The Gold vs Silver Ratio is Back in Focus

The precious metals complex has experienced a strong rally over the last four weeks. As such, it’s not surprising that last week’s market action could be described as high-level price consolidation.

This is typical for this time of year as US and European markets wind down for the Northern summer. We expect trade flows to return to normal around the upcoming key economic data points and in the lead-up to the next FOMC meeting.

Gold and Silver Performance

The impact on Gold and Silver has seen increased intraday volatility against largely range-bound weekly price action.

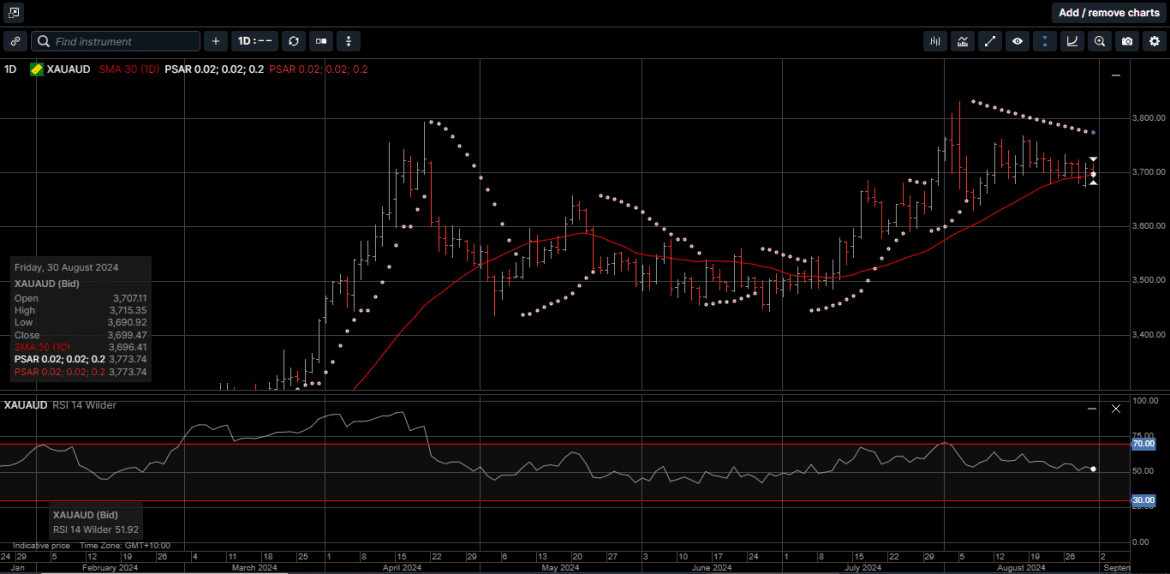

Physical Gold in USD posted a new all-time closing high at $2,524 on Tuesday but finished the week fractionally lower. Gold denominated in AUD held the key support line near $3,670 with a small gain for the week.

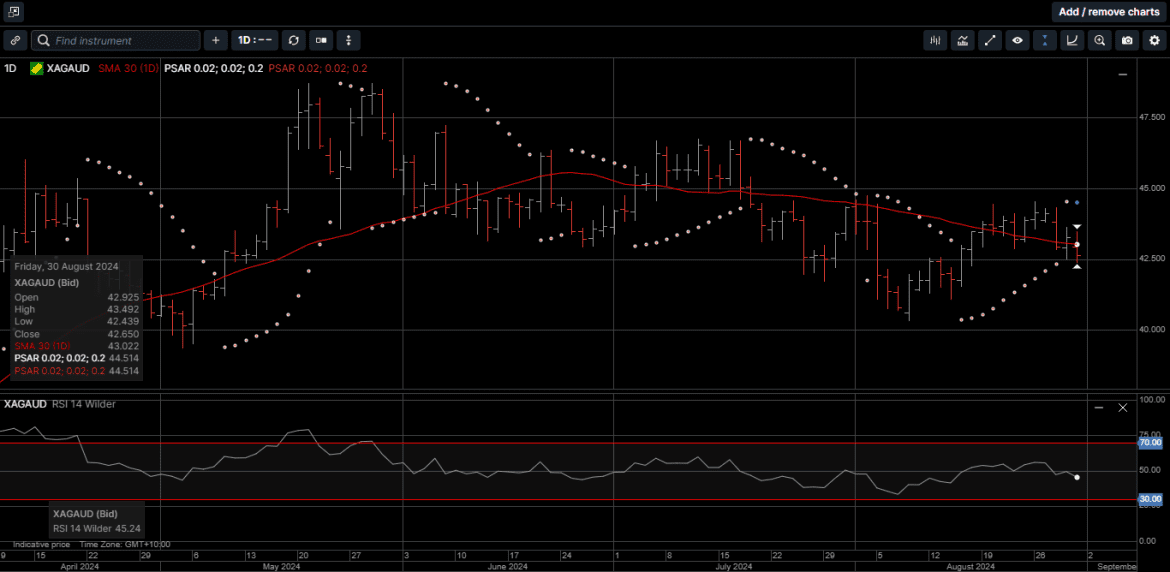

USD Silver underperformed Gold for the first time in a month, closing 3.2% lower for the week, while AUD-based Silver slipped 2.75% at the close of business last week.

Silver’s Steady Rise

It’s important to note that physical Silver prices, in both USD and AUD, have been rising steadily since early August. This technical aspect of the Silver markets suggests that Silver could outperform Gold over the medium term.

Gold vs. Silver Ratio

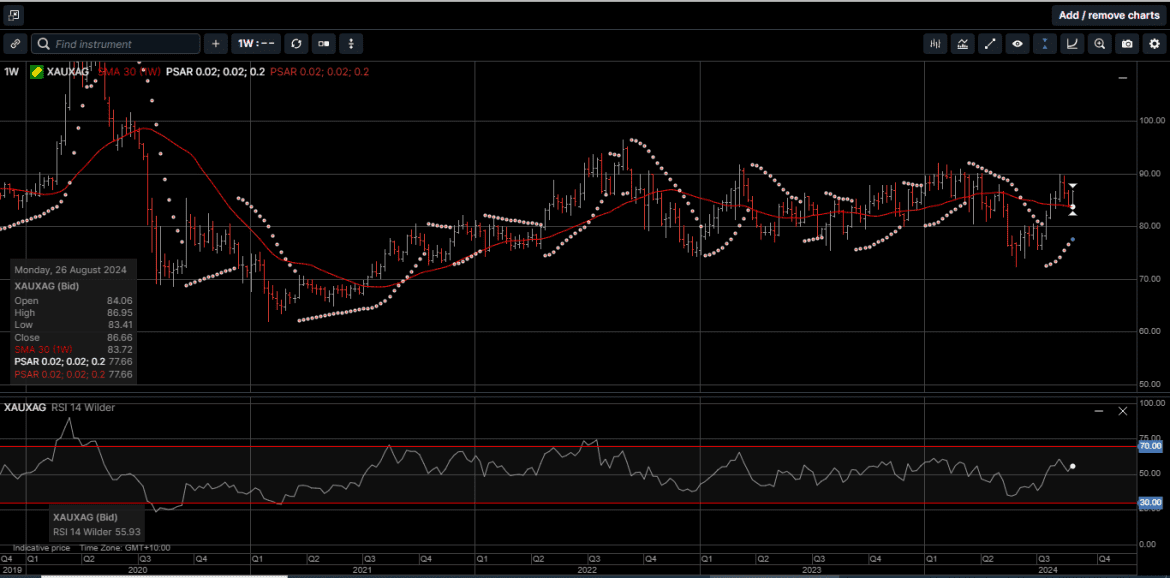

As illustrated on Chart 1, the Gold versus Silver ratio topped out around 91.50 in mid-February and then drifted as low as 73.50 in late May. The current level is 86.50.

This means that in mid-February, it took 91.50 ounces of Silver to equal the price of one ounce of Gold. When the ratio fell to 73.50 at the end of May, that pencilled out to nearly a 20% outperformance in favour of Silver.

Geological Perspective on Silver

From a geological perspective, there is 20 times as much Silver on the planet as there is Gold, so the ratio has a long way to adjust to fit that equation.

Silver’s Industrial Demand

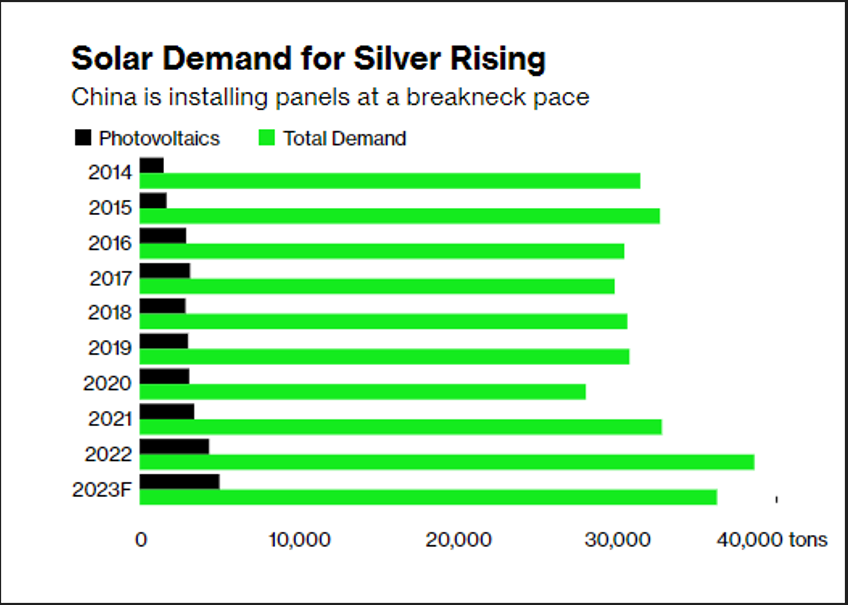

One of the most widespread uses of Silver is in solar panels. Not only is the demand for solar panels growing, but the amount of Silver used in each panel is also increasing.

Industrial demand for Silver hit a record of 654.4 million ounces in 2023, and it is expected to hit new highs this year. According to the Silver Institute in Washington D.C., ongoing structural gains from green economy applications underpinned this surge in Silver demand.

Silver’s Importance in Solar Panel Production

Silver is the best conductor of electricity compared to all other metals, which makes it a vital input in the production of solar panels. To manufacture a solar panel, Silver is formed into a paste that is applied to the front and back of silicon photovoltaic cells. The front side collects the electrons generated when sunlight strikes the cell, while the back side helps to complete the electrical circuit.

Each new generation solar panel uses approximately 0.75 ounces of Silver. While this is a relatively small amount, the total adds up quickly when you consider the number of panels produced each year.

Rising Demand for Silver in Solar Technology

As shown on Chart 2, the solar industry used approximately 100 million ounces of Silver in 2023, accounting for about 14 percent of total Silver demand.

Several years ago, many analysts believed that the amount of Silver used in solar panels would decline over time with the development of new technologies. In 2020, Passivated Emitter and Rear Cell (PERC) technology was the standard, accounting for virtually the entire solar market. A PERC solar panel uses about 10 milligrams of Silver per watt.

By 2022, PERC technology was being replaced by Tunnel Oxide Passivated Contact (TOPCon) cells. This advanced technology enhances the efficiency of solar cells by improving the way they handle electron flow. A TOPCon cell is cheaper to produce but uses more Silver than a PERC solar panel. It contains about 13 milligrams of Silver per watt.

With demand for solar power increasing along with the amount of Silver used in each panel, analysts believe that solar panel production will consume increasingly large amounts of Silver in the future. According to research by scientists at the University of New South Wales, solar manufacturers will likely require over 20 percent of the current annual Silver supply by 2027.

Silver Market Deficits and Future Price Increases

By 2050, solar panel production will use approximately 85–95 percent of the current global Silver reserves. The physical Silver market is already running significant deficits, with demand outstripping supply. In fact, the structural deficit in 2023 came in at 184.3 million ounces. This means investors could see much higher prices due to a significant supply squeeze in the coming years.

Silver as a Monetary Metal

It’s also important to remember that while industrial demand is an important factor driving the price, Silver is still fundamentally a monetary metal. As such, the physical Silver price tends to track with Gold over time.

In short, if high government deficits, global economic uncertainty, and simmering geopolitical tensions have made investors bullish on Gold, then it is reasonable to think that investors should be equally as bullish on Silver. And as we have seen over the last four weeks, Silver can sometimes outperform Gold in a Gold bull market.

Adding Precious Metals to Your Portfolio

There are plenty of reasons why a growing number of investors are turning to the time-proven security and safety of Gold and Silver as the cornerstone of their wealth creation strategy. With the precious metals complex building upside momentum over the last several weeks, now is the time to consider the benefits of adding to your Gold and Silver holdings before prices advance sharply higher.

Chart 1: Weekly Gold Silver Ratio

Chart 2: Silver Demand

Chart 3: Gold AUD

Chart 4: Silver AUD

Disclaimer

This publication has been prepared for the GBA Group companies. It is for educational purposes only and should not be considered either general or personal advice. It does not consider any particular person’s investment objectives, financial situation, or needs. Accordingly, no recommendation (expressed or implied) or other information contained in this report should be acted upon without the appropriateness of that information having regard to those factors. You should assess whether or not the information contained herein is appropriate to your individual financial circumstances and goals before making an investment decision or seek the help of a licensed financial adviser. Performance is historical, performance may vary, and past performance is not necessarily indicative of future performance. Any prices, quotes, or statistics included have been obtained from sources deemed to be reliable, but we do not guarantee their accuracy or completeness.