The FED’s Stealth Easing is Bullish for Gold and Silver

The FED’s Stealth Easing is Bullish for Gold and Silver

With the US reciprocal tariff deadline looming this Wednesday and the holiday shortened trade in front of Independence Day, we weren’t expecting strong price action in either direction last week.

However, as the precious metals complex digested the potential ramifications of the FED’s lowering of the Supplementary Leverage Ratio (SLR) the previous week, both Gold and Silver caught a bid.

Physical Gold priced in USD traded on both sides of the 30-day moving average near $3343.00 and settled 1.9% higher at $3336.00.

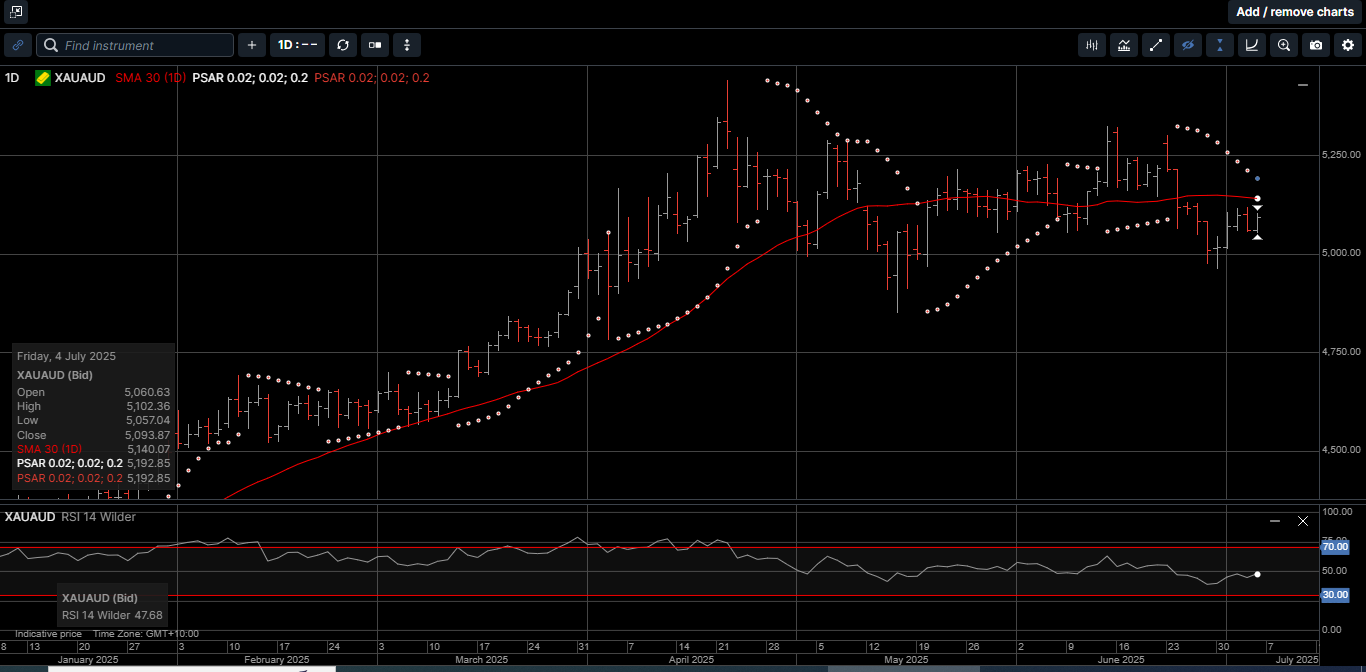

Gold denominated in AUD also improved its technical tone and finished the week 1.6% higher at $5093.00.

Physical Silver based in USD continues to coil higher after tagging a high of $37.10 and closing the week 2.6% higher at $36.95, while Silver denominated in AUD posted a 2.3% gain to close at $56.30.

The Gold versus Silver ratio probed lower in favor of Silver to close at a 15-month low at 90.30. This means it takes 90.30 ounces of Silver to equal the price of one ounce of Gold.

Since the ratio reached a high of 107.00 on April 22nd, Silver has outperformed Gold by 15.6%.

Anyone following financial markets would have heard that a growing number of US administration officials have been very critical of FED chief Jerome Powell’s reluctance to lower the FED Funds target rates.

In fact, some of this criticism has been voiced by other voting FED board members.

With that in mind, the FED’s easing of the SLR at the last FOMC meeting stands as a pivotal regulatory shift with far-reaching implications for US financial markets.

By recalibrating capital requirements from 5.5% to 3.75% for large banks, the FED aims to address systemic liquidity bottlenecks in the Treasury market, which is an integral asset of global finance.

This adjustment could free up as much as $300 billion in bank capital to expand their Treasury portfolios

Analysts estimate that for every 1% reduction in SLR requirements, a major bank’s Treasury holdings could increase by up to $10 billion, directly boosting liquidity in the $23 trillion US sovereign debt market.

US Banks stand to benefit immediately as improved capital ratios could unlock shareholder returns and stabilize stock multiples.

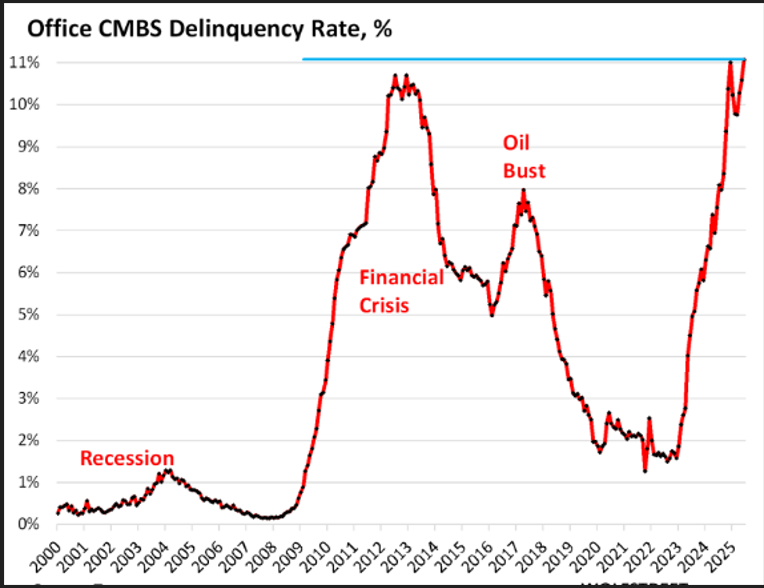

And, as illustrated on Chart 1 this increase in balance sheet liquidity could help alleviate some of the stress banks are facing as commercial real estate loan delinquency rates push up to 14-year highs.

The FED’s SLR easing represents a critical step toward stabilizing banks and the Treasury market’s backbone, which is why some analysts are calling it a Stealth Easing and Gold and Silver prices moved higher.

In addition, two weeks ago, the U.S. Treasury quietly executed the largest debt buyback in history by absorbing $10 billion worth of its own bonds, matching an earlier round in late May.

When the Treasury starts buying back its own IOUs, it signals a deeper problem: the government is having trouble keeping the bond market calm without outside help.

In simple terms, this means the U.S. government is taking old debt off the market, not because it’s paid off, but because rising interest rates are making it harder to manage.

It’s like trying to pay off a credit card by borrowing from another card. You’re not solving the problem, just shifting it around.

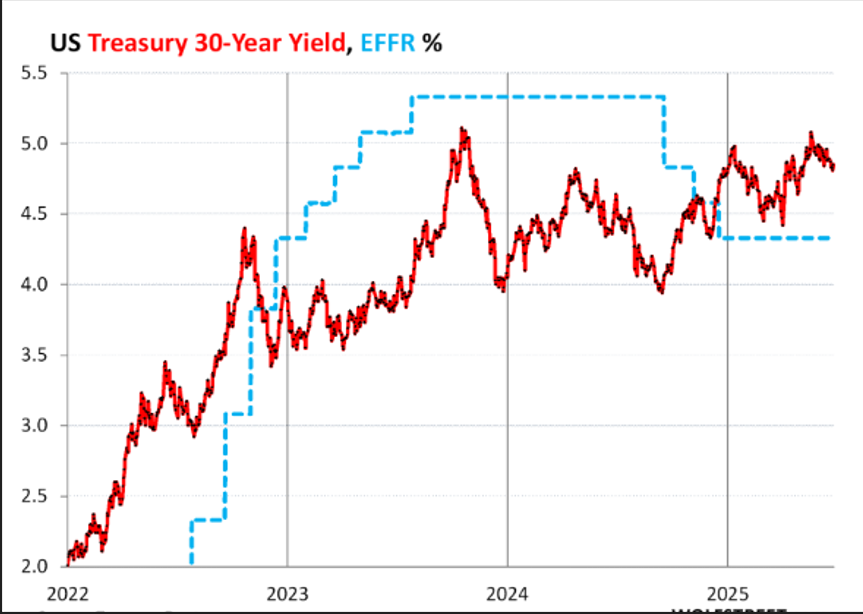

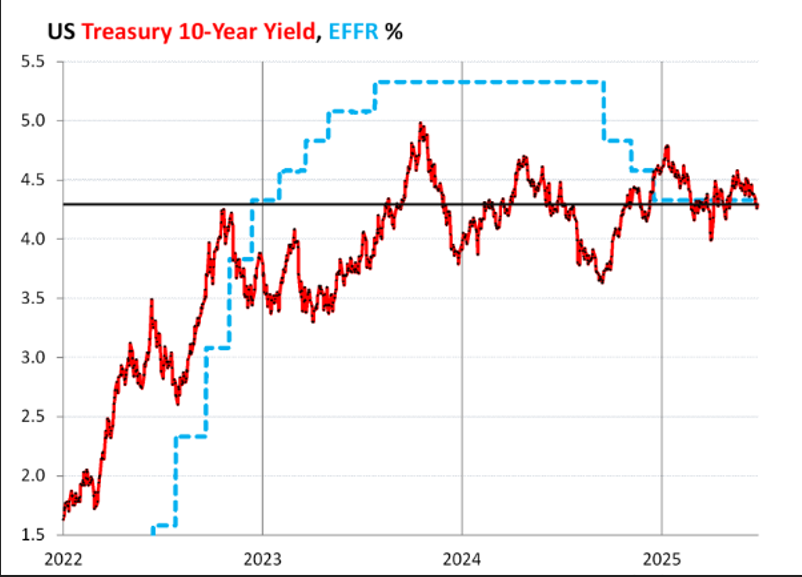

But with the FED lowering the SLR and signaling a rate cut at the July FOMC meeting, the Treasury market got a boost which helped push longer-term rates lower.

As shown on Charts 2 and 3, both the 30-year and the 10-year bond yields have slipped lower toward the current FED Funds target rate in anticipation of lower overnight rates, which is also bullish for Gold and Silver prices.

In other words, the Treasury is stepping in, quietly trying to contain the damage that ballooning deficits, uncertain tariff policies and a lower USD have pressed onto US debt markets.

It is important to note that Gold and Silver are not negatively impacted and only benefit from these capers.

Debt buybacks from the Treasury department, and interest rate policy irresolution from the FED are reminders that paper assets live and die by central planning.

Gold and Silver do not.

Physical Gold and Silver are two of the best performing assets over the last three years.

They have proven to maintain their value over the long-term as secure safe havens against inflation and the erosion of fiat currencies.

Now is the time to consider making physical Gold and Silver the cornerstone assets for your long-term diversified wealth creation strategy.

Chart 4 Gold AUD

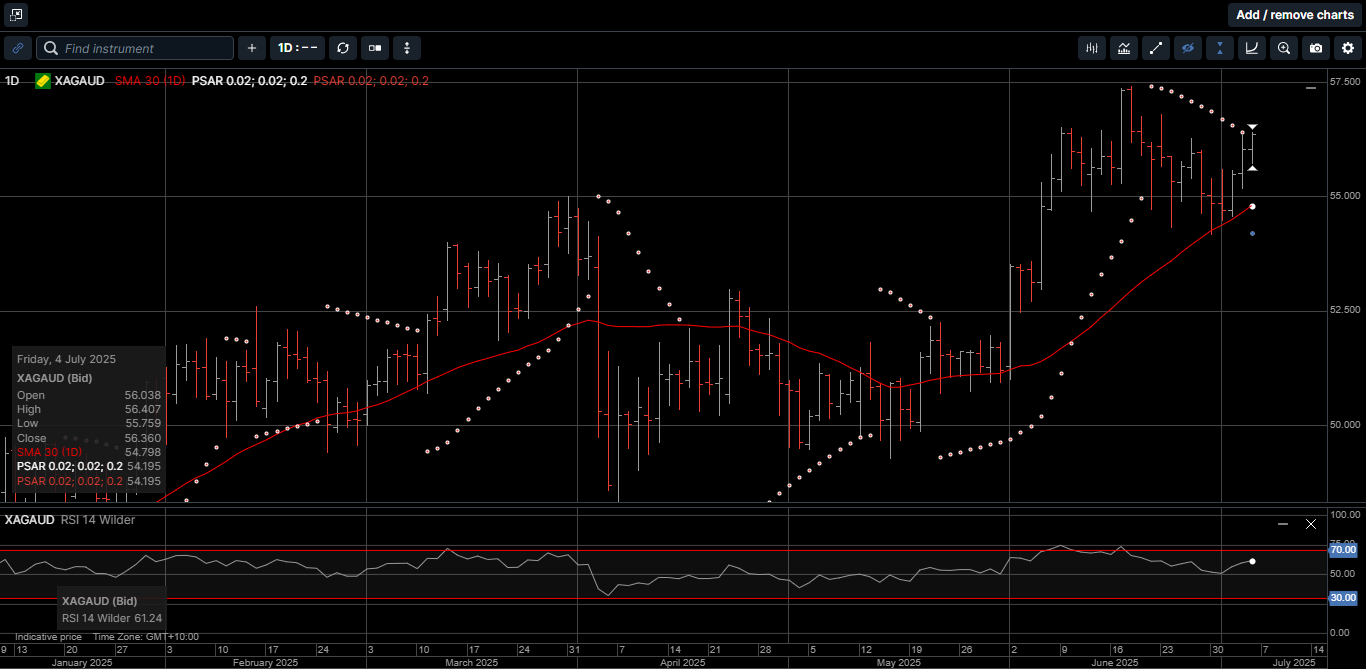

Chart 4 Silver AUD

This publication has been prepared for the GBA Group Companies. It is for education purposes only and should not be considered either general of personal advice. It does not consider any particular person’s investment objectives, financial situation or needs. Accordingly, no recommendation (expressed or implied) or other information contained in this report should be acted upon without the appropriateness of that information having regard to those factors. You should assess whether or not the information contained herein is appropriate to your individual financial circumstances and goals before making an investment decision, or seek the help the of a licensed financial adviser. Performance is historical, performance may vary, past performance is not necessarily indicative of future performance. Any prices, quotes or statistics included have been obtained from sources deemed to be reliable, but we do not guarantee their accuracy or completeness.