Investors Brace for The Jackson Hole Symposium

Investors Brace for The Jackson Hole Symposium

Since 1981, the Kansas City branch of the US Federal Reserve has held its summer meeting in the foothills of picturesque Jackson Hole, Wyoming.

The theme of this year’s meeting is: “Labor Markets in Transition: Demographics, Productivity and Macroeconomic Policy.”

The title is particularly timely considering the dismal US Non-Farm payroll report released two weeks ago, which completely upended FED’s long held stable employment narrative.

Based on the forward rate futures markets, there are growing expectations that the FED will use the Jackson Hole platform to signal an interest rate cut in September, which should give a boost to Gold, Silver and Platinum prices.

Gold priced in USD was contained in a narrow $72.00 range last week and closed 1.8% lower at $3335.00.

This was the narrowest weekly trading range for Gold since early March and suggests a coiling pattern which could break out to the upside.

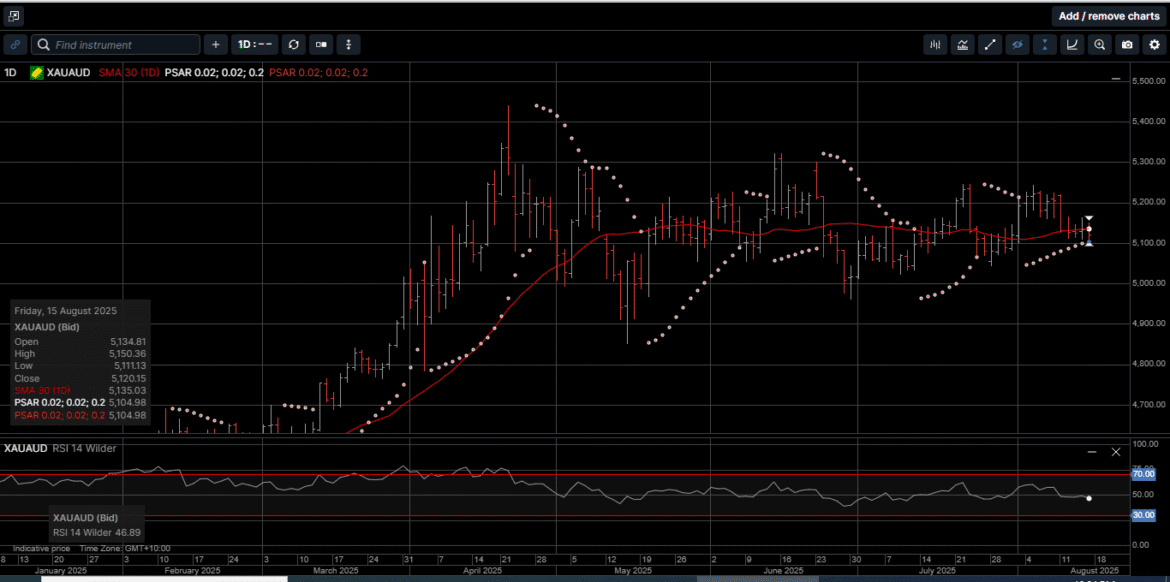

Gold denominated in AUD was pinned in a $102.00 range and closed 1.6% lower at $5120.00.

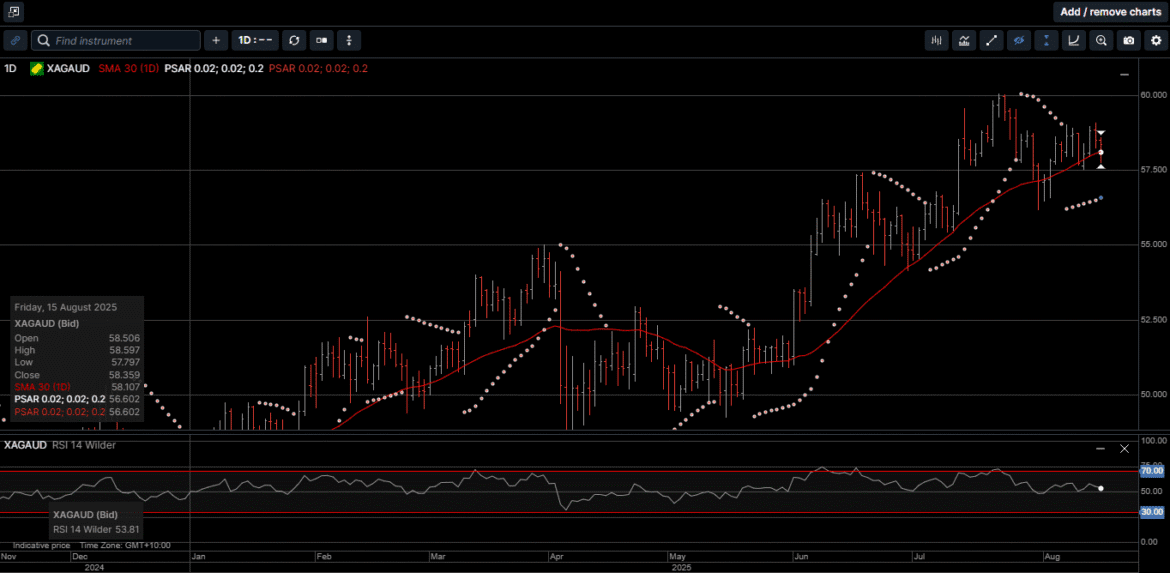

Physical Silver priced in USD slipped 1.0% lower to close at $38.32, while AUD-based Silver dropped 1.5% to close out the week at $57.80.

It is worth noting that Silver in both currencies finished the week above their 30-Day moving averages, which preserves the uptrend pattern.

The Gold versus Silver ratio drifted fractionally lower in favor of Silver to close at 87.32. That means it takes 87.32 ounces of Silver to equal the price of one ounce of Gold.

Physical Platinum prices closed fractionally higher for the week at $1345.00. The price consolidation pattern has now extended to three weeks and a close above $1395.00 would improve the technical tone.

Interestingly, the Jackson Hole Symposium will be attended by over 100 central bankers, financial officers and money managers.

Over the last two years, central banks and other sovereign institutions have emerged as dominant buyers in the Gold and precious metals markets.

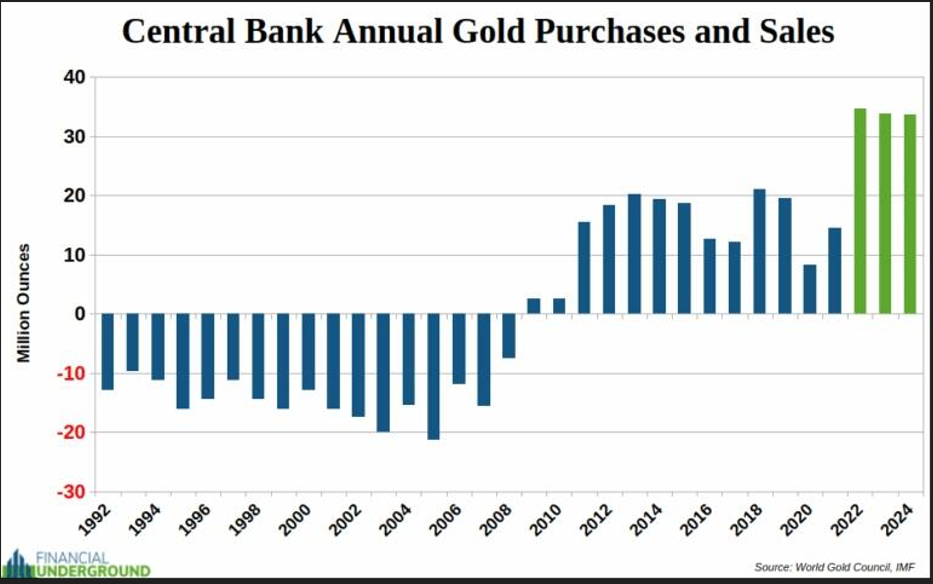

As illustrated on Chart 1, according to the World Gold Council (WGC), central banks purchased 166 tons of Gold in Q2 2025 alone, which is a 40% increase above historical averages.

This surge reflects a fundamental shift in global reserve management strategies as nations diversify away from traditional USD-denominated assets.

The acceleration of Gold accumulation has pushed central bank holdings beyond 36,000 tons globally, which at current prices pencils out to over $3.8 trillion in hard asset value.

This accumulation has created structural support for the entire precious metals complex while signaling a broader transition toward a multipolar, less USD-centric monetary system.

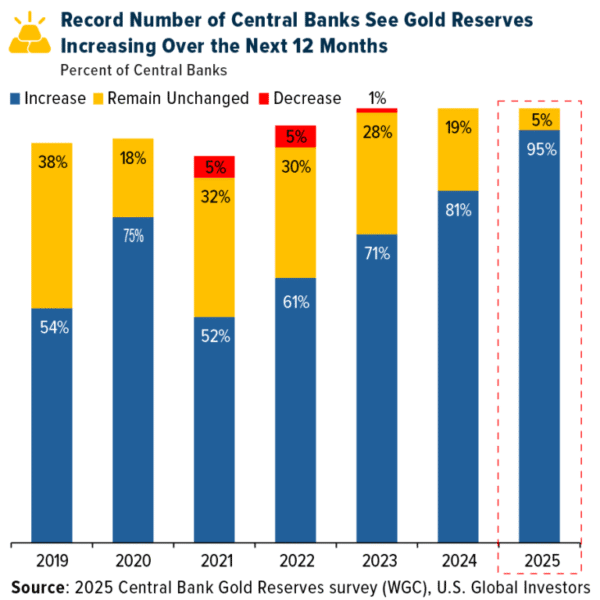

As shown on Chart 2, a WGC survey found that 95% of central bankers expect physical Gold purchases to increase throughout 2025.

Sovereign nations and large institutions are increasingly viewing Gold as insurance against geopolitical instability and sanctions risk.

Unlike currency reserves that can be frozen or devalued through policy decisions, Gold, Silver and Platinum provide sovereignty protection without counterparty risk.

The precious metals complex has a strong and reliable history as a store of value and offers comfort and security during periods of heightened uncertainty.

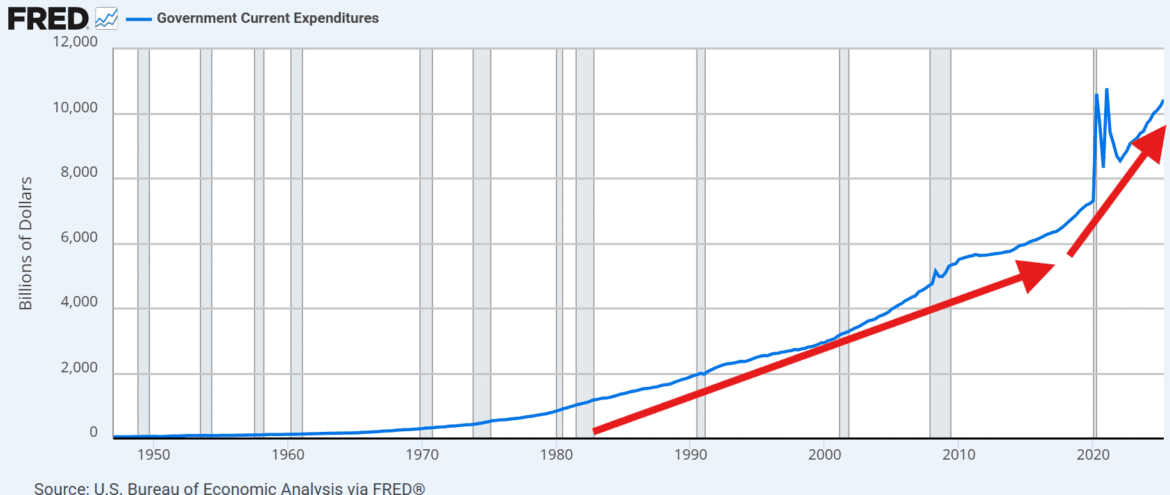

As shown on Chart 3, much of this uncertainty stems from the exponential growth in current US expenditures, which do not seem to have any positive resolution and explains why central banks and intuitions remain price-insensitive buyers of hard assets even at elevated valuation levels.

A primary advantage for physical Gold, Silver and Platinum lies in their non-sovereign status.

These hard assets cannot be devalued through monetary policy decisions or sanctioned by foreign governments, which has become increasingly valuable as geopolitical fragmentation accelerates.

Unlike currency reserves that represent claims on foreign governments, hard asset ownership is absolute and not subject to counterparty risk or policy manipulation.

Despite its physical nature, precious metals maintain exceptional liquidity characteristics with global trading volumes exceeding $150 billion daily across spot and derivatives markets.

This liquidity profile allows central banks and large institutions to accumulate substantial physical positions without significant market disruption.

It’s reasonable to expect that the outcome of the Jackson Hold Symposium will trigger some volatility into global financial markets.

As such, now is a good time to consider a portfolio review to replace high risk, low performing paper assets with the time proven security and long-term store of wealth found in Gold, Silver and Platinum.

Chart 4 – Gold AUD

Chart 5 – Silver AUD

This publication has been prepared for the GBA Group Companies. It is for education purposes only and should not be considered either general of personal advice. It does not consider any particular person’s investment objectives, financial situation or needs. Accordingly, no recommendation (expressed or implied) or other information contained in this report should be acted upon without the appropriateness of that information having regard to those factors. You should assess whether or not the information contained herein is appropriate to your individual financial circumstances and goals before making an investment decision, or seek the help the of a licensed financial adviser. Performance is historical, performance may vary, past performance is not necessarily indicative of future performance. Any prices, quotes or statistics included have been obtained from sources deemed to be reliable, but we do not guarantee their accuracy or completeness.