Gold rose this week after weaker than expected economic data

Gold and Silver Report 6 April 2015

Gold rose this week after weaker than expected economic data come out of the U.S. as well as finding support from some improved buying from china and continuing geopolitical tensions in the Middle East.

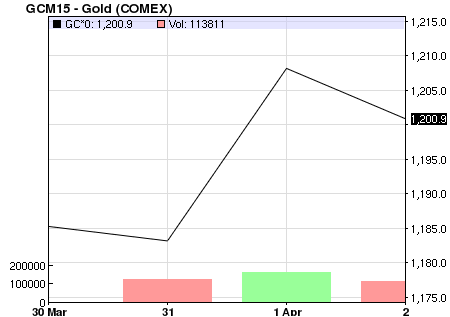

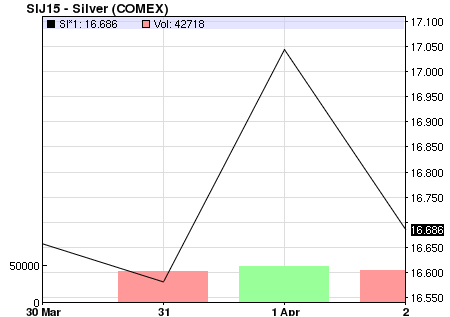

Price and charts snapshot:

| Commodity | Units | Price |

Change |

% Change |

| COMEX Gold (Jun 15 delivery) | USD/t oz. | USD$1,200.90 (AUD$1,573.40) |

-7.30 |

-0.60% |

| Gold Spot | USD/t oz. | USD$1,206.91 (AUD$1,581.28) |

+4.30 |

+0.36% |

| COMEX Silver (May 15 delivery) | USD/t oz. | USD$16.72 (AUD$21.91) |

+0.02 |

+0.11% |

| US Dollar Spot | USD/t oz. | USD$17.06 (AUD$22.35) |

+0.29 |

+1.71% |

Source: Bloomberg

|

|

Source: NASDAQ

On Monday gold prices fell as expectations of the U.S. Federal Reserve rate hike later in the year were restored. The previous Friday, Chairwoman Yellen announced the hike “may well be warranted later this year” citing overall positive economic conditions. The U.S. dollar climbed and spot gold fell by 1.4% on the news[1]. Month-end and quarter-end selling could also have been downward pressures. On Tuesday gold hovered near the Monday’s lows,[2] ending the month of March with a loss of 2.4%[3]. On Wednesday however the yellow metal climbed as the U.S. dollar retreated and mostly held gains on Thursday after a preliminary ADP National

Employment Report showed that private payrolls rose less than forecast.[4] Precious metals firmed on Friday as the comprehensive report was released with data that showed U.S. employers added the fewest jobs in over a year in March.

While there are feelings of certainty from some around the rate hike happening, analysts agree that the Fed will be anything but aggressive in its rate hike path, with many looking at the first rate increase happening in September instead of June as earlier predicted[5].

Yellen’s own comments indicated that a hike will be called for if positive economic conditions are sustained. However various factors are pointing to slower growth: recent data showed slower economic U.S. economic growth in the first quarter[6], its factory activity hit a near two-year low in March and global growth is also slowing. Howie Lee at Phillip Futures said “Given falling oil prices and slowing growth globally they cannot afford to raise rates too early so I think the first rate hike will happen in September”.

In particular the low jobs data on Friday led to speculation that the Federal Reserve may delay the increase in interest rates.[7] Thus not all are relying on a hike, Naeem Aslam, analyst at Ava Trade said “Investors are dialing back on the rate hike expectations”, “This translates as good news for gold, but bad news for the dollar.”

Meanwhile in other market news, buying interest in China, the world’s second-largest gold consumer after India, has been relatively soft of late, but dealers reported some interest overnight after prices eased. MKS reported “Following yesterday’s sell off, China was back as a buyer today”, “We saw gold add a few dollars in Tokyo before Shanghai took over and sent the yellow metal to a session high.”[8][9] Investors were also keeping an eye on tensions in Yemen including a clash in Aden, which aided gold’s climb last week.[10]

By Lisa Casagrande | https://www.goldbullionaustralia.com.au

[1] http://www.reuters.com/article/2015/03/30/markets-precious-idUSL3N0WW2WC20150330

[2] http://www.reuters.com/article/2015/03/31/markets-precious-idUSL3N0WW2WW20150331

[3] http://www.reuters.com/article/2015/04/01/markets-precious-idUSL3N0WX39620150401

[4] http://www.reuters.com/article/2015/04/01/markets-precious-idUSL3N0WY30R20150401

[5] http://www.reuters.com/article/2015/03/30/markets-precious-idUSL3N0WW2WC20150330

[6] http://www.reuters.com/article/2015/04/01/markets-precious-idUSL3N0WY30R20150401

[7] http://www.reuters.com/article/2015/04/03/markets-precious-idUSL3N0X024120150403

[8] http://www.reuters.com/article/2015/04/01/markets-precious-idUSL3N0WY2WN20150401

[9] http://www.reuters.com/article/2015/03/30/markets-precious-idUSL3N0WW16U20150330

[10] http://www.reuters.com/article/2015/03/30/markets-precious-idUSL3N0WW16U20150330