Gold and Silver Report 27 April 2015

Precious metals initially dropped mid-week due to strong U.S. home sales data but then reversed on Thursday on worse than expected jobless claims and manufacturing growth data. However, the commodities ended the week on a low point due to a strong equities market. Safe-haven appeal also declined as uncertainty eased over the Greek crisis and Yemen conflict.

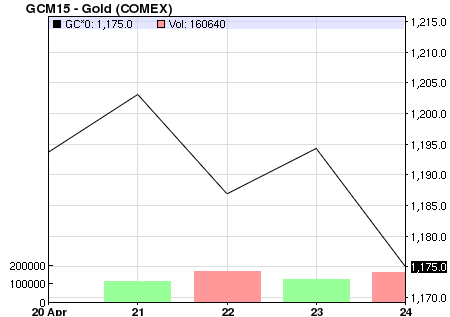

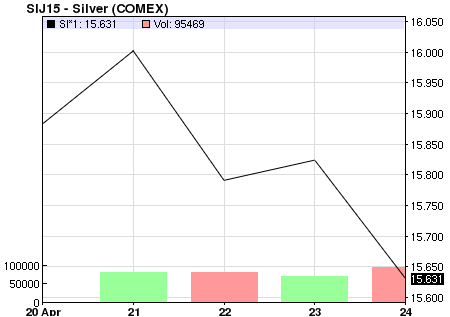

Price and charts snapshot:

| Commodity | Units | Price |

Change |

% Change |

| COMEX Gold (Jun 15 delivery) | USD/t oz. | USD$1,175.00 (AUD$1,501.96) |

-19.30 |

-1.62% |

| Gold Spot | USD/t oz. | USD$1,179.45 (AUD$1,508.15) |

+0.45 |

+0.04% |

| COMEX Silver (Jul 15 delivery) | USD/t oz. | USD$15.68 (AUD$20.05) |

-0.19 |

-1.20% |

| US Dollar Spot | USD/t oz. | USD$15.74 (AUD$20.13) |

+0.01 |

+0.05% |

Source: Bloomberg

|

|

Source: Nasdaq

On Monday Gold started the week little changed, sitting above the USD$1,200 mark with a softer dollar providing some safe-haven support. [1] On Tuesday gold held to overnight losses trading below the key USD$1,200 level, due to a rally in global equities and a firmer U.S. dollar. The strength in the U.S. dollar and equities also offset boosts from concerns over the Greek debt crisis.[2] On Wednesday the yellow metal fell by 1.3%, to its lowest level in more than a week, after a U.S. home sales report showed strong sales in March, raising expectations for a June Federal Reserve interest rate hike. Greece also announced it could meet payment obligations into June, reducing fears of an imminent default, lowering the precious metal’s appeal. On Thursday however, Gold jumped after other U.S. economic reports showed jobless claims rose for a third straight week, and U.S. manufacturing sector growth declined more than expected in April. Gold rose from a three-week low as the U.S. dollar retreated on the weaker-than-expected economic data. On Friday gold turned again, reaching its lowest in more than a month and falling for the third straight week as strength in global equities diverted safe-haven interest, although persisting uncertainty over the timing of the U.S. rate hike kept prices in a tight range.

Investors have been monitoring the situation in Greece this week, with the nation quickly running out of cash.[3] The nation originally pledged to agree upon a comprehensive set of reforms by the end of April. The dollar initially benefited, rising broadly on Monday as the euro slide by half a percent against the U.S greenback as concern grew that Greece may default on its debts.[4] However, the country appeared to scrape together enough cash to cover its payments for until June, which in the end reduced safe-haven demand. Tensions in Yemen also easy slightly as Saudi Arabia stopped airstrikes this week. Ole Hansen from Saxo Bank said “The (gold) market is growing tired of watching the Greek saga, while tensions in Yemen, an element of support to safe-haven bids, seem to have eased”.[5]

Investors will no doubt be watching the U.S. Fed’s meeting at the end of the month for signals towards how they will react towards the recent weak U.S. data and indications of the rate hike date.

world’s No. 2 consumer would remain tepid this year.[10]

By Lisa Casagrande | https://www.goldbullionaustralia.com.au

[1] http://www.reuters.com/article/2015/04/20/markets-precious-idUSL4N0XH1FD20150420

[2] http://www.reuters.com/article/2015/04/20/markets-precious-idUSL4N0XH6CB20150420

[4] http://www.reuters.com/article/2015/04/20/markets-precious-idUSL4N0XH6CB20150420

[5] http://www.reuters.com/article/2015/04/22/markets-precious-idUSL1N0XJ21H20150422