Gold and Silver Report 22 June 2015

Gold and silver remained tight as investors waited for the next U.S. Federal Reserve meeting, however a cautious stance despite an improving U.S. economy caused the dollar to fall, and boosted gold prices. Increasing danger of impending Greek exit from the Eurozone also supported commodities.

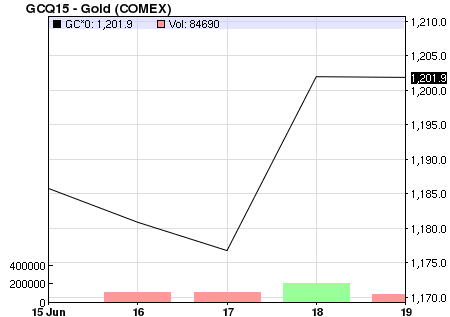

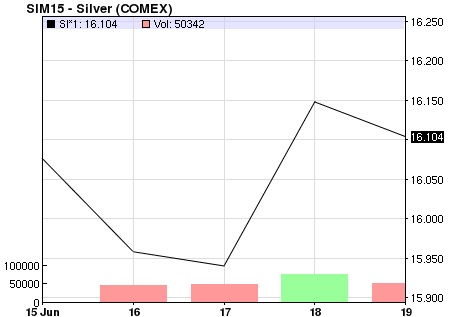

Start of Week Price and Charts snapshot:

| Commodity | Units | Price |

Change |

% Change |

| COMEX Gold (Aug 15 delivery) | USD/t oz. | USD$1,201.90 (AUD$1547.54) |

-0.10 |

-0.01% |

| Gold Spot | USD/t oz. | USD$1,199.59 (AUD$1544.57) |

-0.68 |

-0.06% |

| COMEX Silver (Jul 15 delivery) | USD/t oz. | USD$16.11 (AUD$20.74) |

-0.04 |

-0.27% |

| US Dollar Spot | USD/t oz. | USD$16.14 (AUD$20.78) |

+0.03 |

+0.18% |

Source: bloomberg

|

|

Source: NASDAQ

On Monday gold was buoyed by some chart-based buying and a softer U.S. dollar ahead of a Federal Reserve policy meeting, with uncertainty over Greece after debt talks stalled supporting prices.[1] On Tuesday, gold and silver fell as the greenback firmed as the U.S. Fed meeting began, and reports that U.S. permits for home construction surged to near an eight-year high in May. Despite warnings that Europe is preparing for Greece to leave the euro. a looming crisis failed to boost demand for safe-haven assets.[2] On Wednesday Gold jumped higher after the Federal Reserve revealed a dovish statement, said the while U.S. economy is likely strong enough to support an interest rate increase by the end of 2015, it will maintain the current near-zero interest rate and a hike would only occur after further improvement in the labour market and if inflation would rise, causing the dollar to extend losses.[3] Gold extended the gains on Thursday as the U.S. dollar continued to be under pressure from the Fed’s statements, helping gold to also clung to its biggest gain in a month on Friday.

Bullion has not seen much headway in recent months because of uncertainty over the timing of a U.S. rate hike and investors had hoped this time for a clearer signal from this week’s Federal Reserve meeting. For example, Societe Generale analyst Robin Bhar said “Yellen can now be a bit more optimistic about growth, maybe she will intimate that the path is being prepared for a rate rise (by year-end)”.[4] However, the Fed remained cautious; Tai Wong from BMO Capital Markets in New York commented “The FOMC (Federal Open Market Committee) statement recognized a rebound in activity from the first quarter but otherwise was remarkably indistinct from March”, and “The Fed chair wants decisive evidence that moderate growth will be sustained,” adding “Gold is moving higher on that decisive comment.”[5]

Meanwhile, uncertainty in Europe and the Greek debt crisis has provided support for gold prices, however its influence has been limited. As Citi strategist David Wilson said, people are focusing on those positives of the U.S. economy rather than the macro negatives of a Greek exit (from the European Union), given that the Athens crisis has been dragging on for a very long time”. Morgan Stanley Research reported that it expects progressively lower gold prices over the next two years, but added that “any resumption of debate over Greece’s debt position” among others, could prevent a collapse in prices.”[6] This may come into play soon, as Euro zone leaders will hold an emergency summit on Monday to try to avert a Greek default after bank withdrawals accelerated and government revenue slumped recently.[7]

Author Lisa Casagrande | https://www.goldbullionaustralia.com.au

[1] http://www.reuters.com/article/2015/06/15/markets-precious-idUSL3N0Z12VH20150615

[2] http://www.reuters.com/article/2015/06/16/markets-precious-idUSL3N0Z22QU20150616

[3] http://www.reuters.com/article/2015/06/17/markets-precious-idUSL3N0Z32LJ20150617

[4] http://www.reuters.com/article/2015/06/15/markets-precious-idUSL3N0Z12VH20150615

[5] http://www.reuters.com/article/2015/06/17/markets-precious-idUSL3N0Z32LJ20150617

[6] http://www.reuters.com/article/2015/06/15/markets-precious-idUSL3N0Z12VH20150615

[7] http://www.reuters.com/article/2015/06/19/markets-precious-idUSL3N0Z506W20150619