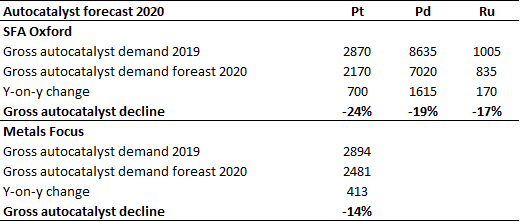

and as a result autocatalyst PGM demand will fall sharply in 2020 – Figure 7.

Figure 7: Autocatalyst demand forecasts y-on-y 2020

Source: SFA Oxford, Metals Focus, Davis analysis

SFA Oxford forecasts a y-on-y decline in gross autocatalysts of -24%, -19%, and -17%, which amounts to

a decline of total supply of around c.700koz, c.1,615koz and c.170koz for platinum, palladium and

rhodium respectively.

It is of note that China has become a ray of hope for automakers, including Volkswagen and General

Motors. China’s vehicle sales are estimated to rise 11.7% in May. The China Association of Automobile

Manufacturers (CAAM), cautioned that with this rise and even if China is able to contain the outbreak

effectively, its auto sales are expected to drop 15% this year, from over 25 million vehicles in 2019. If the

pandemic continues, the annual sales contraction will likely be by up to 25%.

Under these circumstances, some in the market are indicating the possibility of a V-shaped recovery for light vehicles in China and a U-shaped recovery in Western Europe.

JM reports that the impact of the COVID-19 pandemic on emission standards in China may lead to new regulations in some regions, which could allow some domestic automakers to thrift the autocatalyst content of palladium and rhodium, and to accelerate platinum substitution programmes.

On this point, JM has indicated that there will be some substitution of palladium by platinum in some gasoline engines (at last). In this regard, I am of the view that substitution will gain momentum which in turn will likely put upward pressure on the platinum price.

Investment

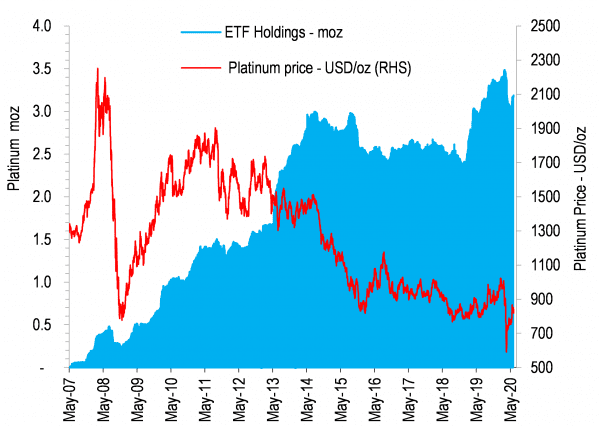

ETF purchasing and physical investment demand sent investment to a record of 1.13moz in 2019 (JM). However, the poor economic climate has led to some profit taking in the beginning of 2020 and by early May ETF withdrawals amounted some -350kz. Since then, however, investors have quickly clawed-back some of the outflow, withdrawals as at 6 June amounted to some -155koz. I would expect investors to continue to regain this initial loss – Figure 8.

SFA Oxford reports that Japan investors have increased their purchases of platinum bars this year. Platinum coin sales have also been strong. WPIC expects coin and bar investment demand to leap 115% to 605 000 oz in 2020, at a time of historic platinum price discount to itself, gold and palladium.

WPIC recently reported that the” demand for platinum bullion investment products surged to record highs in the first quarter of 2020, as retail investors reacted to heightened global risk and the platinum price falling to decade low levels. Investors bought 312koz of bars and coins in Q1 2020 ─ at an annual rate 5 times higher than over the past 40 years”.

In is important to note that platinum lease rates have reacted to the current market supply dynamics and remain elevated and significantly higher than palladium lease rates (6 June).

Source: Bloomberg, Davis analysis

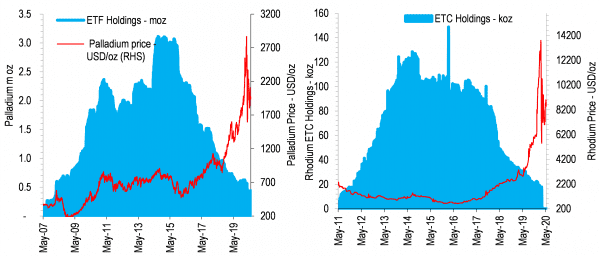

Palladium and rhodium holdings have declined since the beginning of the year by -177koz (6 June) and

10.8koz (26 March) respectively. Rhodium holdings have declined by just over a half, which I suspect

was due to profit taking.

Figure 9: Palladium and rhodium ETF holdings.

Source: Bloomberg, Davis analysis

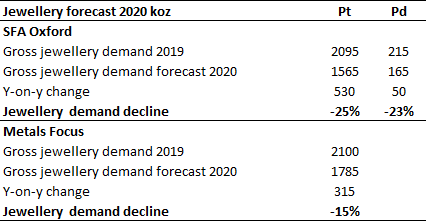

Jewellery

As expected, jewellery demand will likely fall sharply y-on-y in 2020 – Figure 10.

Figure 10: Jewellery demand forecast y-on-y 2020

Source: SFA Oxford, Metals Focus, Davis analysis

Market balance

Clearly, the COVID 19 pandemic has severely impacted PGM supply and demand dynamics for 2020 and

going forward.

Supply

In the discussion above, I have argued that the industry/market forecasts y-on-y 2020 are, in my view,

over optimistic with regard to PGM primary mine supply from South Africa and similarly, over optimistic

with regard the implied timing and return to a “new normal” of PGM supply. In this regard, I am of the

view that the downside risks associated with lockdown, and new mining safety protocols together with

the loss in production associated with an explosion at Amplats’ ACP plant have not been fully taken into

account.

Under these circumstances, I am of the view that PGM mine supply will decline y-on-y by between c. –

25% and -35%. The market view on mine supply forecasts ranges between -17%, 22% and at least more than -20%. It is important to note that JM has elected not to publish forecasts for 2020 as industry demand forecasts for 2020 are undergoing regular downgrades. Furthermore, JM indicated that it was unclear to what extent primary and secondary supplies will be disrupted and did not believe that it was possible to make a meaningful prediction of market balance.

The market reports that the impact of COVID-19 has caused a severe disruption to secondary refining operations. SFA Oxford expects autocatalyst recycling to decline y-on-y by -18%, -21% and -17% for platinum, palladium and rhodium.

Supplies from Russia appear to be relatively unaffected. SFA Oxford forecasts a -3% decline in supply of both platinum and palladium y-on-y for 2020.

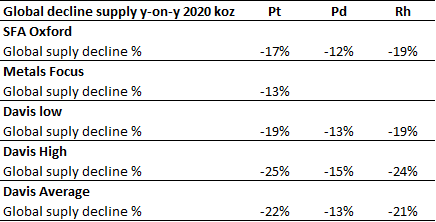

Overall, global PGM supply is set to decline significantly, much depends on the forecast decline in primary supply from the South African PGM mines. Figure 11 illustrates summary forecasts surrounding global PGM supply declines obtained from the industry and from risk-adjusted forecasts. It is important to note the forecast magnitude and trends in the decline of platinum, palladium and rhodium. In this regard, platinum and rhodium global supplies are likely to be more heavily impacted than palladium.

Furthermore, the risk-adjusted forecasts for PGM supply from South African mines is not unexpectedly a major driver of global supply. Notwithstanding, the decline will likely tighten the supply side of market fundamentals, especially the supply of rhodium and platinum.

Figure 11: Global decline in supply forecast y-on-y 2020

Source: SFA Oxford, Metals Focus, Davis analysis and estimates

Demand

As discussed, the COVID-19 pandemic has caused severe PGM demand destruction in all sectors of the industry: Vehicle and autocatalyst manufacture, industrial uses, jewellery and the financial and investment sector, ETF, bars and coins. The recovery will depend on the global financial climate beating COVID-19.

Figure 12 illustrates a summary forecast surrounding PGM global demand obtained from SFA Oxford and Metals Focus. It is apparent that these organisations expect a general decline in global demand of between -18% and -20%. Much will depend on the rate of return on vehicle manufacture and sales.

Figure 12: Global decline in demand forecast y-on-y 2020

Source: SFA Oxford, Metals Focus, Davis analysis

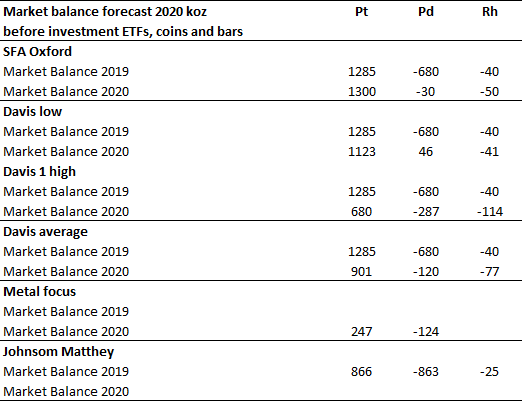

Market balance forecasts

Figure 13 below, illustrates a summary of market balance forecasts for platinum, palladium and rhodium obtained from the industry and risk-adjusted forecasts. It should be noted that the market balances listed in Figure 13 are stated before investment ETFs, coins and bars.

As indicated previously, it is important to note the forecast magnitude and trends in the market balance of platinum, palladium and rhodium. I note that the market balance forecasts differ significantly between the industry. However, they show an underlying market balance trend for platinum, palladium and rhodium trends which continue through from 2019 to 2020: This trend is magnified when the risk-adjusted forecasts are included in the comparison.

• Rhodium remains in deficit, which increases with an increase in the risk-adjusted decline in primary supply from South Africa’s PGM mines, and with a significant decline in global recycling. The continued market deficit combined with tight physical availability will put upward pressure on the rhodium price.

It is important to note that as the auto industry recovers from demand destruction caused by the COVID-19 pandemic the market deficit will become continuous and as a result will likely push up the rhodium price significantly.

• Palladium remains in a much-reduced deficit. I am of the view that the impact of a tighter supply scenario together with the application of tightening emissions standards will support the price. Going forward, palladium’s supply deficit likely will rise again as the auto industry recovers.

• Platinum remains in surplus, however, after significant withdrawals from the ETF investment market. At the beginning of the year, investors returned to the ETF market and to date (6 June) have nibbled away over half of the 350koz of the initial withdrawal. Demand is, however, expected by WPIC to leap 115% to 605 000oz in 2020. Coin and bar investment will reduce the market balance surplus significantly. Going forward, platinum demand will accelerate as the substitution of palladium gains momentum. So, in my view, platinum remains a good investment in the medium to long term.

Figure 13: Market balance forecast y-on-y 2020

Source: SFA Oxford, Metals Focus, Davis analysis and estimates

PGM prices

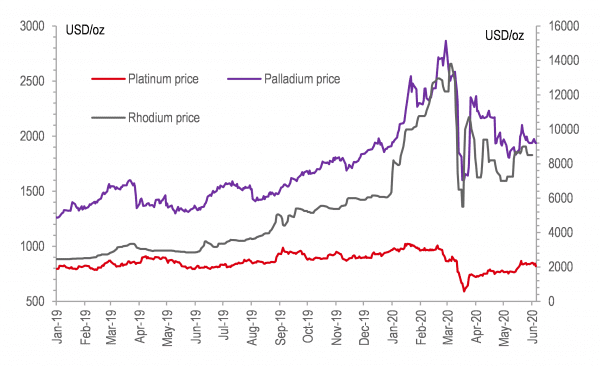

Figure 14: Platinum, palladium and rhodium price history

Source: Bloomberg, Davis analysis

Looking ahead in the medium term

I am of the view that the South African PGM mining industry will take some time to reach a new normal.

In this regard, there is an argument for a likely recovery in primary mine PGM supply from South Africa in 2021 ceteris paribus. It is important to note that mine management has indicated that some deep-level mines, which are operating at around 75% or 80% production, will likely be about cash neutral in the current economic environment. I am of the view that it is likely that some of the mines will have to undergo restructuring should production rates remain low. In this regard, it is therefore imperative that mines ramp up production by 2021. It should be noted that the mining industry has been adept in confronting adversity in the past.

The South African Government expects the COVID-19 pandemic could likely peak between August and September and that hopefully a COVID-19 vaccine will have been developed by early 2021.

About Dr David Davis PhD. MSc. MBL. CEng. CChem. FIMMM. FSAIMM. FRIC.

David has been associated with the South African mining industry and mining investment industry for the past 43 years (mainly PGM, gold and uranium). At present, David is working as an independent precious metal consultant. David’s PhD involved: “Studies in the catalytic reduction and decomposition of nitric oxide 1976”.

Important Notice

General Disclosures, Disclaimers and Warnings

This Report (“the report”) in respect of the global Rhodium Industry is directed at and is being issued on a strictly private and confidential basis to, and only to, Professional Clients and Eligible Counter-parties (“Relevant Persons”) as defined under the Investment Research Regulatory Rules and is not directed at Retail Clients. This report must not be acted on or relied on by persons who are not Relevant Persons. Any investment or investment activity to which this Report relates is available only to Relevant Persons and will be engaged in only with Relevant Persons.

The Report does not constitute or form part of any invitation or offer for sale or subscription or any solicitation for any offer to buy or subscribe for any securities in any Company discussed nor shall it or any part of it form the basis of or be relied upon in connection with any contract or commitment whatsoever.

The opinions, estimates (and where included) projections, forecasts and expectations in this report are entirely those of Dr David Davis as at the time of the publication of this report, and are given as part of his normal research activity, and should not be relied upon as having been authorised or approved by any other person, and are subject to change without notice. There can be no assurance that future results or events will be consistent with such opinions, estimates (where included) projections, forecasts and expectations. No reliance may be placed for any purpose whatsoever on the information or opinions contained in this Report or on its completeness and no liability whatsoever is accepted for any loss howsoever arising from any use of this Report or its contents or otherwise in connection therewith. Accordingly, neither Dr David Davis nor any person connected to him, nor any of his respective Consultants make any representations or warranty in respect of the contents of the Report. Prospective investors are encouraged to obtain separate and independent verification of information and opinions contained in the Report as part of their own due diligence. The value of securities and the income from them may fluctuate. It should be remembered that past performance is not necessarily a guide to future performance.

Dr David Davis has produced this report independently of the companies that may be named in this report except for verification of factual elements. Any opinions, forecasts, projections, or estimates or other forward-looking information or any expectations in this Report constitute the independent judgement or view of Dr David Davis who has produced this report (independent of any company discussed or mentioned in the Report or any member of its group).

The Report is being supplied to you for your own information and may not be reproduced, further distributed to any other person or published, in whole or in part, for any purpose whatsoever, including (but not limited to) the press and the media. The distribution of the Report in certain jurisdictions may be restricted by law and therefore any person into whose possession it comes should inform themselves about and observe any such restriction.

The Report has been prepared with all reasonable care and is not knowingly misleading in whole or in part. The information herein is obtained from sources that Dr David Davis considers to be reliable but its accuracy and completeness cannot be guaranteed.

Dr David Davis Certification

Dr David Davis attests that the views expressed in this report accurately reflect his personal views about the Companies mentioned in this report. Dr David Davis does not hold any interest or trading positions in any of the Companies mentioned in the report.