Gold and Silver Continue to Trend Higher

The precious metals complex started last week with a cautious tone after the Trump administration announced that they would impose sweeping 25% tariffs on imports from Mexico and Canada and 10% tariff on goods from China.

As the week progressed, weaker US economic data and a temporary suspension of the tariffs underpinned the market and physical Gold and Silver prices traded higher.

Gold priced in USD reached a new all-time high of $2886.00 and posted the first ever weekly close above $2800.00. For the week, USD Gold gained 2.25% to close at $2860.00.

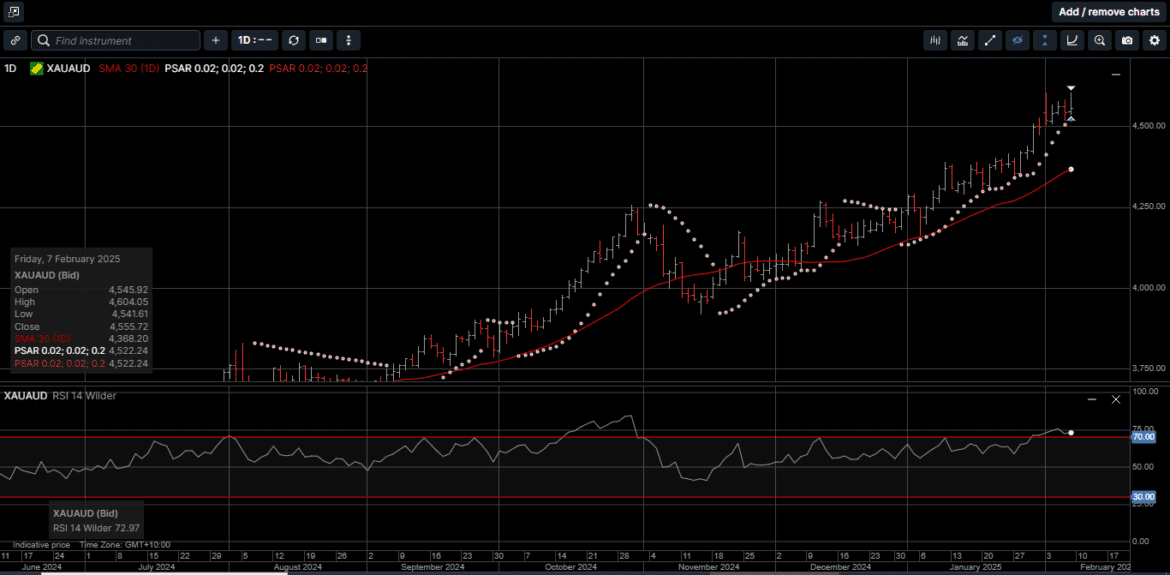

Gold denominated in AUD also hit a new all-time high at $4605.00 and finished the week 1.3% higher at $4555.00 for the first ever weekly close above $4500.00.

It’s worth noting that physical Gold prices in both currencies are showing a Relative Strength Indicator (RSI) reading of over 75.00, which is generally defined as approaching an overbought condition.

However, based on the price patterns from 2024, Gold prices in both USD and AUD could maintain these elevated RSI readings while moving materially higher before a pause or technical correction lower.

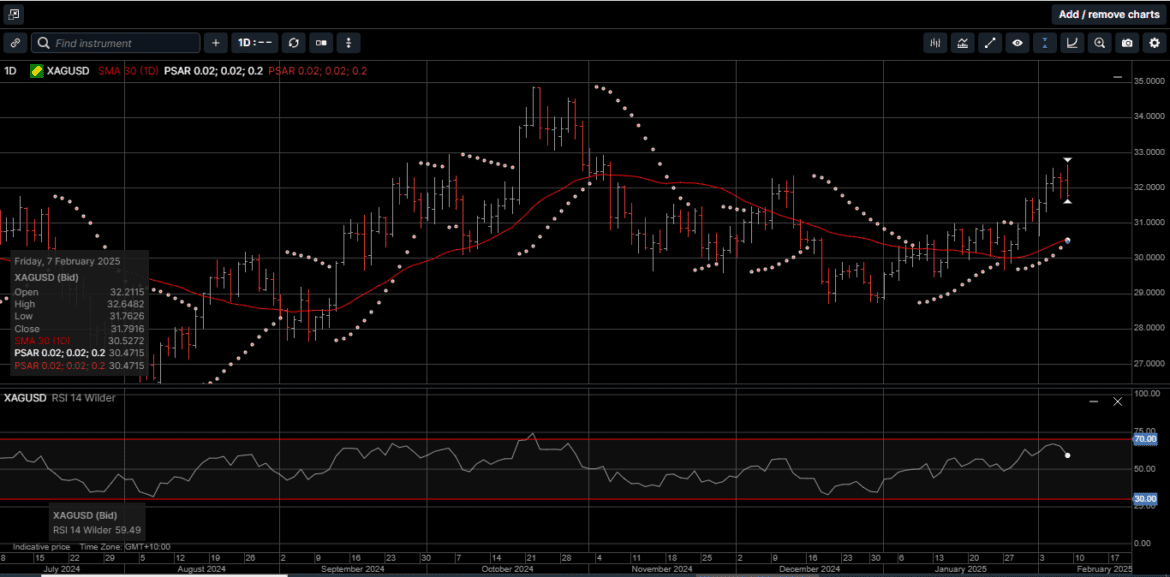

Physical Silver prices traded higher but underperformed Gold last week.

Silver priced in USD tagged a three-month high of $32.65 before drifting lower to close the week with a 1.6% gain at $31.80, while Silver based in AUD reached a four-month high at $51.90 and finished the week 1.0% higher at $50.65.

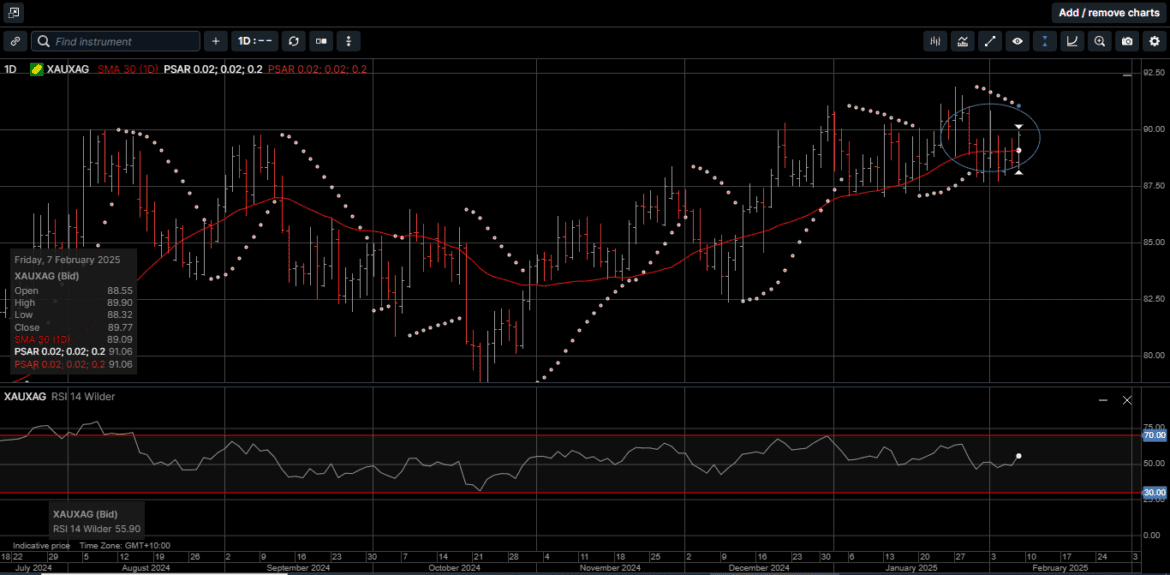

As illustrated on Chart 1, the Gold versus Silver ratio has traded on both sides of the 30-day Moving Average near 89.00 for the last eight consecutive trading sessions.

This consolidation pattern typically precedes an extension of the current price trend, which in this case would be for the ratio to trade lower as Silver outperforms Gold on a percentage basis.

The main driver of Gold and Silver prices last week was the US tariff announcements.

Supporters of the tariffs consider them a bold move to strengthen American industry and reduce foreign dependence.

But global financial markets are watching closely as the potential economic shake-up could have serious ripple effects for inflation, supply chains, and commodities.

Tariffs are designed to revitalize the US manufacturing sector by reducing reliance on cheap imports.

But here’s the reality: when tariffs go up, prices usually rise as well.

US businesses facing higher costs on raw materials like steel and aluminum will pass them to consumers, meaning higher prices on everything from cars to building materials to electronic devices.

That scenario represents inflationary pressure. And inflation eats away at the USD’s purchasing power, which is one of the key reasons investors’ demand for physical Gold and Silver is on the rise.

Financial markets don’t like uncertainty, and retaliation from trading partners is already on the table.

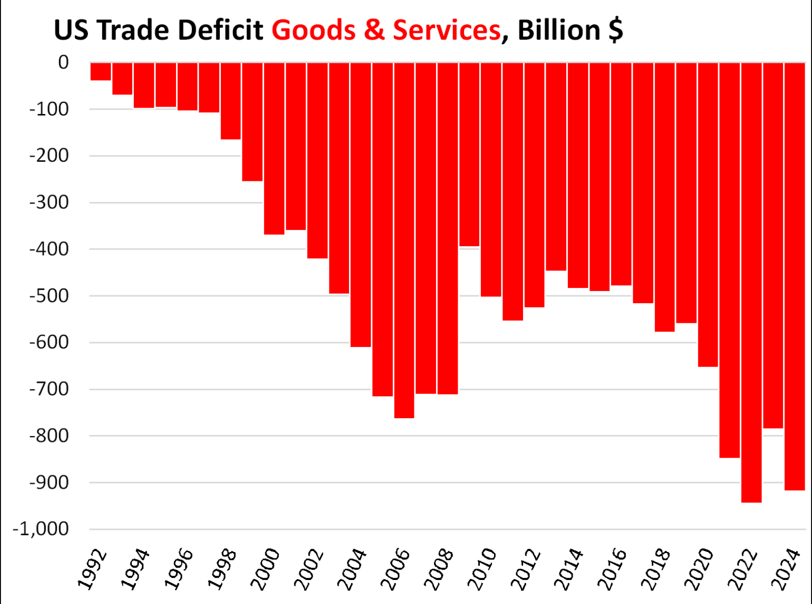

And, as shown on Chart 2, with the US Trade deficit approaching $1 trillion, the US can ill-afford a protracted trade war.

We remember what happened in 2019, when Mr. Trump’s first tariff driven trade war triggered major market swings on Wall Street and in commodity markets.

The US relies on Mexico and Canada for Silver imports, and those are now tariff targets. Silver is already in a supply deficit, with demand soaring from industries like electronics, Electric Vehicles, and solar panels.

If tariffs slow the flow of Silver into the US, prices of both Gold and Silver could move sharply higher during 2025.

Tariffs could boost the USD in the short term, as fewer Dollars flow overseas.

But over the longer-term a stronger USD makes US exports more expensive, hurting American businesses that sell abroad.

So, if economic growth slows due to tariffs, the US Federal Reserve may cut interest rates to counterbalance, which would potentially weaken the USD.

This back-and-forth is one reason why Gold and Silver remain the ultimate hedge, since they preserve wealth and hold their value when the USD is under pressure.

If the US administration uses tariffs as aggressively as some analysts expect, consumer prices may rise sharply, equity markets could get more volatile, and economic uncertainty could increase.

In this scenario, Gold and Silver stand apart from other asset classes.

Gold and Silver have been the investors’ favored store of value for centuries, representing secure and enduring wealth regardless of trade wars or other forms of economic instability.

In short, trade wars, geopolitical tensions and bad economic policies will come and go, but the monetary value of physical Gold and Silver will likely continue to build wealth for long-term investors.

There is never a bad time to make a good investment.

And even though Gold and Silver prices have risen since the beginning of the year, as uncertainty spikes, Gold and Silver prices will likely thrive as safe-haven assets; just as they did during the last tariff standoff in 2019.

Chart 3 Gold AUD

Chart 4 Silver AUD

This publication has been prepared for the GBA Group Companies. It is for education purposes only and should not be considered either general of personal advice. It does not consider any particular person’s investment objectives, financial situation or needs. Accordingly, no recommendation (expressed or implied) or other information contained in this report should be acted upon without the appropriateness of that information having regard to those factors. You should assess whether or not the information contained herein is appropriate to your individual financial circumstances and goals before making an investment decision, or seek the help the of a licensed financial adviser. Performance is historical, performance may vary, past performance is not necessarily indicative of future performance. Any prices, quotes or statistics included have been obtained from sources deemed to be reliable, but we do not guarantee their accuracy or completeness.