Gold and Silver Consolidate After US Credit Downgrade + Free Boat show ticket giveaway!!

Gold and Silver Consolidate After US Credit Downgrade (Giveaway at the bottom of the page!)

On April 2nd, the US administration shocked financial markets by announcing sweeping import tariffs on more than 100 of its international trading partners.

The market’s perception for potential economic disruption was powerful enough to drive Gold to a series of all-time highs and Silver to 12-month highs.

Now that the most extreme tariffs have been paused for 90 days, the bullish impulse which pushed the precious metals complex higher has been diminished.

As a result, physical Gold and Silver prices have pulled back from the April highs and have been consolidating within technical support levels.

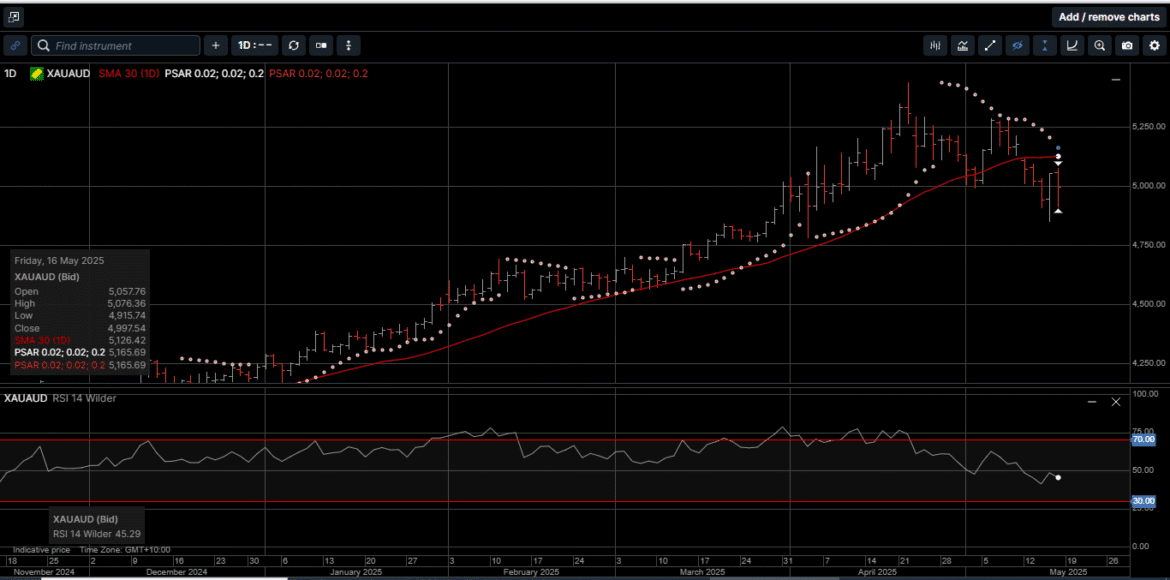

For the week, Gold priced in USD covered a wide trading range of over 7.0% and closed 3.7% lower at $3202.00.

Gold denominated in AUD was also very active trading in a 9.0% range from top to bottom as it slipped 3.5% lower to settle at $4997.00.

Silver priced in USD continues to trade on both sides of the 30-day moving average at $32.25 and closed into the weekend 1.4% lower at $32.27. A daily close above $32.75 would improve the technical outlook.

AUD based Silver settled 1.3% lower at $50.34.

The Gold versus Silver ratio closed at 99.17 compared to 101.50 the previous week, which means it takes 99.17 ounces of Silver to equal the price of one ounce of Gold.

Even though the tariff panic has cooled for now, there are still several fundamental economic and geopolitical issues that can drive Gold and Silver prices higher.

It’s important to note that Gold and Silver have been in a secular bull market since several US and European banks collapsed back in March of 2023.

Along those lines, after the markets closed last Friday, Moody’s credit agency downgraded the US sovereign debt one notch from AAA to Aa1, which brings Moody’s in line with Fitch and S&P ratings.

In their statement, Moody’s pointed out that the US has government debt and interest payment ratios that are significantly higher than similarly rated nations.

Moody’s are absolutely right.

The US government hit the debt ceiling back in January and has been using extraordinary accounting measures ever since. This usually means dipping into things like Civil Service Retirement funds to free up cash to avoid borrowing any more money.

Still, the US debt ceiling will be lifted, and the government will go on borrowing way beyond its means.

During the last 5 years, the annual borrowing has not been less than $1.8 Trillion and was $2.2 Trillion in 2024. Expect more of the same this year once the ceiling is raised.

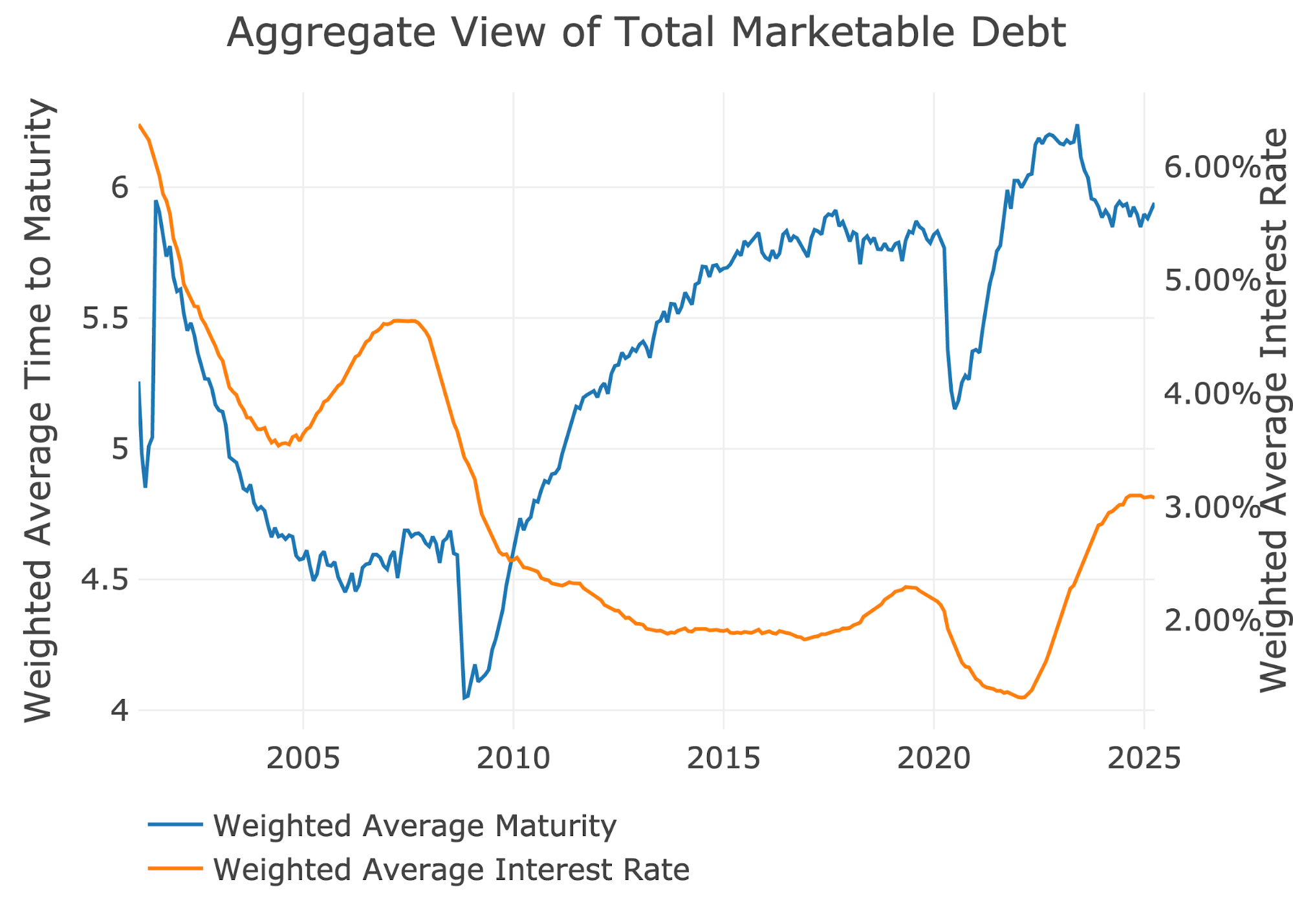

As illustrated on Chart 1, both the maturity of the debt and average interest rate are at high risk levels without a significant reduction of government spending.

In our opinion, the most acute danger facing the US government is still in the massive interest currently being paid on the debt.

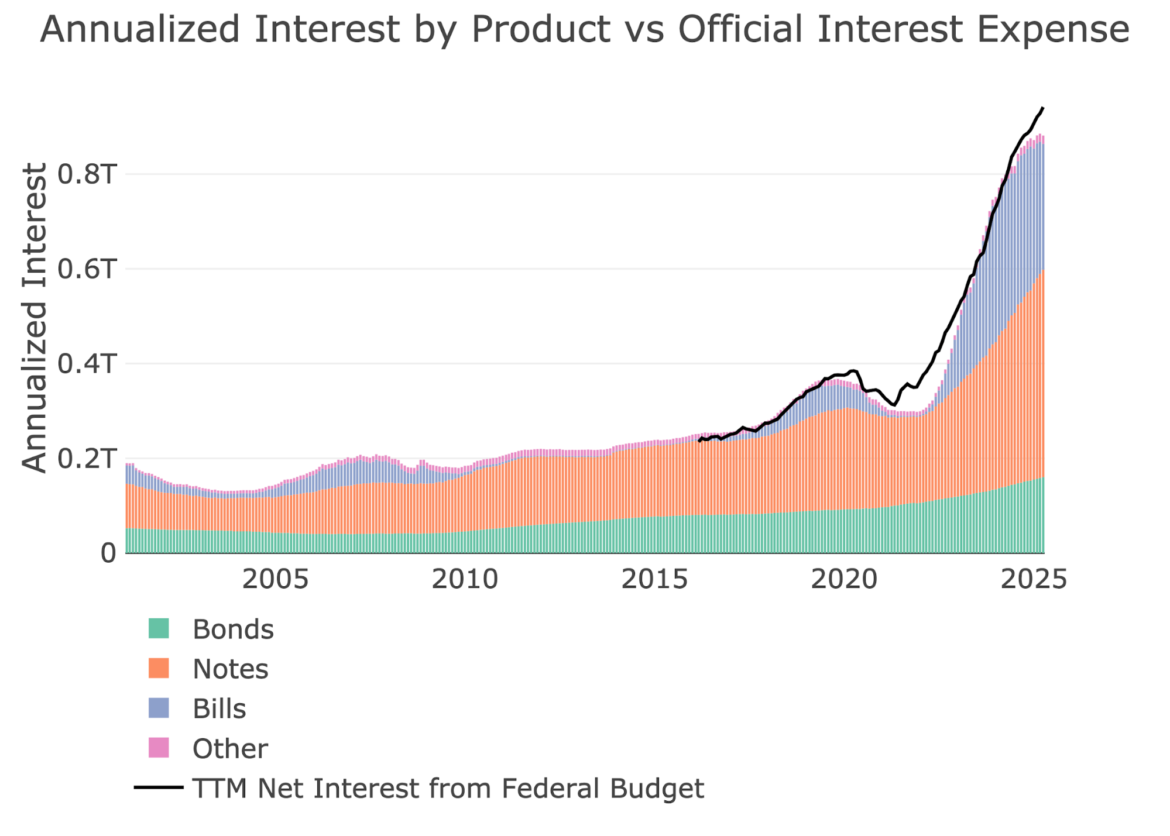

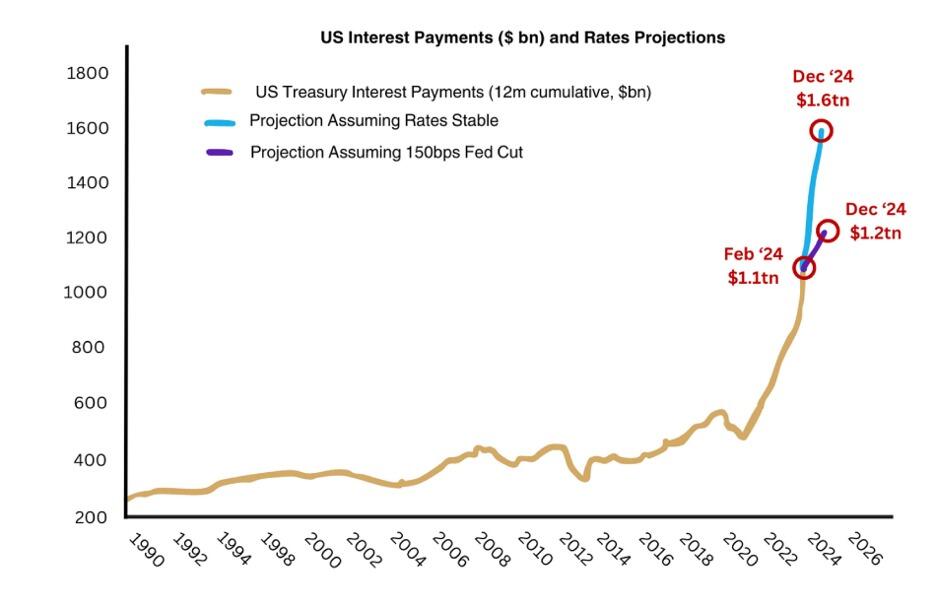

As shown on charts 2 and 3, the US debt service has risen to over $940 billion per year, or $2.5 billion every day of the week.

This means that of the $2.2 Trillion in new debt created during 2024, almost half of that was just for interest on the debt itself. That is a very dangerous financial position to be in while the Sovereign debt is being downgraded.

It seems the US Treasury is now absolutely haemorrhaging cash on debt service costs, which supports the strategy of owning hard assets.

Many Fed officials and market analysts have called the current fiscal situation unsustainable, which is an understatement.

The US fiscal situation has been called a ticking time bomb for the last 15 years.

The debt ceiling will likely get raised sometime in the next six months.

The US debt accumulation will continue to expand and at some point, there will be another debt and/or systemic banking crisis.

With Moody’s downgrade last Friday, it seems that the debt problem is no longer 10-20 years away and will likely impact the financial markets much harder than the recent tariff panic.

As such, physical Gold and Silver are truly the everything hedge for the long-term investor.

We believe the recent pullback in Gold and Silver prices represents an opportunity to add to your current hard asset holdings before the next leg higher in prices.

At current prices, provident investors should consider the time proven monetary benefits of owning Gold and Silver as a cornerstone asset within a diversified portfolio.

Chart 4 – Gold AUD

Chart 5 – Silver AUD

Sanctuary Cove Boat Show Weekend Ticket Giveaway Announcement!!

We are pleased to announce a special giveaway: five lucky individuals will each receive two complimentary tickets to the Sanctuary Cove Boat Show. This is a wonderful opportunity to enjoy the event with a guest of your choice—on us.

To participate, simply fill out this online form here with the following information – Your first and last name, date of birth and phone number.

The winners will be selected at random and notified.

*By entering this competition, you consent to receiving marketing communications, promotional offers and other updates from GBA Group. You can unsubscribe at any time by emailing [email protected]*

This publication has been prepared for the GBA Group Companies. It is for education purposes only and should not be considered either general of personal advice. It does not consider any particular person’s investment objectives, financial situation or needs. Accordingly, no recommendation (expressed or implied) or other information contained in this report should be acted upon without the appropriateness of that information having regard to those factors. You should assess whether or not the information contained herein is appropriate to your individual financial circumstances and goals before making an investment decision, or seek the help the of a licensed financial adviser. Performance is historical, performance may vary, past performance is not necessarily indicative of future performance. Any prices, quotes or statistics included have been obtained from sources deemed to be reliable, but we do not guarantee their accuracy or completeness.