Gold & Silver News – 20th Oct 2014

Gold advanced for the second straight week amid global economic concerns. While gold initially dropped last week to its lowest for the year, touching USD$1,183.30 it rebounded as the Fed signaled a worldwide slowdown, causing equities slumps and the US dollar to retreat. This week gold continued an overall advance amid global economic concerns in Europe and as Africa.

Gold and silver prices

| Commodity | Units | Price |

Change |

% Change |

| COMEX Gold (Dec 14 delivery) | USD/t oz. | 1,239.00 (AUD$1415.77) |

-2.20 |

-0.18% |

| Gold Spot | USD/t oz. | 1,238.32 (AUD$1415.00) |

-0.49 |

-0.04% |

| COMEX Silver (Dec 14 delivery) | USD/t oz. | 17.33 (AUD$19.80) |

-0.11 |

-0.61% |

| US Dollar Spot | USD/t oz. | 17.27 (AUD$19.73) |

-0.12 |

-0.71% |

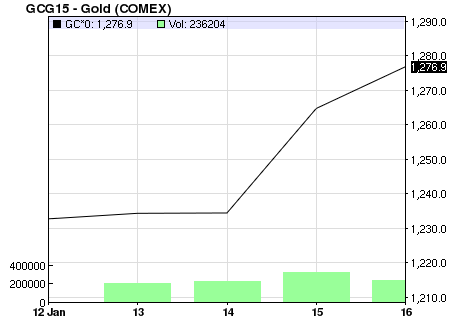

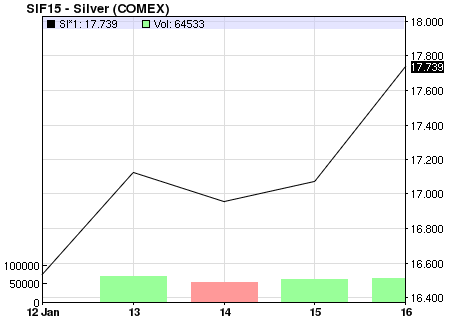

Gold and Silver Weekly charts:

|

|

By Wednesday prices hit a high of USD$1,250.30 (AUD$1428.69), its highest since September 11th[1]. On Thursday prices lowered as gains in equities reduced haven demand and after the St. Louis Federal Reserve President said more quantitative easing might occur, increasing doubt over interest rate rises. However Silver December futures prices closed nearer their session high Thursday.

As the week ended Bloomberg reported gold futures for December delivery fell 0.2%, settling at USD$1,239 (AUD$1415.77) on the New York Comex, ending up 1.4% for the week. Silver futures for December delivery fell 0.6% to USD$17.331 (AUD$19.80) on the Comex[2], up 0.16% on the week.

Concerns in Europe and the spread of Ebola were market factors this week. Forbes reported that surges in European yields helped boost gold, with Greek yields in particular jumping to 9%. Meanwhile, the Ebola virus has spread to two new regions in Guinea, including an area where an AngloGold Ashanti mine is located[3].

Conversely, Phillip Streible from RJO Futures forecasted gold to back down to the USD$1200 mark next week, expecting improved corporate earnings, lower geopolitical risks and the Ebola virus becoming contained.

In the weekly Kitco gold survey 23 participants responded. Responses were mixed but slightly bearish, with eight seeing higher prices, ten expecting lower prices and five seeing sideways prices in the week ahead.

Forbes reports that early technical clues suggest a near-term market low could be coming. Gold bulls’ first resistance was set at Thursday’s high of USD$1,245.60 (AUD$1423.32) and then at this week’s high of USD$1,250.30 (AUD$1428.69). The first support line was set at Thursday’s low of USD$1,235.20 (AUD$1411.43) and then next at USD$1,230.00 (AUD$1405.49). Meanwhile, silver bears were considered to have a firm near-term technical advantage. Silver bulls’ first resistance was set at Thursday’s high of USD$17.54 (AUD$20.04) and then next at the current week’s high of USD$18.82 (AUD$21.51). Its next support was set at Thursday’s low of USD$17.20 (AUD$19.65) and then at USD$17.00 (AUD$19.43).

Upcoming events include the Federal Open Market Committee meeting at the end of October, and the Swiss referendum on gold reserves is also ongoing discussion.

By Lisa Casagrande | https://www.goldbullionaustralia.com.au

[1] http://www.bloomberg.com/news/2014-10-17/gold-heads-for-second-weekly-gain-after-advance-to-5-week-high.html

[2] http://www.bloomberg.com/news/2014-10-17/gold-heads-for-second-weekly-gain-after-advance-to-5-week-high.html

[3] http://www.bloomberg.com/news/2014-10-18/guinea-says-ebola-spreads-to-new-regions-near-anglogold-mine.html