Gold Cracks $3700.00 as the Federal Reserve Eases Rates

Gold Cracks $3700.00 as the Federal Reserve Eases Rates

Last Wednesday, the US Federal Reserve (FED) lowered their FED FUNDS target rate by 25 basis points to 4.0% to 4.25%.

The move was widely expected by the mainstream financial media with a handful of commentators calling for a 50-basis point cut.

The precious metals complex initially traded lower on the news but found a bid as investors bought the dip to push prices higher into the weekend.

Physical Gold priced in USD rose by 1.1% to hit a new all-time high at $3007.00 as well as a new all-time high weekly close at $3684.00.

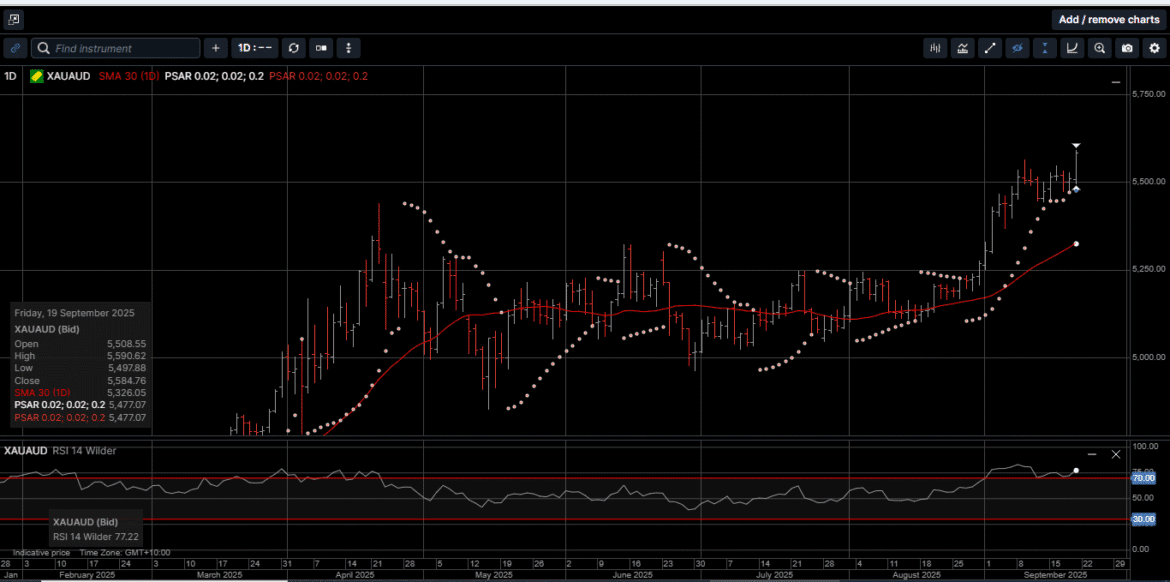

Gold denominated in AUD also reached a new all-time high at $5590.00 and finished the week 2.1% higher with a new weekly high close at $5584.00.

The brief selloff after the FED announcement has alleviated the overbought conditions for Gold in both currencies which could lead to an extension higher to start this week.

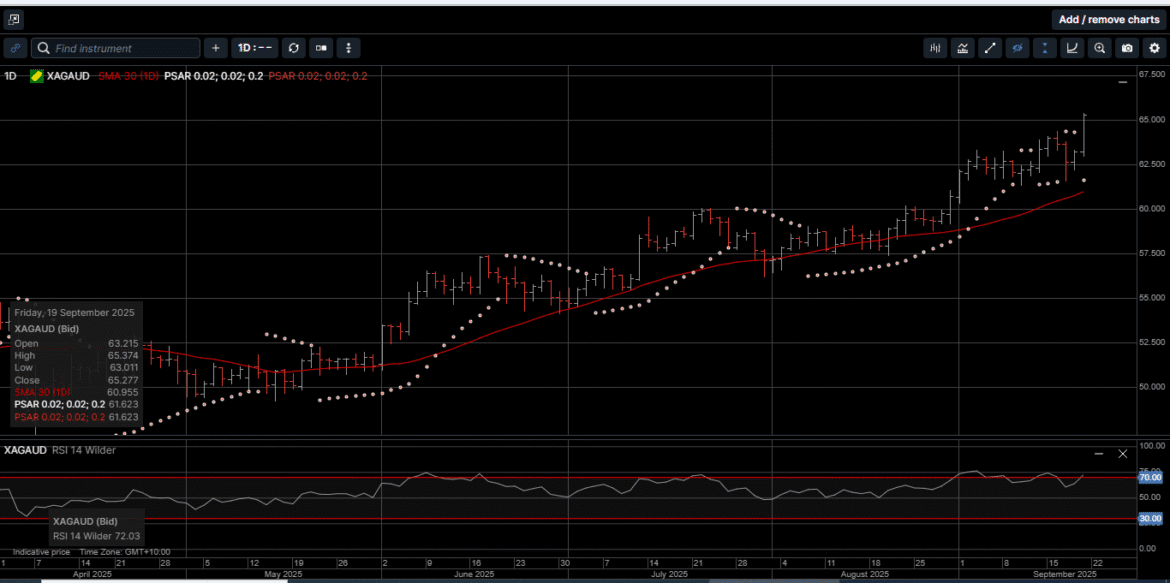

Physical Silver priced in USD tagged the $43.00 handle for the first time since September of 2011 on the way to a 2.0% gain with a close just off the high of the week at $43.07.

Silver based in AUD hit a new all-time high at $65.37 and closed out the week 3.1% higher and just 10 cents off the high for the week $65.27.

Silver in both currencies were well bid into Friday’s close, which suggests more upside momentum over the near-term.

The Gold versus Silver ratio moved 1.1% lower in favor of Silver to close at 85.48. This means it takes 85.48 ounces of Silver to equal the price of one ounce of Gold.

The Gold versus Silver ratio reached 107.10 on April 22nd. Over the last five months, the ratio has moved in favor of Silver by 20%.

Physical Platinum prices rose by half a percent to finish the week at $1402.00. Despite trading over $1400.00 during 15 of the last 16 trading sessions, this was the first daily close above $1400.00 since July 25th.

Internal momentum indicators are pointing higher, which is in line with the current bullish chart structure.

As illustrated on Chart 1, it’s been nine months since the FED last adjusted rates; and there is plenty of room to ease on the downside.

Only once since it started publishing its target rate in the 1970s had The FED waited longer to make a policy adjustment.

That was during 2001-2002 when, unlike now, Wall Street was near a bear-market low, consumer spending was weak, and inflation was below target.

The forward guidance from the meeting suggests The Fed members are also shifting in a dovish direction with at least 50 basis points more easing now set for 2025.

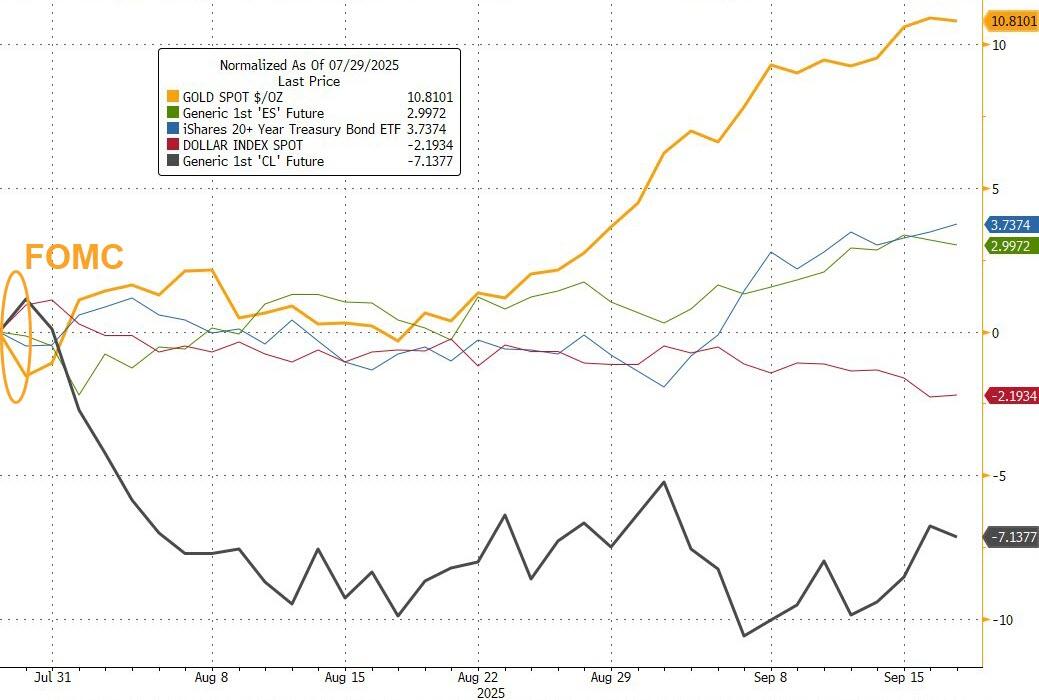

Since The Fed’s last meeting on July 30th, many interesting events have driven financial markets.

These events include the massive 911,000 downward revisions to the US Jobs market, continued questions about inflationary pressure from tariffs, and a rise in both geopolitical and trade policy uncertainty.

As shown on Chart 2, Gold has been a steady outperformer during the interim period since the last FED meeting.

In fact, since the FED’s July 30th meeting, Gold, Silver and Platinum have outperformed the SP 500, US bonds, the USD Index and crude oil prices by a wide margin.

This is because in the current market environment, hard assets are security against uncertainty.

Throughout history, hard assets represent sound money and a safe haven store of value for long-term investors.

With global sovereign debt soaring, fiat currencies faltering, and trust in central banks eroding, the risk of a major monetary reset is on the rise.

As such, physical Gold, Silver and Platinum can play a pivotal role in protecting and growing your generational wealth creation strategy.

Chart 3 – Gold AUD

Chart 4 – Silver AUD

This publication has been prepared for the GBA Group Companies. It is for education purposes only and should not be considered either general of personal advice. It does not consider any particular person’s investment objectives, financial situation or needs. Accordingly, no recommendation (expressed or implied) or other information contained in this report should be acted upon without the appropriateness of that information having regard to those factors. You should assess whether or not the information contained herein is appropriate to your individual financial circumstances and goals before making an investment decision, or seek the help the of a licensed financial adviser. Performance is historical, performance may vary, past performance is not necessarily indicative of future performance. Any prices, quotes or statistics included have been obtained from sources deemed to be reliable, but we do not guarantee their accuracy or completeness.