2026 and The Everything Bubble

It is not unusual for the precious metals complex to trade in narrow ranges during the Christmas and New Year holiday period.

That did not happen this year.

To the contrary, the strong 2025 rally experienced an end of year crescendo as Gold, Silver and Platinum all reached new all-time highs on December 29th.

Since our last newsletter was posted on December 22nd, we will use the December 19th closing prices as our points of reference.

Physical Gold priced in USD posted an all-time high at $4550.00 and rose 3.9% since December 19th to close at $4508.00.

Gold denominated in AUD reached a new all-time high at $6778.00 and gained 3.1% to close out last week at $6734.00.

Physical Silver priced in USD soared to a new high at $83.54 and settled last week at $79.90, which is 19% higher than the December 19th close.

Silver denominated in AUD came within a whisker of $125.00 and closed out last week 17.7% higher at $119.25.

The Gold versus Silver ratio reached a 13-year low of 53.80 in favor of Silver on December 29th and finished last week 12.6% lower at 56.30.

That means it takes 56.30 ounces of Silver to equal the price of one ounce of Gold.

Physical Platinum posted a new all-time high at $2491.00 and finished last week at $2275.00, which is 15.5% higher than the December 19th close.

The precious metals and Wall Street have both started 2026 on a solid footing, which is not typical. For much of the last 50 years, investor logic was governed by a simple rule: buy equities for growth, representing a bet on a prosperous future, and buy hard assets as a safe-haven, serving as insurance against economic uncertainty.

During 2025, this logic was dissolved.

We observed a profound and counterintuitive anomaly in American markets last year.

Some analysts have called it an Everything Bubble where both risk assets and safe havens are simultaneously hitting record highs.

It seems the sheer volume of global liquidity has overpowered traditional fundamentals, leading to a structural breakdown in market pricing.

In other words, it looks like investors are buying both the speedboat for sunny weather and the lifeboat for the storm at the same time.

In short, risk boundaries have blurred and we see opportunities for long-term investors when the risk boundaries reset sometime during 2026.

Financial markets have seen liquidity-driven manias before and there is money to be made when they unwind.

There was the 1979 inflation fear, when Gold, Silver and Platinum rallied as US consumer inflation reached levels over 15%.

There was the 1999 tech bubble, when the NASDAQ composite surged over 85% in a single year on the promise of the internet revolution.

And there was the 2008 to 2012 QE driven bailout of everything, when post-Global Financial Crisis balance sheet expansion explicitly targeted asset prices.

One could reasonably argue that in 2025 all three of these manias converged to create the Everything Bubble.

As 2026 commences, we have the 1999-style tech euphoria on Wall Street and the 1979-style inflation angst, all built on the 2008-style QE playbook, but on an unprecedented scale.

The difference is that in the past, each phase of the bubble unfolded sequentially.

Now, they overlap.

It is our view that the powerful structural force of central bank demand is supercharging this overlap, as governments have joined investors in buying Gold.

Central banks, particularly non-Western ones, bought over 1,000 tons of Gold each year over the last four years.

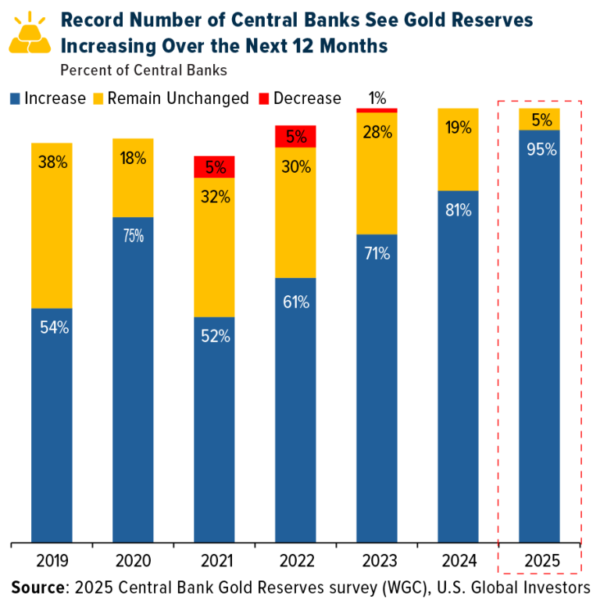

As illustrated on Chart 1, in a 2025 World Gold Council survey 95% percent of central banks expect their Gold holdings to rise over the next 12 months.

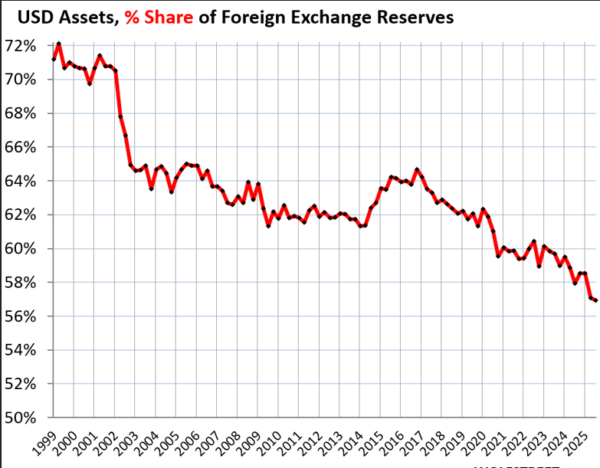

This is a clear, multi-decade hedge against USD-system risk, which, as shown on Chart 2, has been steadily declining as a global reserve asset.

Central banks and fiscal authorities face the reality of a global liquidity trap in 2026.

Specifically, the US Federal Reserve is caught in a policy trilemma; it must simultaneously maintain price stability (fighting inflation), ensure financial stability (preventing a crash on Wall Street), and support massive government deficits.

These mandates are in direct conflict with each other and have the potential to increase financial market volatility throughout 2026.

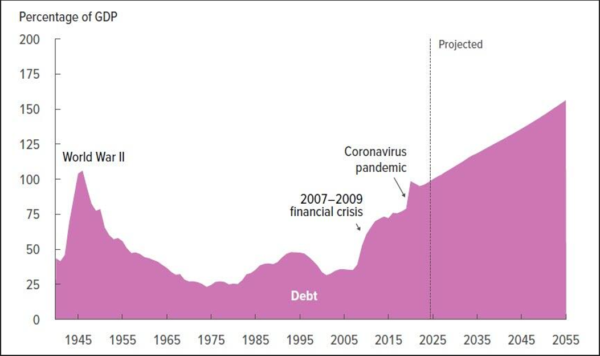

As shown on Chart 3, the US debt as a percentage of GDP only looks to get worse over time, which means the central bank will be forced to keep interest rates artificially low just to pay the interest on the debt.

Putting all of these themes together, we believe the elevated valuations in global equity markets represents the largest risk to investors’ long-term wealth.

Hard assets are the purest form of money with a time-proven track record of increasing wealth security.

As such, now is the time to consider rotating out of over valued, low performing equity assets and adding to long-term physical Gold, Silver and Platinum holdings.