Hard Assets Go Up as the US Government Shuts Down

Hard Assets Go Up as the US Government Shuts Down

Growing concerns about the European sovereign debt market and the government shutdown in the US kept the precious metals complex well bid last week.

After a sharp downside correction on Wednesday, Gold, Silver and Platinum prices reversed higher further extending yearly gains.

Physical Gold priced in USD posted a new all-time high at $3895.00 and finished the week 3.4% higher at a new all-time high close at $3886.00.

Gold denominated in AUD also reached a new all-time high at $5898.00 on the way to a weekly gain of 2.5% and a new high closing price at $5884.00.

Physical Silver priced in USD tagged an intraday high of $48.35 last Friday and closed out the week 4.2% higher at $48.00, which is the highest level since May 2011.

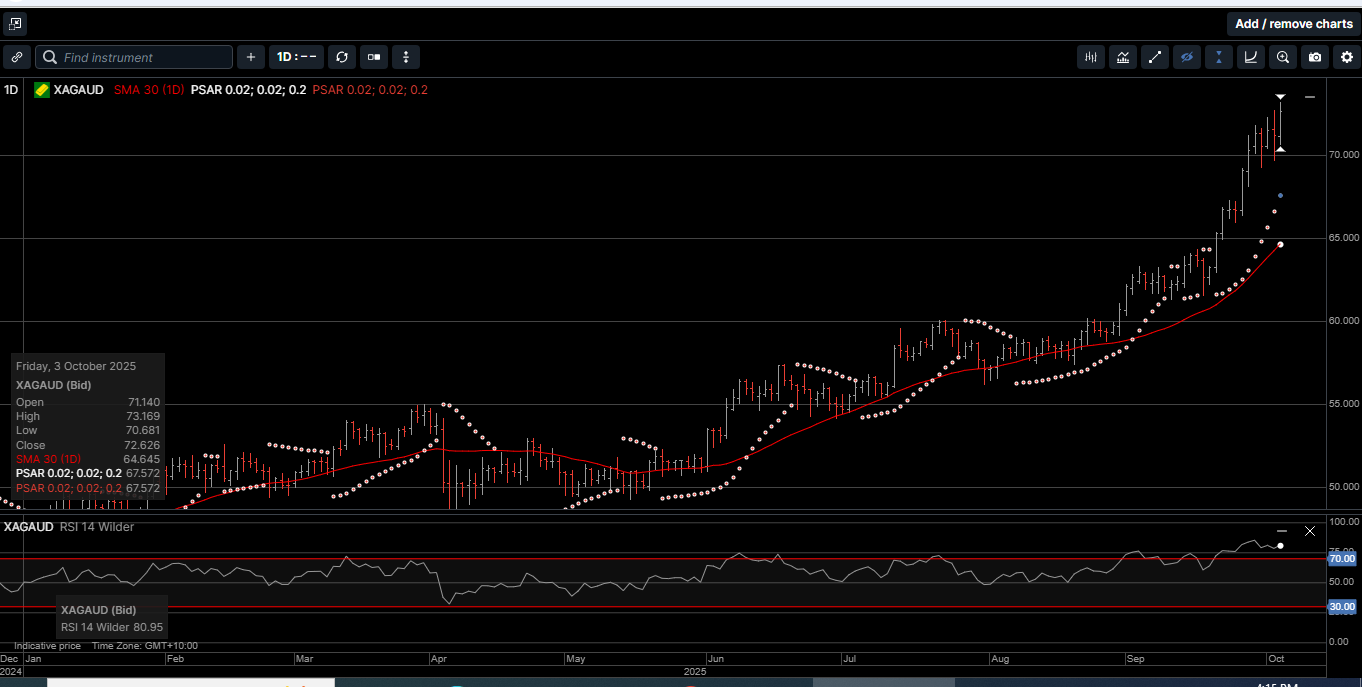

Silver based in AUD cracked the $73.00 barrier to hit a new all-time high of $73.20 before drifting lower into the weekend with a 3.3% gain to close at $72.60.

The Gold versus Silver ratio slipped 1.1% lower in favor of Silver to settle at a 52-week low at 80.70. This means it takes 80.70 ounces of Silver to equal the price of one ounce of Gold.

Physical Platinum prices traded with an upward bias, posting a high of $1626.00 on the way to a 1.3% weekly close at $1601.00, which is the highest-level since February 2013.

Last week’s recovery from the midweek selloff underscores the strong institutional buying interest in Gold and the increasing attraction to Silver and Platinum.

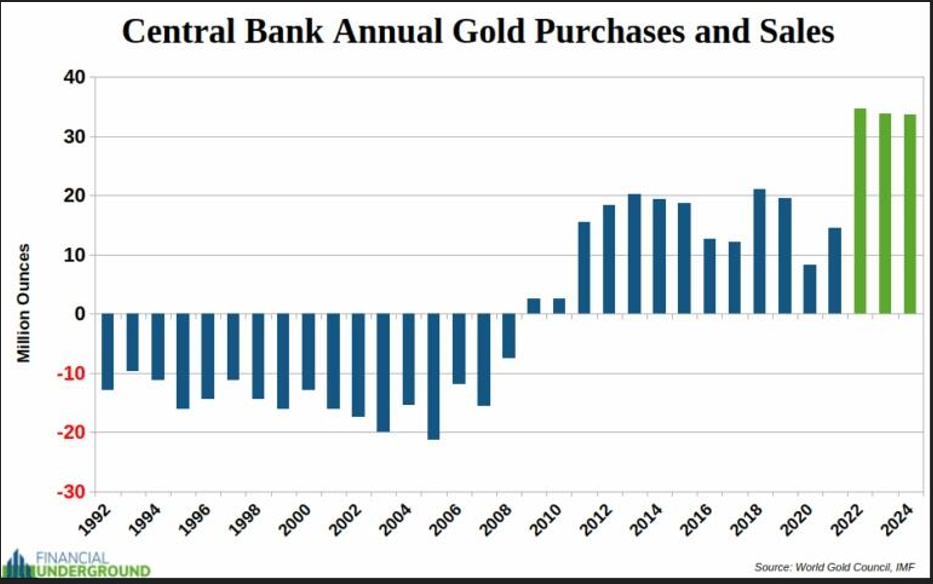

Over the last four years, central banks worldwide have been on a gold-buying spree, accumulating the precious metal at rates not seen in decades.

This strategic shift represents a fundamental change in how these institutions view their reserve assets in an increasingly uncertain global economy.

The trend has accelerated steadily since 2021, with central banks buying Gold and adding over 1,000 tons annually to their sovereign reserves.

The current buying trend marks a complete reversal from previous decades.

As illustrated on Chart 1, between 1992 and 2009, central banks were net sellers of Gold.

Since 2010, they’ve transformed into aggressive net buyers, with the pace accelerating dramatically after 2020 and not showing any signs of slowing this year.

This transformation reflects a significant reevaluation of Gold’s role in monetary policy and reserve management.

Central banks and institutions that once viewed Gold as an outdated relic now consider it an essential strategic asset.

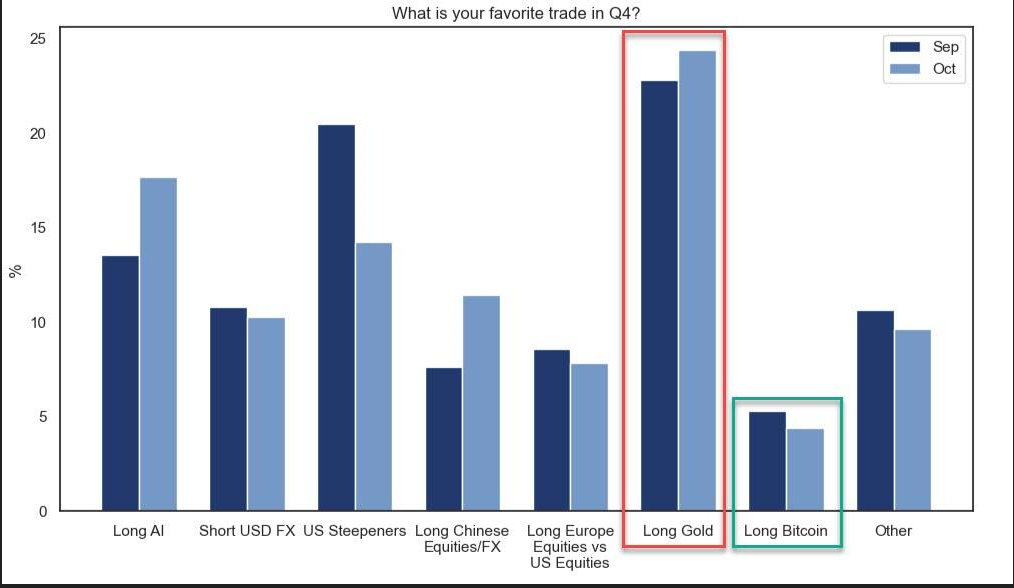

In fact, as shown on Chart 2, a recent survey of money managers claimed that Gold was their preferred trade for the remainder of 2025 and into 2026.

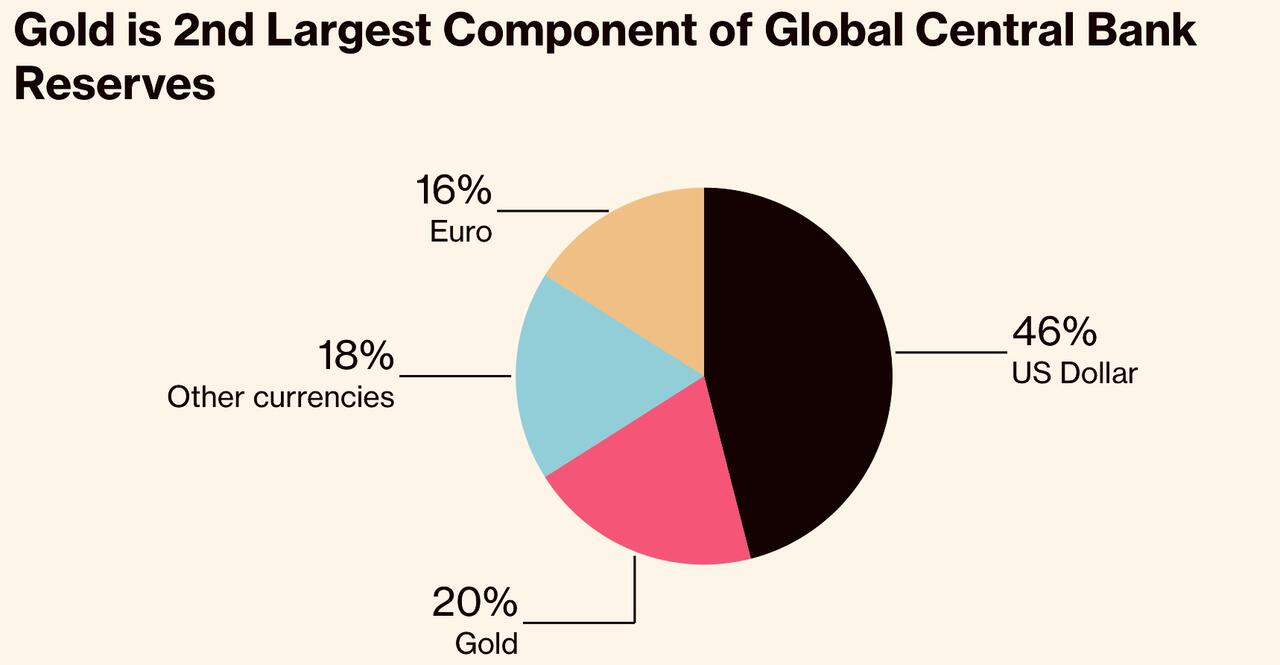

The most frequently cited reason for central bank gold purchases is diversification away from US dollar-denominated assets. While the USD remains the world’s primary reserve currency, its dominance has gradually eroded.

As shown on Chart 3, the share of global reserves denominated in USD has declined to 46% as the share of Gold reserves has increased to 20% and is growing.

The active pace of central banks buying Gold represents more than just a temporary trend; it signals a fundamental reevaluation of the role of Gold, Silver and Platinum as secure monetary assets in the international financial system.

This shift reflects deep concerns about the stability of the current fiat currency system, growing geopolitical tensions, and the search for financial security in an increasingly uncertain world.

For provident investors looking for a store of value and long-term wealth creation, the message is clear: Gold, Silver and Platinum remain essential assets within the current global financial environment.

And as evidenced by the powerful seven-week rally in the precious metals complex since early August, their popularity appears to be growing rather than diminishing as we move toward the end of 2025.

Chart 4 Gold AUD

Chart 5 Silver AUD

This publication has been prepared for the GBA Group Companies. It is for education purposes only and should not be considered either general of personal advice. It does not consider any particular person’s investment objectives, financial situation or needs. Accordingly, no recommendation (expressed or implied) or other information contained in this report should be acted upon without the appropriateness of that information having regard to those factors. You should assess whether or not the information contained herein is appropriate to your individual financial circumstances and goals before making an investment decision, or seek the help the of a licensed financial adviser. Performance is historical, performance may vary, past performance is not necessarily indicative of future performance. Any prices, quotes or statistics included have been obtained from sources deemed to be reliable, but we do not guarantee their accuracy or completeness.