Hard Assets Rebound on Simmering Bank Stress

As the US Government shutdown enters its second month, economists are finding it increasingly more difficult to judge the health of the world’s largest economy.

However, the lack of weekly macroeconomic data has not dampened activity in financial markets. In fact, daily volatility indicators in the precious metals complex pushed against five-year highs last week.

And while key support levels were frayed during Thursday’s trading session, strong buying on the dip lifted Gold, Silver and Platinum prices back into the recent consolidation ranges.

Physical Gold priced in USD traded in a wide, 3.0% weekly range and finished the week pretty much unchanged at $4000.00.

The yellow metal has traded on both sides of the 30-Day Moving Average (30-DMA) during eight of the last 10 trading sessions, which suggests upside momentum is building. A trade above $4110.00 would lift the technical tone and likely spur a move higher.

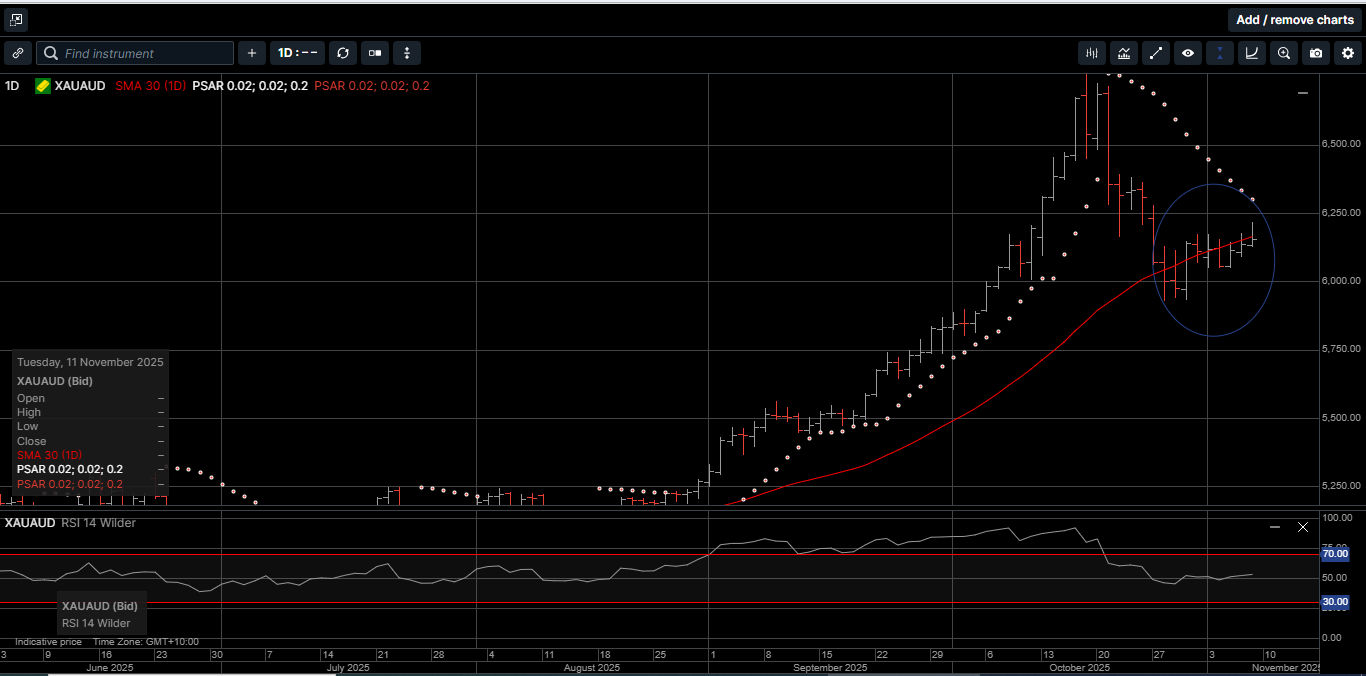

Gold denominated in AUD posted a 1.1% gain for the week and closed at $6155.00.

As illustrated on Chart 1, AUD Gold traded on both sides of the 30-DMA during nine of 10 trading sessions with a noticeable upward bias. We see a pivot level in the $6300.00 area to support upside range extension.

Physical Silver priced in USD slipped 1.0% lower to close out the week at $48.30. The daily chart looks to be carving out a pennant formation, which is generally bullish. With a pivot in the $49.60 area, USD Silver could see more consolidation before breaking higher.

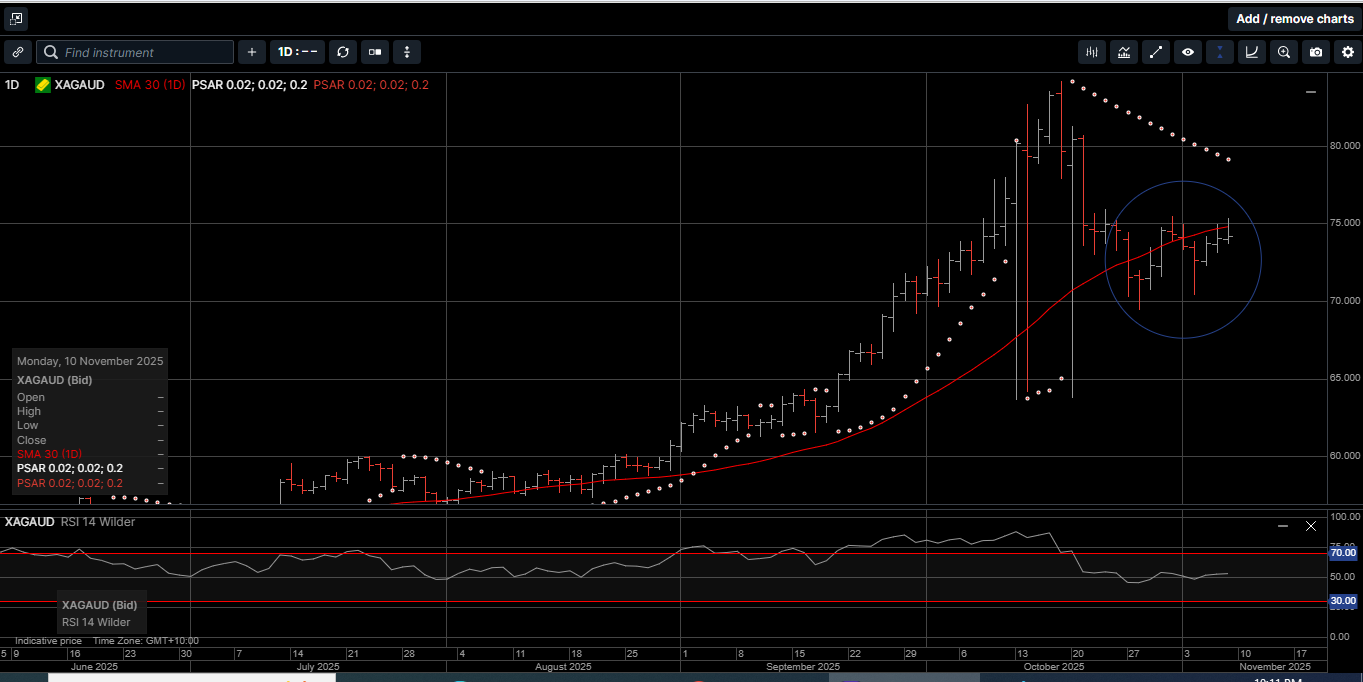

Silver denominated in AUD was down 6.4% last Thursday at $70.50 before snapping back to finish the week fractionally lower at $74.20. As shown on Chart 2, AUD Silver traded on both sides of the 30 DMA during 8 of the last 10 sessions with an upward bias.

A close above $76.15 would improve the technical tone.

The Gold versus Silver ratio moved half a percent in favor of Gold to close at 82.50. This means it takes 82.50 ounces of Silver to equal the price of one ounce of Gold. We expect this ratio to continue to trend lower as Silver outperforms Gold over a longer-term time horizon.

Physical Platinum hit a six-week low at $1497 and was down 8.1% on Thursday before bouncing back to finish the week 1.8% lower at $1540.00. The technical picture still looks to be corrective and a close above $1620.00 is needed to confirm a durable low is in place.

With most market commentators focused on the government shutdown, tariffs and geopolitical unrest, the increasing stress on US banks, especially regional banks, has been under reported.

It is worth pointing out that the current rally in the precious metals complex was triggered back in March of 2023 after several regional banks hit the wall.

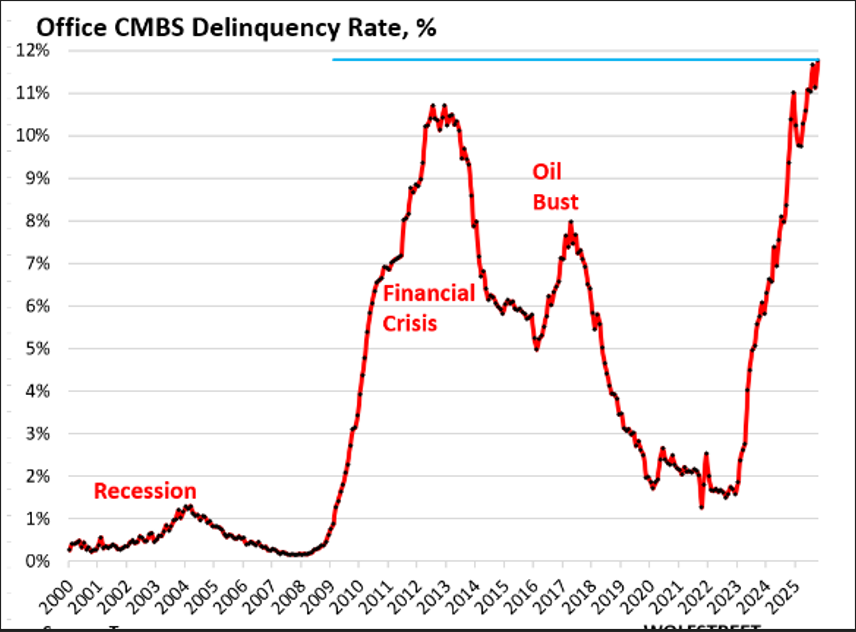

As shown on Chart 3, the delinquency rate of office mortgages that have been securitized into commercial mortgage-backed securities (CMBS) spiked to 11.8% in October, the worst ever, and over a percentage point higher than at the peak of the Global Financial Crisis.

CMBS are bonds that are sold to institutional investors around the world, such as bond funds, insurers, pension funds and other banks.

The CMBS market was good until suddenly it wasn’t. In October 2022, the office CMBS delinquency rate was still 1.8%. In the three years since then, it exploded by 10 percentage points.

Older office tower valuations are getting crushed by a flight to quality and by corporate downsizing of office space due to continued working from home stemming from COVID.

Even newer office tower valuations are under pressure by corporate downsizing.

With more than $5 trillion of US bank exposure tied to commercial property through direct loans, securities holdings, credit lines, and developer financing, the risk doesn’t sit in one corner, it interlocks throughout the system.

And three of these banking stress points, Commercial Real Estate, private credit, and auto loans, disproportionately sit on or flow through US regional banks.

Smaller and midsize banks have historically been key lenders to offices, apartments, and other income-producing properties, leaving a larger portion of their balance sheets tied to property performance than the bigger banks.

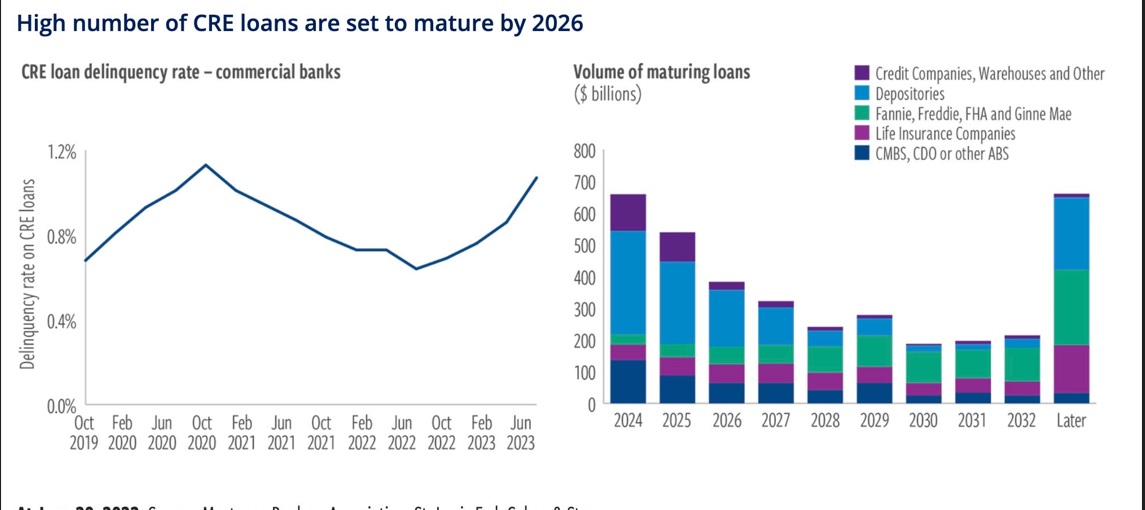

As shown on chart 4, with valuations under pressure and a wave of loan maturities approaching by 2026, lenders will likely face rising delinquencies and the need to boost reserves; especially where office loans or recently underwritten, higher-leverage deals are concentrated.

That could leave these banks vulnerable as fundamentals worsen. The result could very well look like a slow-motion replay of 2023’s bank failures: liquidity strains, forced mergers, and emergency weekend interventions from the FED.

The ultimate outcome seems pre-scripted: a cycle where stress first hits regional banks and ends, once again, with a FED backstop like Quantitative Easing (QE) protecting the larger banks.

After the QE starts, the effect is usually US interest rates and the USD slip lower and Gold, Silver and Platinum trade higher.

It’s hard not to see the parallels to the run-up to the global financial crisis in 2008, when losses were visible everywhere except in official commentary.

It seems like the global markets have reached that eerie pause where risks are acknowledged in theory but not reflected in the pricing of traditional paper assets.

To the mainstream financial media, the playbook hasn’t changed much since 2008: delay the markdowns, hope the cycle bails equity markets out, and treat denial as a risk-management strategy.

But the stresses building in commercial real estate, auto lending and consumer credit, suggest we are once again in the quiet center of the storm; the part where the outcomes are predictable, but the recognition hasn’t yet hit the Wall Street Indexes.

Central banks have read this script before, which is why they have been buying Gold aggressively over the last three years.

The recent eight-week rally in the precious metals complex was a wakeup call to investors that the consistent accumulation of hard assets increases personal wealth security.

Hard assets represent the purest form of money and a store of value in an uncertain economic environment.

With the precious metals trading off their recent highs, now is the time to consider making Gold, Silver and Platinum the cornerstone assets in your long-term wealth creation strategy.

This publication has been prepared for the GBA Group Companies. It is for education purposes only and should not be considered either general of personal advice. It does not consider any particular person’s investment objectives, financial situation or needs. Accordingly, no recommendation (expressed or implied) or other information contained in this report should be acted upon without the appropriateness of that information having regard to those factors. You should assess whether or not the information contained herein is appropriate to your individual financial circumstances and goals before making an investment decision, or seek the help the of a licensed financial adviser. Performance is historical, performance may vary, past performance is not necessarily indicative of future performance. Any prices, quotes or statistics included have been obtained from sources deemed to be reliable, but we do not guarantee their accuracy or completeness.