Gold enjoyed a prosperous week as the U.S. continued to receive downbeat economic data

Gold and Silver Report 18 May 2015

Gold enjoyed a prosperous week as the U.S. continued to receive downbeat economic data, causing the dollar to fall. This and weakness in other markets helped offset reduced fears as Greece made a key payment to the IMF and high performing yields.

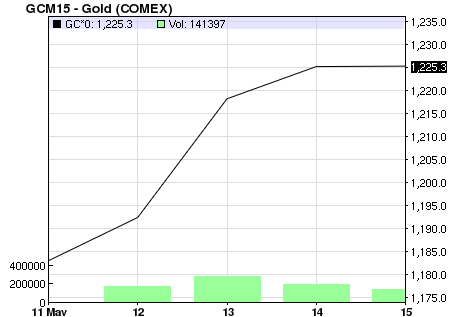

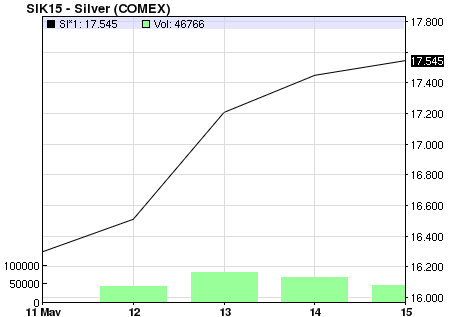

Price and charts snapshot:

| Commodity | Units | Price | Change | % Change |

| COMEX Gold (Jun 15 delivery) | USD/t oz. | USD$1,225.30 ($1,523.91) |

+0.10 |

+0.01% |

| Gold Spot | USD/t oz. | USD$1,224.80 ($1,523.29) |

+3.66 |

+0.30% |

| COMEX Silver (Jul 15 delivery) | USD/t oz. | USD$17.56 ($21.84) |

+0.10 |

+0.56% |

| US Dollar Spot | USD/t oz. | USD$17.51 ($21.78) |

+0.05 |

+0.27% |

Source: bloomberg

|

|

Source: NASDAQ

On Monday gold prices held after weaker U.S. jobs data in April and downward revisions to previous figures suggested the Federal Reserve would be in no hurry to raise interest rates next month.[1] On Tuesday, gold struggled with some small overnight losses at first, as Greece calmed fears by making a critical payment to the International Monetary Fund.[2] However, the metal rose 1% near a one-week high as the U.S. dollar and European shares dropped from a sell-off in global bonds. On Wednesday gold jumped 2%, and silver climbed 3.4%, both to five-week highs, as the U.S. dollar hit a three-month low after disappointing employment data[3]. On Thursday gold hovered near the five-week high supported by overnight gains from poor U.S. retail sales data that showed households cut back on purchases signalling the economy was struggling to rebound.[4] On Friday gold held the gains, sitting near three-month highs, as expectations the Federal Reserve would soon hike U.S. interest rates receded.

Recent economic reports have suggested the U.S. economy is not strong enough for a rate hike in June. U.S. nonfarm payrolls increased only slightly lower than market expectations but March payrolls were revised downwards, to their smallest since June 2012. The data boosted gold’s safe haven appeal. Eugen Weinberg from Commerzbank said “If the data remains soft in the United States, this rally has potential. When data is more on the soft side, the market will be looking for indications on when the Fed will be raising interest rates.” However, unemployment dropped to a near-seven-year low, suggesting underlying strength in the economy, that mean a rate rise later in the year is still possible, capping gains in gold.[5]

Weakness in other markets also supported gold this week, offsetting pressure from rising yields which would otherwise weigh on gold, as they increase the opportunity cost of holding non-yielding bullion. U.S. 10-year yields rose to a more than five-month high above 2.3% , boosted recently by higher German Bunds. Gold remains vulnerable to a further jump in yields, but for now, as Commerzbank analyst Carsten Fritsch said “Today it is two to one in favor of rising gold – weak U.S. dollar and weak stocks versus rising bond yields.

Author Lisa Casagrande | https://www.goldbullionaustralia.com.au/articles/gold-and-silver-latest-news/it-was-a-mixed-week-for-precious-metals

[1] http://www.reuters.com/article/2015/05/11/markets-precious-idUSL3N0Y21R720150511

[2] http://www.reuters.com/article/2015/05/12/markets-precious-idUSL3N0Y308F20150512

[3] http://www.reuters.com/article/2015/05/13/markets-precious-idUSL3N0Y44OW20150513

[4] http://www.reuters.com/article/2015/05/14/markets-precious-idUSL3N0Y506G20150514

[5] http://www.reuters.com/article/2015/05/11/markets-precious-idUSL3N0Y21R720150511

[6] http://www.reuters.com/article/2015/05/12/markets-precious-idUSL3N0Y34QV20150512