Gold and Silver Report 29 June 2015

Gold prices were under pressure from an improving US economic outlook and expectations of Greece reaching a deal with creditors. However, gold saw some support as Greece failed to secure a critical agreement at the end of the week, tumbling towards defaulting on its next debt payment.

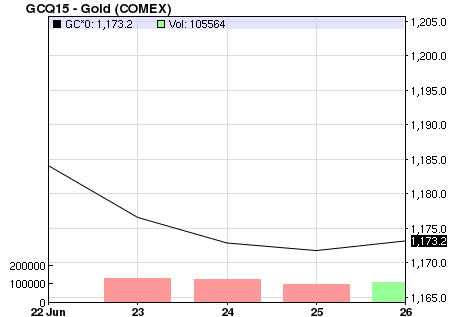

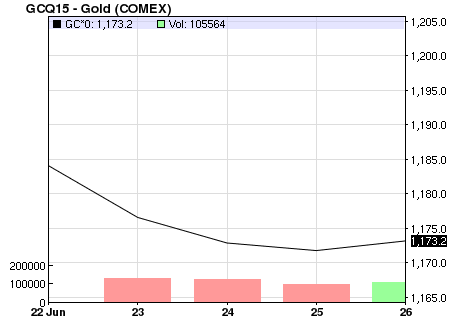

Start of Week Price and Charts snapshot:

| Commodity | Units | Price | Change | % Change |

| COMEX Gold (Aug 15 delivery) | USD/t oz. | USD$1,173.20 (AUD$1532.00) | +1.40 | +0.12% |

| Gold Spot | USD/t oz. | USD$1,175.52 (AUD$1535.03) | +2.35 | +0.20% |

| COMEX Silver (Sep 15 delivery) | USD/t oz. | USD$15.77 (AUD$20.59) | -0.07 | -0.46% |

| US Dollar Spot | USD/t oz. | USD$15.81 (AUD$20.65) | -0.06 | -0.35% |

Source: bloomberg

|

|

Source: NASDAQ

Gold eased from a previous near-four-week high on Monday as Greek debt talks showed possible progress.[1] On Tuesday, gold retained losses from increasing hopes that Greece would reach a deal with creditors, after Greece presented new budget proposals welcomed by eurozone leaders. Prices were also pressured by news that U.S. home resales data surged to a 5-1/2-year high.[2] Gold then slid to a one-week low on Wednesday as the US dollar strengthened and the prospect of rate rises returned after Governor Jerome Powell said he was prepared to raise interest rates twice this year if the economy performs as expected. Stock markets also rallied as investors were optimistic of Greece reaching a debt deal.[3] On Friday, gold recovered from its lowest in more than two weeks after Greece failed to reach an agreement with creditors, although gains were capped by expectations of a U.S. interest rate hike.

Greece is nearing its June 30 deadline, whereby it must repay 1.6 billion euros to the International Monetary Fund by Tuesday or face default. The country however failed to reach a deal with creditors despite pitching a last-ditch effort on Saturday.[4] Greek PM Tsipras called for a referendum on 5 July, setting citizens to vote on whether to accept or reject the latest terms offered by creditors, which would unlock billions of euros in bailout funds. However creditors rejected the request to extend Greece’s bailout until the referendum is completed, setting Greece closer to the risk of exiting the eurozone. The rejection means Athens is expected to default on its key payment to the IMF on Tuesday, causing queues to form outside banks in Athens. Banks are now set to close on Monday and implement capital controls as the country’s future in the eurozone hangs in the balance.[5]

Despite uncertainty from the Greek crisis supporting gold, the metal is still facing pressure from an improving US economic outlook, stronger US dollar and expectations of a interest rate increase.[6] Speculation that the U.S. Federal Reserve will raise rates for the first time in nearly a decade has weighed on gold prices. “U.S. economic data continues to get a little bit better as the days go by, which is bearish for gold,” said Mike Dragosits, of TD Securities.[7] Meanwhile Barclays said “Yellen’s comments including the need for decisive evidence, as well as the heightened uncertainty surrounding Greece, have limited the downside risk for gold in the absence of physical demand” adding; “While we believe the floor for prices remains soft in the coming weeks, the events surrounding Greece in the coming sessions could still reignite interest in gold.”[8]

Author Lisa Casagrande | https://www.goldbullionaustralia.com.au

[1] http://uk.reuters.com/article/2015/06/22/markets-precious-idUKL3N0Z81JD20150622

[2] http://uk.reuters.com/article/2015/06/23/markets-precious-idUKL3N0Z908B20150623

[3] http://uk.reuters.com/article/2015/06/24/markets-precious-idUKL3N0ZA17920150624

[4] http://uk.reuters.com/article/2015/06/26/markets-precious-idUKL3N0ZC2EY20150626

[5] http://www.bbc.co.uk/news/world-europe-33299347

[6] http://uk.reuters.com/article/2015/06/25/markets-precious-idUKL3N0ZB31M20150625

[7] http://uk.reuters.com/article/2015/06/24/markets-precious-idUKL3N0ZA2TF20150624

[8] http://uk.reuters.com/article/2015/06/22/markets-precious-idUKL3N0Z81JD20150622