Gold and Silver Get a Boost From Chinese Stimulus

Gold and Silver Get a Boost From Chinese Stimulus

In what has become a familiar pattern over the last month, physical Gold and Silver prices posted strong gains during the week, and then drifted lower into the weekend.

Gold based in USD reached a new all-time high of $2685.50 on the way to a 1.4% gain for the week. This is the 10th new all-time high for USD Gold this year.

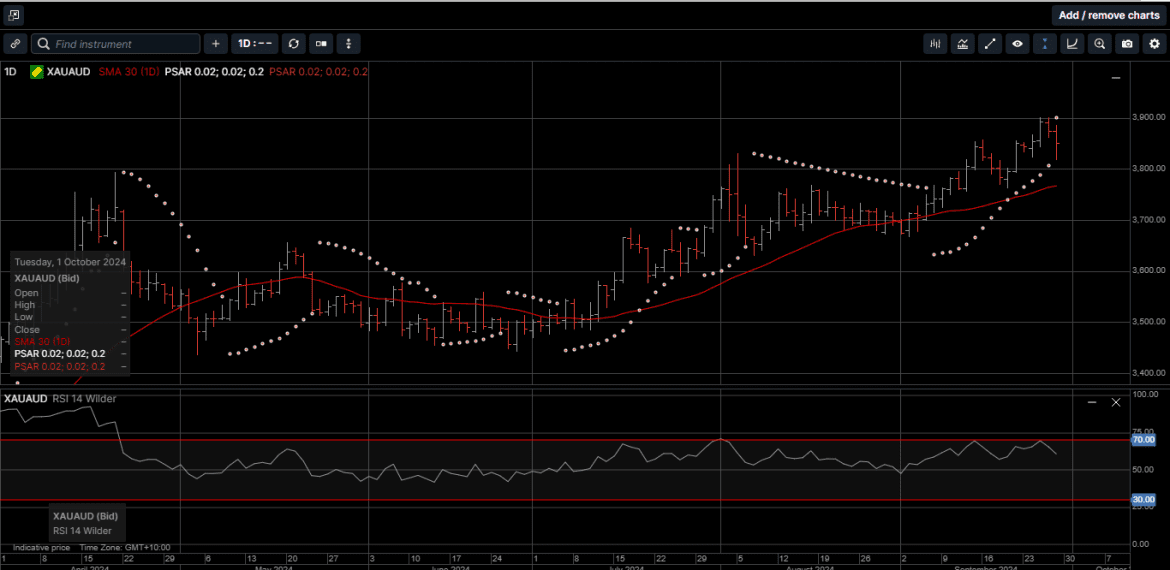

AUD denominated Gold broke through the $3900.00 level for the first time ever but drifted back to unchanged by the end of the week as the AUD/USD continued to rally.

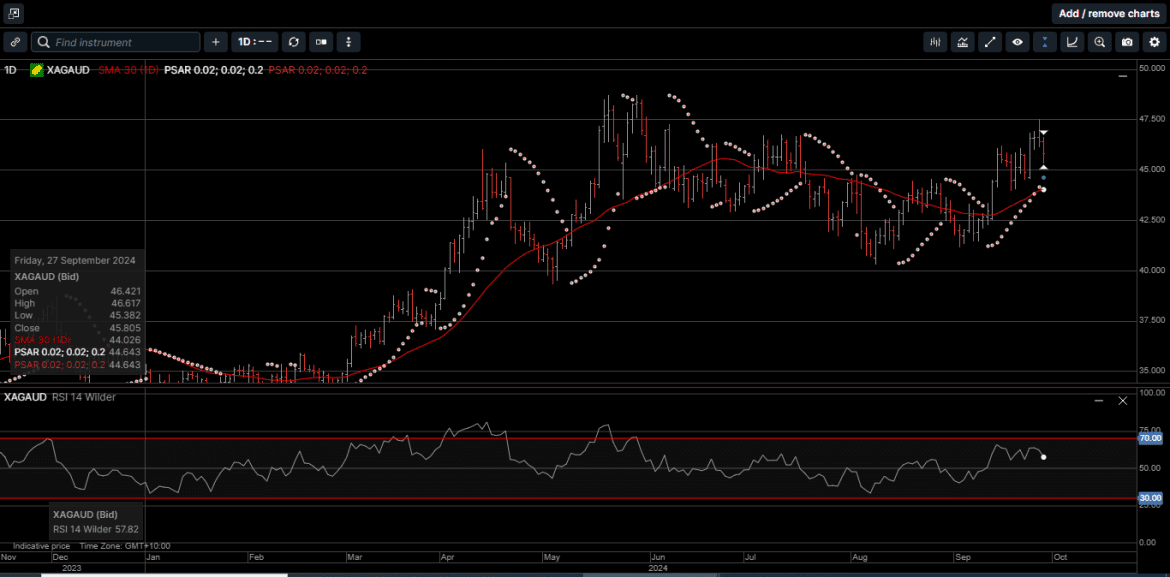

USD Silver traded above the $30.00 level every day last week, rose to a 12-year high at $32.70 and ended the week 1.5% higher, while Silver based in AUD tagged a four-month high of $47.50 and was up fractionally for the week.

The massive stimulus package announce by the Chinese government was a primary driver in a wide spectrum of financial markets last week, including Gold and Silver.

With the Federal Reserve’s 50 basis point (bp) rate cut on August 18th, seven of the G10 central banks have begun an easing cycle that will extend, broaden, and may accelerate going forward.

Australia’s RBA and Norway’s Norges bank have stood firm on rates so far, but will likely begin easing next year, while some, like Canada and Sweden may increase the pace of their rate cuts before the end of the year.

Last week, Beijing jumped into the mix with rate cuts, reserve requirement reductions, and a flood of liquidity aimed at supporting the property markets and domestic stocks.

After numerous pledges to take decisive monetary action over the last several months, Chinese officials moved in a big way last week.

The Peoples Bank of China (PBoC) cut the 7-day repo rate by 20 bp to 1.50%, reduced the one-year Medium-Term Lending Facility rate by a record 30 bp to 2.0%, and cut reserve requirements on retail banks by 0.5%.

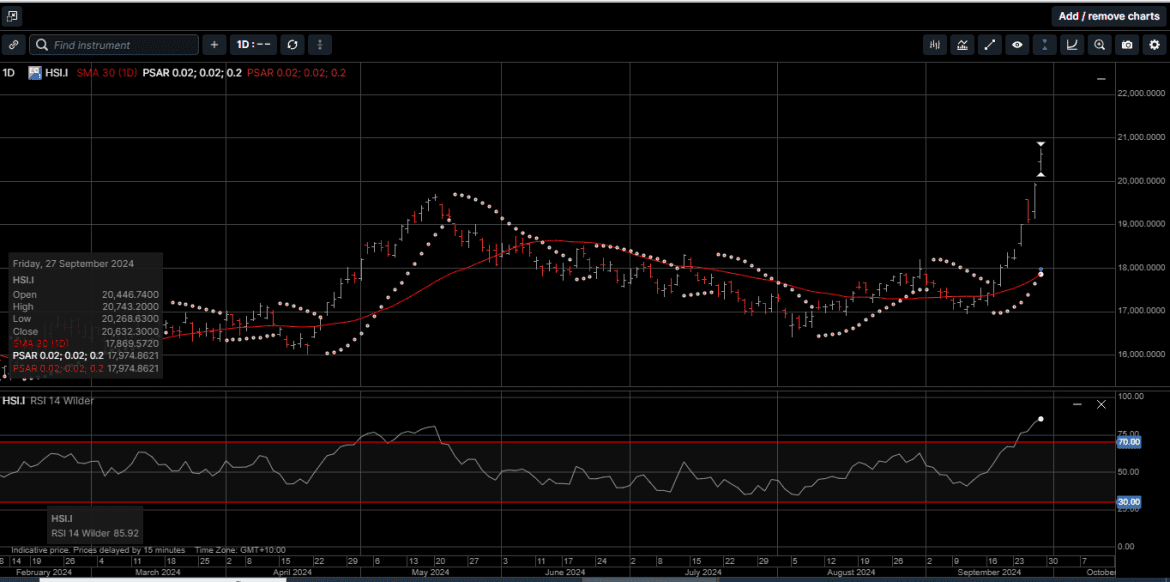

The PBoC also announced 800 billion Yuan (120 billion USD) in direct support for Chinese equity markets, which, as illustrated on Chart 1, pushed the Hang Seng index up 13.4% for the week.

This was the strongest weekly performance for the Hang Seng since June of 2008.

But that’s not all, the Chinese government followed up the PBOC’s performance by announcing new fiscal stimulus measures aimed at supporting China’s ailing real estate sector.

The government offered few specifics beyond a commitment to stem the sharp slide in residential housing prices, but reports suggest that policy measures will include approximately 2 trillion Yuan (290 billion USD) of new bond issuance this year to support retail sales and alleviate debt burdens for consumers.

It’s important to note the timing of these announcements are in front of China’s Golden Week holiday, which will close financial markets from October 1st to the 8th.

As expected, some market commentators believed that the numbers announced are inadequate to the challenge, but the material point is that the Chinese government is now sending a clear signal that this is their “whatever it takes” moment.

Interestingly, the plans also include limitations on the construction of new homes as the government seeks to address oversupply in the housing stock that has contributed to falling prices.

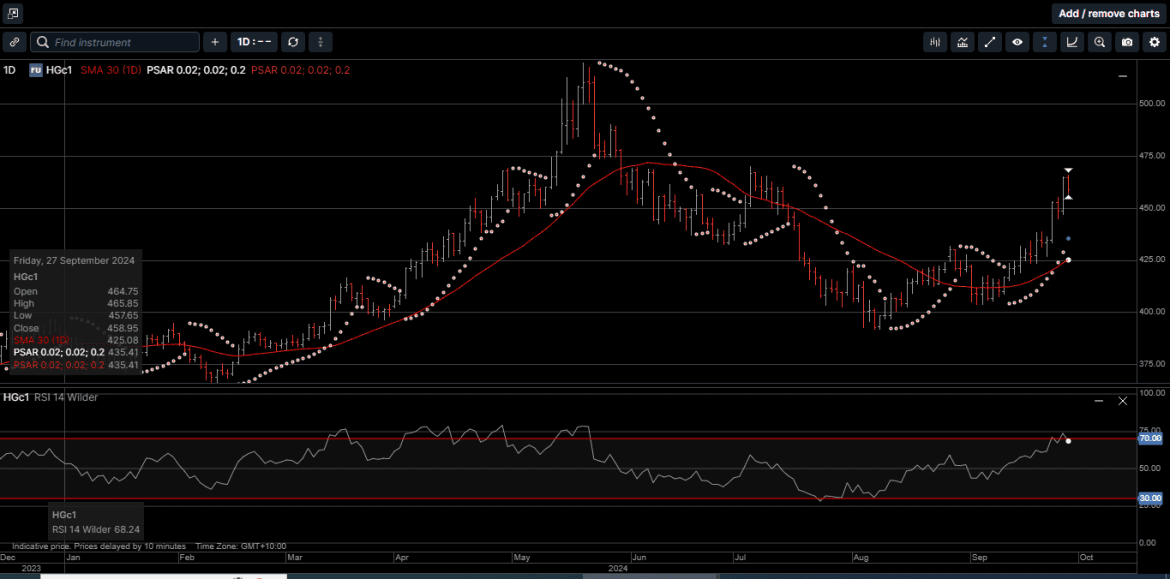

Despite the government’s announced intention to place strict limits on new development, the market latched onto the broad state support theme to bid up construction related commodities like iron ore, copper and steel futures.

For example, Chart 2 shows that the price of copper, often considered and inflation indicator, rallied 7.4% on the stimulus news.

So, what could go wrong?

Well, China has just fired their stimulus bazooka less than two weeks after the US FED kicked off its easing cycle with a supersized 50 bp rate cut.

Suddenly we are seeing a strong rally in commodity markets right after the FED declared “mission accomplished” in the inflation fight and turned its attention instead to a softening labor market.

With all of this new potentially inflationary stimulus from China, and the G10 central banks almost unanimously in easing cycles, is it any wonder that Gold is making new all-time highs, and Silver is at a 12-year high?

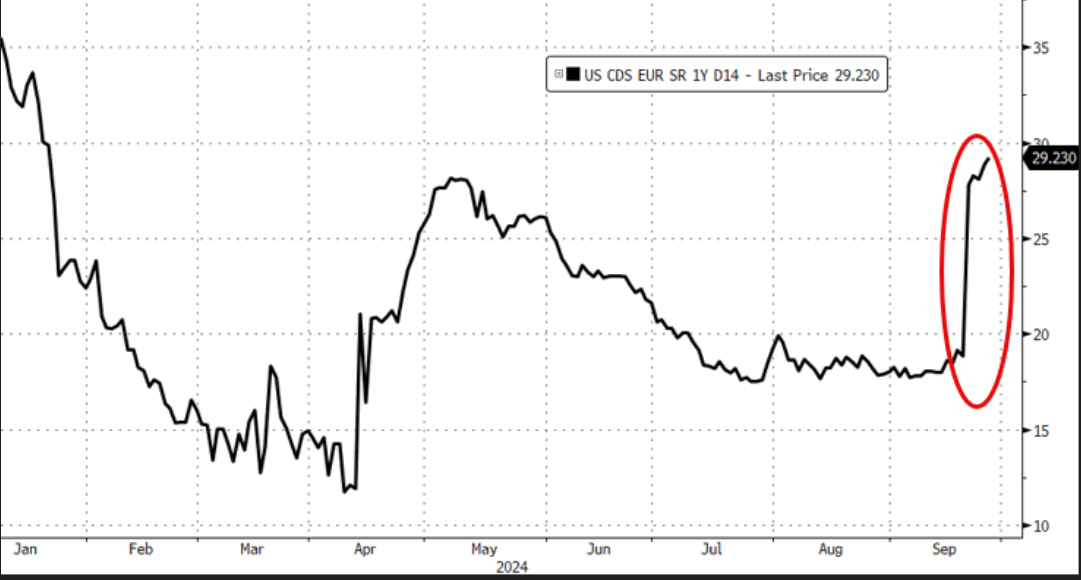

And while global financial markets have been surging from “risk on” easing of financial conditions euphoria, Chart 3 reveals that US sovereign Credit Default Swaps have spiked by more than 50% over the last three weeks.

Credit Default Swaps are essentially an insurance policy to protect large government bond holders from default. The higher the premium, the higher the perceived risk of default.

This is more than just a simmering side effect of the FED pivoting to an easing cycle while deficits grow virtually unchecked.

And, importantly, the US is not the only G10 nation whose risk of sovereign debt default is increasing recently.

Provident, long-term investors understand that unlike local currencies, which are created by governments, physical Gold and Silver cannot default or go bankrupt.

This is why accumulating physical Gold and Silver is an excellent safe haven against financial market instability and economic uncertainty.

Gold and Silver have been recognized throughout time as a true form of wealth, secure assets, and an essential part of a diversified investment strategy.

Chart 1 HANG SENG Index:

Chart 2 Copper:

Chart 3 US CD Swaps:

Chart 4 Gold AUD:

Chart 5 Silver AUD:

This publication has been prepared for the GBA Group Companies. It is for education purposes only and should not be considered either general of personal advice. It does not consider any particular person’s investment objectives, financial situation or needs. Accordingly, no recommendation (expressed or implied) or other information contained in this report should be acted upon without the appropriateness of that information having regard to those factors. You should assess whether or not the information contained herein is appropriate to your individual financial circumstances and goals before making an investment decision, or seek the help the of a licensed financial adviser. Performance is historical, performance may vary, past performance is not necessarily indicative of future performance. Any prices, quotes or statistics included have been obtained from sources deemed to be reliable, but we do not guarantee their accuracy or completeness.