Stagflation is Bullish for Gold and Silver

Stagflation is Bullish for Gold and Silver

The uncertainty over US reciprocal and sector tariffs, due to commence on April 2, is boosting apprehension among policymakers, investors, and businesses.

Aside from tariff headlines and rumors, the most significant market event last week was the US Federal Reserve (FED) meeting.

As expected, the FED did nothing except lower growth estimates, raise inflation expectations, and move closer to suggesting no interest rate cuts this year.

In short, the FED, like many investors, are in wait-and-see mode.

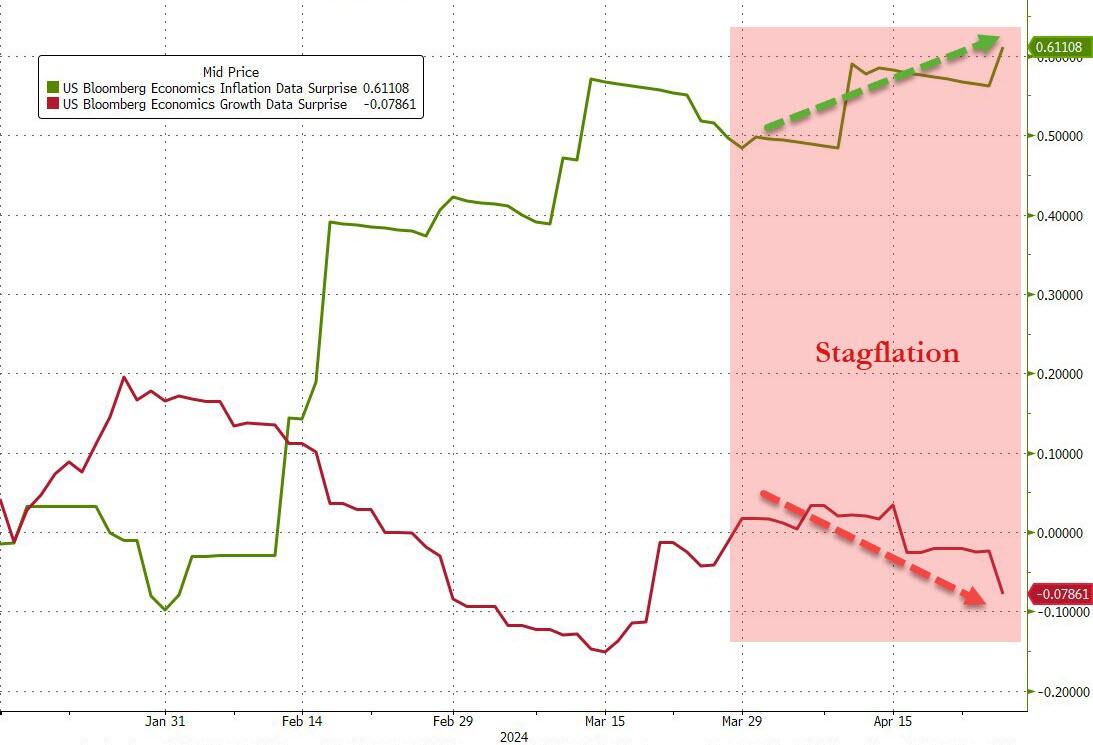

As we have seen in the past, low growth and higher inflation is referred to as Stagflation.

And as illustrated on Chart 1, periods of Stagflation put downward pressure on interest rates and the USD, which is bullish for Gold and Silver over the longer-term time horizon.

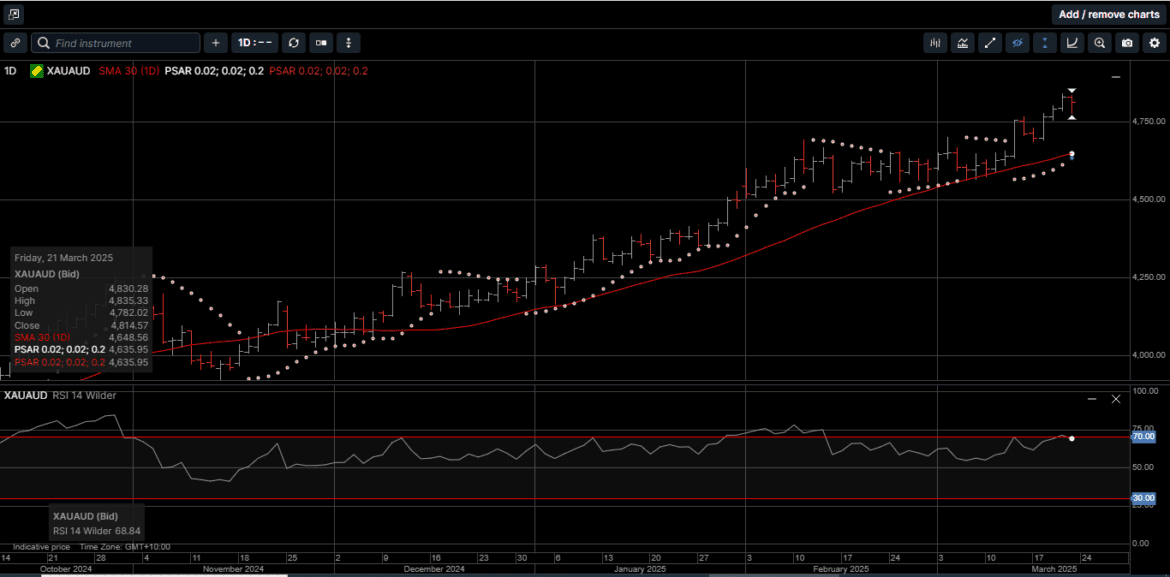

Physical Gold priced in USD hit another all-time high of $3057.00 last Thursday before drifting lower into the weekend to post a 1.3% gain at $3023.00.

Gold denominated in AUD got a bit of a tailwind from the 1.1% drop in the AUD/USD to post a fresh all-time high at $4840.00 and finished the week with a 2.5% gain at $4835.00.

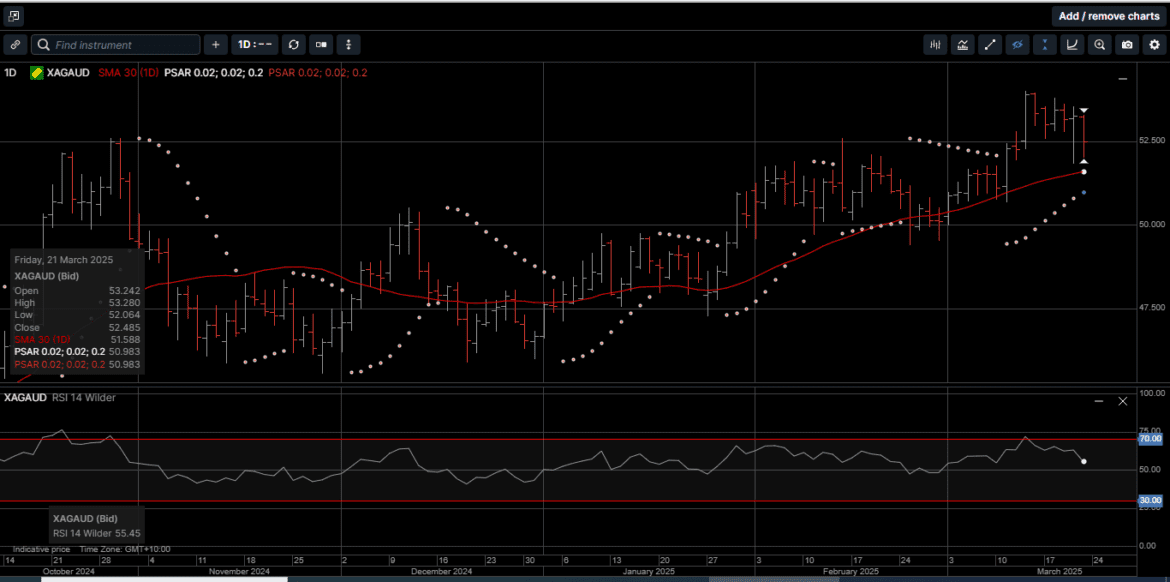

Physical Silver prices snapped a three-week winning streak and were sold off during the second half of last week.

Silver priced in USD slid 3.2% lower to close at $33.05, while losses in AUD based Silver were tempered by the AUD/USD weakness to finish the week 1.6% lower at $52.48.

With Silver prices underperforming Gold last week, the Gold versus Silver ratio spiked 3.45% higher to the advantage of Gold from 88.20 to 91.30.

This means that it takes 91.30 ounces of Silver to equal the price of one ounce of Gold.

It is important to note that despite last week’s correction in Silver, the prices for both USD and AUD Silver remain above the key 30-day moving average lines of $32.55 and $51.50, respectively.

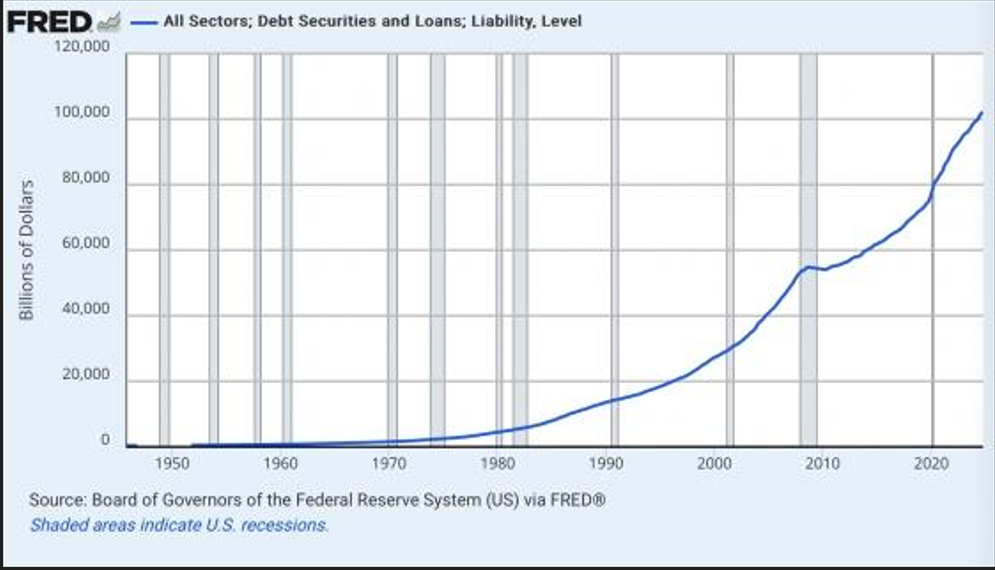

And while the potential impact of tariffs featured prominently in the financial media last week, we noticed an alarming chart released from the US FED.

As shown on Chart 2, the US aggregate debt from all sectors has doubled over the last 10 years and is now over $100 trillion.

In response to this debt, the US administration has been looking into several different strategies including a Crypto Strategic Reserve.

The US government’s proposal to create a Crypto Strategic Reserve aims to cement America’s dominance in digital assets.

But while Washington flirts with a government-backed crypto play, provident investors aren’t forgetting about the most time proven reserve assets: Gold and Silver.

The administration’s plan would mark the first time the US government formally holds cryptocurrency as part of its financial reserves.

Will this plan make crypto more centralized? Or could it expose the financial system to extreme volatility? And if the US government suddenly becomes a major player in crypto markets, how much control will it have over the price?

While some may see this as a game-changer, others recognize that crypto remains speculative, digital, and dependent on government policy.

Gold and Silver, on the other hand, has outlasted every other financial experiment in history.

Gold and Silver aren’t just another asset; they are real, tangible forms of wealth which have stood the test of time.

As such, while governments manipulate fiat currency and crypto markets swing wildly, Gold and Silver remain the constant safe haven in an uncertain world.

Crypto currencies are prone to price swings, regulatory crackdowns, and exchange failures. In contrast, Gold and Silver don’t disappear in a hack, get frozen in a government wallet, or rely on a blockchain to exist.

A government-backed crypto reserve may be a historic move, but it doesn’t change one fact: Gold and Silver remain the ultimate store of value and the purest form of money.

When investing in Gold and Silver, there is no blockchain, no government, no central bank needed, just hard assets that have preserved and secured wealth for centuries.

Over the last four months, physical Gold and Silver prices have outperformed the three most widely traded crypto currencies by more than 20%.

Now is the time to consider adding to your physical Gold and Silver holdings as the cornerstone asset of your diversified, long-term wealth creation strategy.

Chart 3 Gold AUD

Chart 4 Silver AUD

This publication has been prepared for the GBA Group Companies. It is for education purposes only and should not be considered either general of personal advice. It does not consider any particular person’s investment objectives, financial situation or needs. Accordingly, no recommendation (expressed or implied) or other information contained in this report should be acted upon without the appropriateness of that information having regard to those factors. You should assess whether or not the information contained herein is appropriate to your individual financial circumstances and goals before making an investment decision, or seek the help the of a licensed financial adviser. Performance is historical, performance may vary, past performance is not necessarily indicative of future performance. Any prices, quotes or statistics included have been obtained from sources deemed to be reliable, but we do not guarantee their accuracy or completeness.