Central Banks Look to Gold and Silver as Reserve Assets

Central Banks Look to Gold and Silver as Reserve Assets

The precious metals complex has shown remarkable resilience and strength throughout 2025, which has created opportunities for short-term traders, longer-term investors and central banks.

And even though the Northern Summer Doldrums dampened trading activity and narrowed the trading ranges last week, both the technical and fundamental prospects are still very bullish for physical Gold and Silver.

Gold priced in USD traded in a $60.00 range from top to bottom last week and closed fractionally lower at $3350.00. This was the tightest weekly trading range since mid-December of 2024.

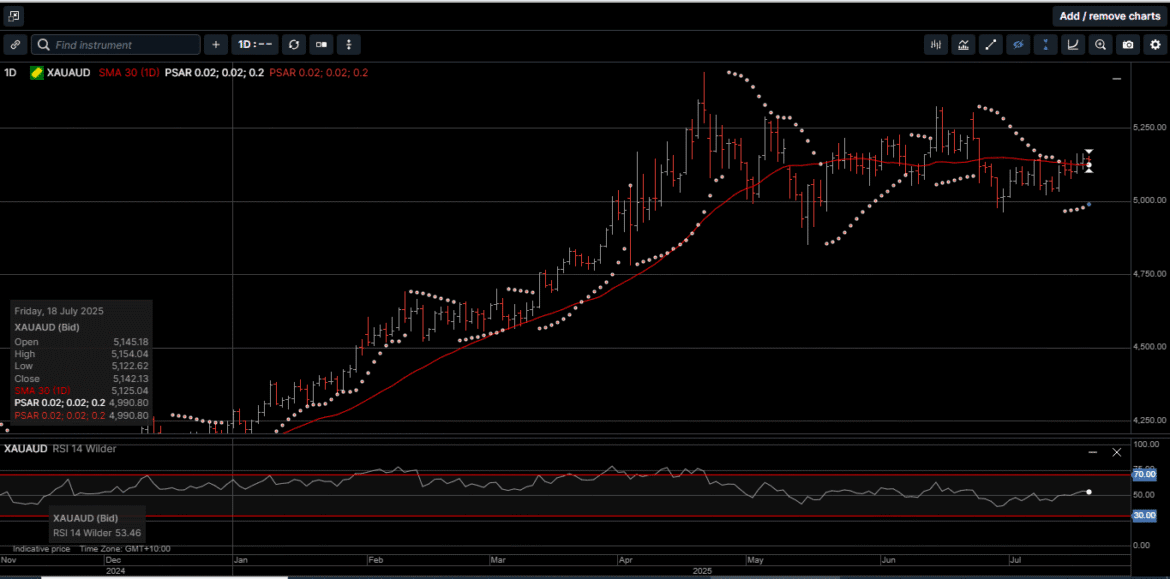

Gold denominated in AUD gained 1% on the back of weakness in the AUD/USD and closed at $5142.00. This is the first weekly close above the 30-Day Moving Average since June 20th, which suggests more upside range extension.

Silver priced in USD raced to a new 14-year high at $39.15 last Monday before drifting lower to close the week half a percent lower at $38.20.

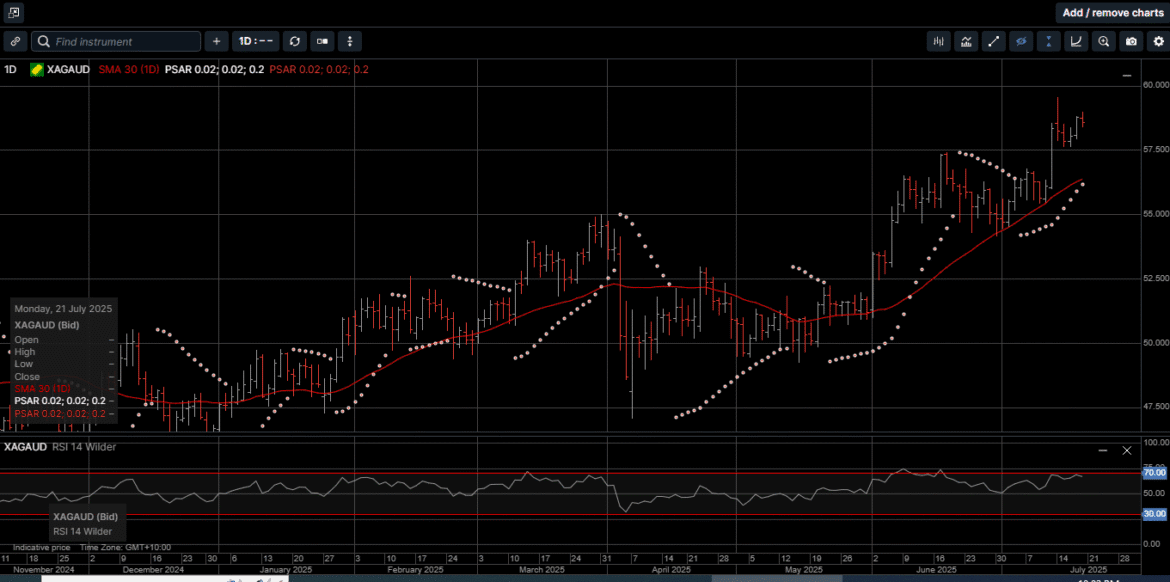

AUD based Silver followed a similar pattern and posted a new all-time high at 59.55 last Monday. The weaker AUD allowed for a fractionally higher weekly close at $58.60.

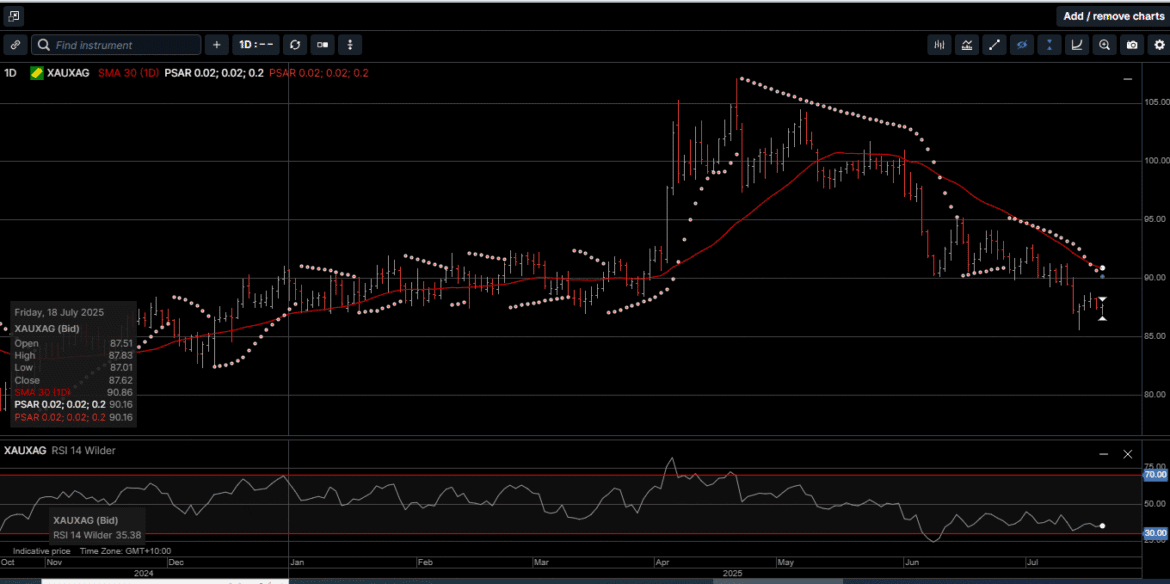

As illustrated on Chart 1, the Gold versus Silver ratio slipped to a seven-month low in favor of Silver at 87.60. That means it takes 87.60 ounces of Silver to equal the price of one ounce of Gold.

This ratio stood at 107.00 on April 22nd, which means physical Silver has outperformed Gold on a relative price basis by 18.1% over the last three months.

As such, we expect some degree of mean reversion higher in favor of Gold before the next leg lower into the low 80.00 handle, which was last seen in October of last year.

In other words, Gold could outperform Silver on a near-term basis.

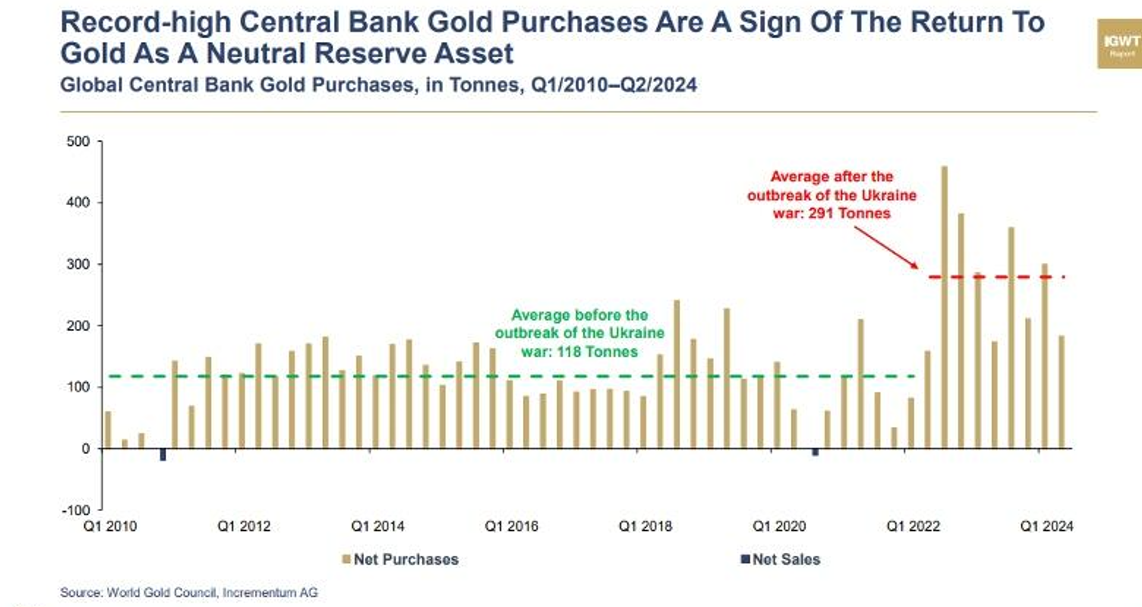

As shown on Chart 2, since 2021, central banks have bought an unprecedented amount of Gold, significantly contributing to this year’s rally and consecutive all-time highs.

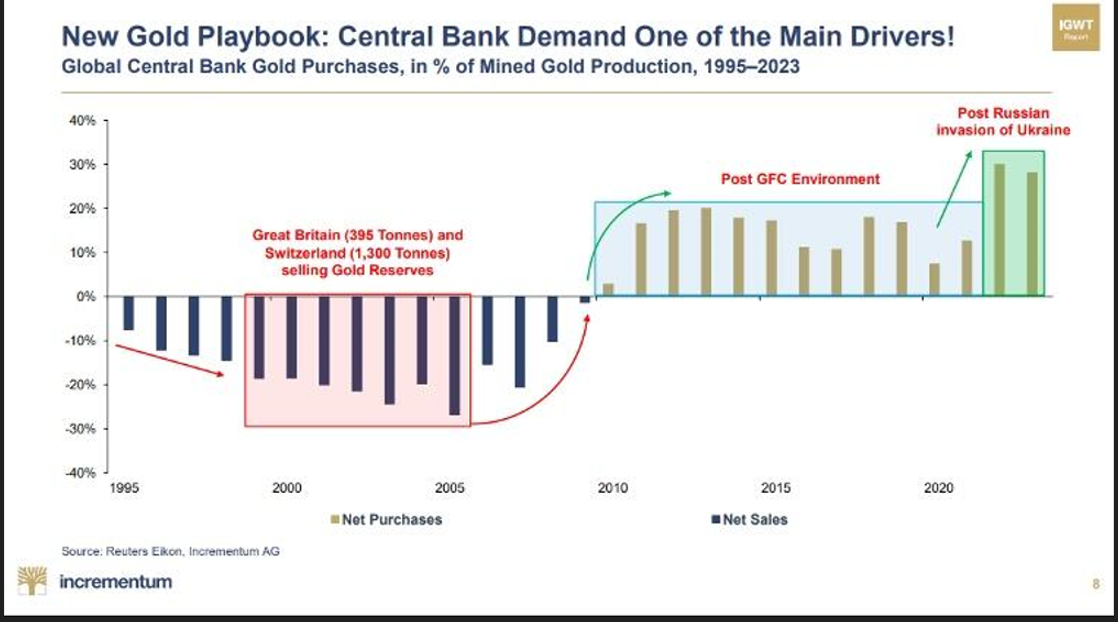

In fact, as shown on Chart 3, central banks are buying an increasingly large percentage of all of the Gold being extracted by mining operations around the world.

The question now is whether one central bank’s diversification can have the same effect on other precious metals ?

According to a report published last week, the Russian government is considering spending 51 billion rubles ($535 million USD) over the next three years to replenish its precious metals reserves.

While Gold has been an important asset in foreign reserves, the proposal indicates that the Russian government is looking to expand its holdings to include Silver and Platinum group metals.

The draft budget did not include extensive details regarding a potential purchasing program; however, some analysts suggest that Silver’s inclusion in foreign reserves could generate new investor interest, reestablishing it as an official monetary metal.

Central banks stopped accumulating Silver in the mid-1850s, as most central banks moved away from the Silver standard as a strategic reserve asset.

However, some analysts point out that while Silver remains an attractive monetary asset among retail investors, nations like Russia and the other BRICS members may be more interested in maintaining a strategic supply of the precious metal due to its industrial usage.

Silver is a crucial precious metal in the alternative energy sector.

According to the Silver Institute in Washington D.C., industrial consumption of Silver is expected to rise by 10% to 710 million ounces this year.

Conversely, the Silver market is anticipated to experience its second-highest supply deficit on record, driven by demand from the solar sector, with Silver demand for photovoltaic (PV) solar panels expected to increase by 20% to 230 million ounces.

In short, while 60% of Silver demand is from industrial applications, it seems like central banks, as well as investors, have not dismissed Silver’s role as a secure monetary asset.

It’s clear that global demand for both Gold and Silver is growing.

Precious metals have been one of the best performing assets in the world over the last few years, thriving while many other assets have underperformed.

Investors with a longer-term time horizon can follow the logic of central banks and use Gold and Silver to protect and grow their wealth for the future.

With Gold and Silver currently trading off the previous highs, now is the time to consider adding more safe haven assets to your long-term, diversified wealth creation strategy.

Chart 4 Gold AUD

Chart 4 Silver AUD

This publication has been prepared for the GBA Group Companies. It is for education purposes only and should not be considered either general of personal advice. It does not consider any particular person’s investment objectives, financial situation or needs. Accordingly, no recommendation (expressed or implied) or other information contained in this report should be acted upon without the appropriateness of that information having regard to those factors. You should assess whether or not the information contained herein is appropriate to your individual financial circumstances and goals before making an investment decision, or seek the help the of a licensed financial adviser. Performance is historical, performance may vary, past performance is not necessarily indicative of future performance. Any prices, quotes or statistics included have been obtained from sources deemed to be reliable, but we do not guarantee their accuracy or completeness.