Gold and silver held some limited gains at the start of the week

Gold and Silver Report 8 June 2015

Gold and silver held some limited gains at the start of the week, as investors waited on upcoming U.S. economic reports and the developments in Europe, but gold prices quickly declined to an 11-week low after strong U.S. data was released and concerns over Greece lowered.

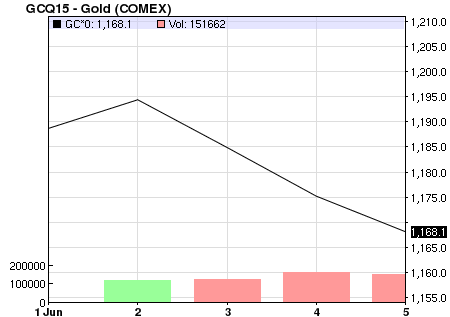

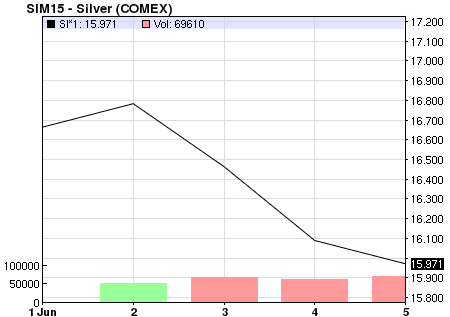

Start of Week Price and Charts snapshot:

| Commodity | Units | Price |

Change |

% Change |

| COMEX Gold (Aug 15 delivery) | USD/t oz. | USD$1,168.10 (AUD$1,531.80) |

-7.10 |

-0.60% |

| Gold Spot | USD/t oz. | USD$1,171.94 (AUD$1,536.83) |

-4.95 |

-0.42% |

| COMEX Silver (Jul 15 delivery) | USD/t oz. | USD$15.98 (AUD$20.96) |

-0.12 |

-0.74% |

| US Dollar Spot | USD/t oz. | USD$16.11 (AUD$21.13) |

-0.04 |

-0.22% |

Source: bloomberg

|

|

Source: NASDAQ

On Monday Gold was started the week with little change, losing gains as the U.S. dollar rallied, advancing against major currencies after stronger-than-expected U.S. manufacturing and construction data, while worries of a Greek default mounted.[1] On Tuesday, Gold edged higher in response to losses in the dollar as uncertainty persisted during high-level meetings on Greece’s debt crisis were failing to make any significant progress.[2] However, on Wednesday, gold fell to a three-week low as better-than-expected U.S. employment data showed first-time applications for unemployment aid fell last week while the number of people on benefit rolls hit the lowest level since 2000.[3] Prospects of a debt deal for Greece improved when international creditors indicated a possible compromise to avoid a Greek default.[4] On Thursday, Gold prices fell hitting five-week lows despite some early weakness in the U.S. dollar, thanks to the robust U.S. economic data strengthening expectations the Federal Reserve will raise interest rates within the year. Sentiment in the Eurozone also improved as Greek Prime Minister Alexis Tsipras emerged from meetings saying a deal with creditors was “within sight” and that Athens would make a payment due to the IMF by Friday.[5] On Friday, gold hit an 11-week low, looking at a third straight weekly slide, as the U.S. dollar rallied after non-farm payrolls increased the largest since December, above expectations.[6]

This week sentiment towards the yellow metal was bearish. Gold prices remained limited early in the week even when the U.S. dollar was hitting its lowest against the euro.[7] Ole Hansen from Saxo Bank’s said “If this unraveling of core positions continues I think gold will find support, but obviously at this stage it is worrying that the dollar weakness has failed to attract buyers”.[8] Later in the week, as stronger U.S. data came out, gold held a steady decline. ActivTrades analyst Carlo Alberto de Casa said “The U.S. data triggered a break below important support levels of $1,175 and $1,170,”, and “The break lower caused the metal to exit that $1,170-$1,220 trading range in which it had been confined for many weeks, making it more vulnerable to further declines towards $1,150 and $1,131.”[9]

Investors have been watching the Greek situation after Athens missed a promised Sunday deadline with lenders. This raised concerns of Greece risking a default or bankruptcy, which supported gold prices but only to an extent. The tables quickly turned again after Greece managed to get an extension until the end of the month, and Tsparis stated a deal with creditors was within sight, easing concerns for the short-term.[10] As INTL FCStone reported: “Greece and global equity markets remain the perennial wild cards”.

Author Lisa Casagrande

[1] http://www.reuters.com/article/2015/06/01/markets-precious-idUSL3N0YN2NZ20150601

[2] http://www.reuters.com/article/2015/06/02/markets-precious-idUSL3N0YO32820150602

[3] http://www.reuters.com/article/2015/06/04/markets-precious-idUSL3N0YQ2QM20150604

[4] http://www.reuters.com/article/2015/06/03/markets-precious-idUSL1N0YP23320150603

[5] http://www.reuters.com/article/2015/06/04/markets-precious-idUSL3N0YQ2QM20150604

[6] http://www.reuters.com/article/2015/06/05/markets-precious-idUSL3N0YR2P520150605

[7] http://www.reuters.com/article/2015/06/03/markets-precious-idUSL1N0YP23320150603

[8] http://www.reuters.com/article/2015/06/04/markets-precious-idUSL3N0YQ2QM20150604

[9] http://www.reuters.com/article/2015/06/05/markets-precious-idUSL3N0YR2P520150605