This week’s US FOMC policy statement will likely include 25 basis points of easing, and perhaps an end to the FED’s quantitative tightening (QT) operations, which could be bullish for Gold, Silver and Platinum prices.

Physical Gold priced in USD hit a new all-time high at $4381.00 on Monday before reversing 8.6% to post a low of $4004.00 early Wednesday. The yellow metal ended the week down 3.3% at $4111.00.

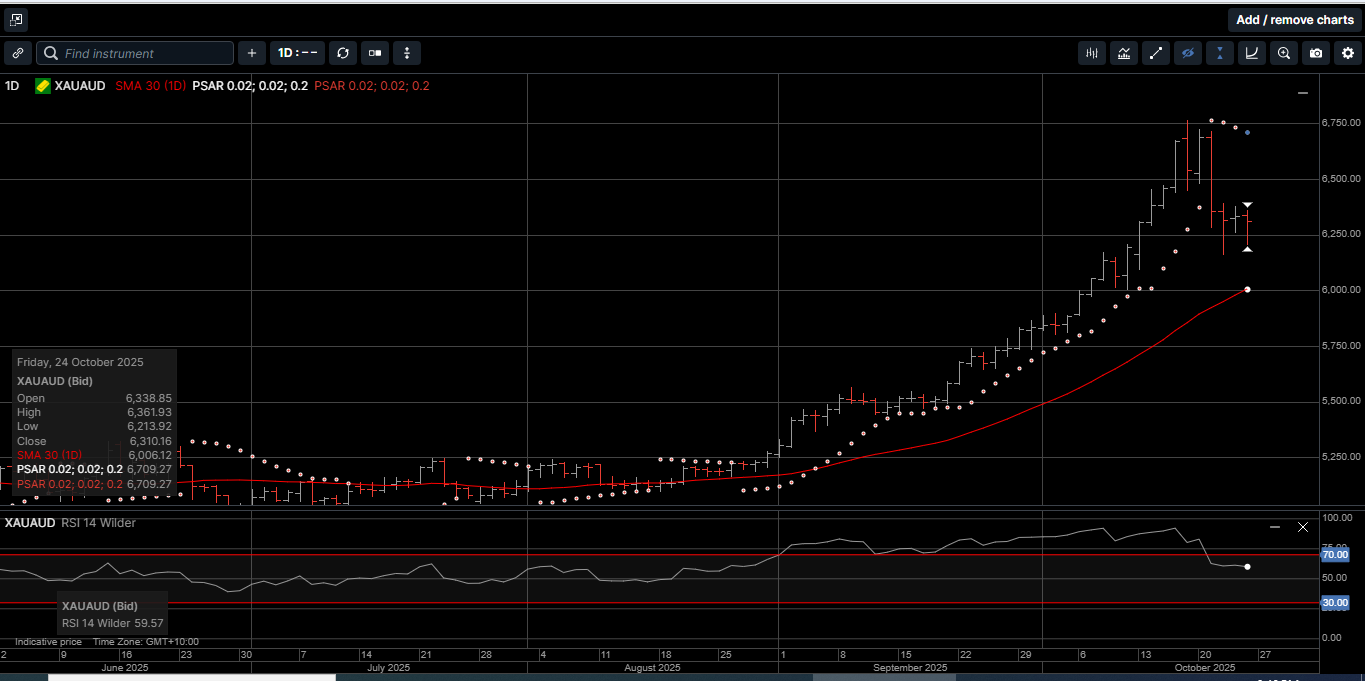

Gold denominated in AUD faced similar midweek selling pressure and finished the week with a 3.5% loss at $6310.

USD based physical Silver was down over 11% during Wednesday’s London session but recovered somewhat to close Friday’s NY session with a 6.1% loss at $48.60.

Silver denominated in AUD followed a similar price pattern and slipped 6.4% lower to close at $74.60.

The Gold versus Silver ratio rose 3.6% in favour of Gold to close at 84.50. This means it takes 84.50 ounces of Silver to equal the price of one ounce of Gold.

Physical Platinum traded in a 14% range for the week and dipped below $1500.00 for the first time in a month before finding support to finish the week with a 1.1% loss at $1604.00.

The precious metals complex was in overbought territory last week, so a reversion lower is not alarming and could be considered a technical correction as opposed to a change in trend.

Typically, initial price support within a bull market can be found in the area of the 30-day moving average on daily price charts.

The current 30-day moving average levels for the precious metals complex are: $3941.00 for USD Gold, $6006.00 for AUD Gold, $47.50 for USD Silver, $72.32 for AUD Silver, and $1558.00 for Platinum.

It’s often a temptation for chartists to dwell on the neatness of round numbers, especially in the physical Gold market.

But a more significant theme emerges when considering how quickly Gold has moved between the thresholds of the $1000.00 round numbers.

As illustrated on Chart 1, Gold first broke above the 1980 high of $850.00 per ounce and crossed $1,000 per ounce in March of 2008 during the global financial crisis.