Gold and Silver Rally as the FED Pivots to Easing

Gold and Silver Rally as the FED Pivots to Easing

In his keynote address at the Jackson Hole symposium last Friday, FED chief Jerome Powell laid the groundwork for the next US easing cycle, which could commence as early as the FOMC meeting on September 17th.

Mr. Powell’s dovish tone and specific details about the central bank’s future interest rate policy pressured the USD lower and boosted risk asset prices across the board, especially physical Gold, Silver and Platinum.

Gold priced in USD broke out of its slumber and closed 1.1% higher at $3371.00. Daily chart points suggest a break of $3410.00 could signal range extension to the upside.

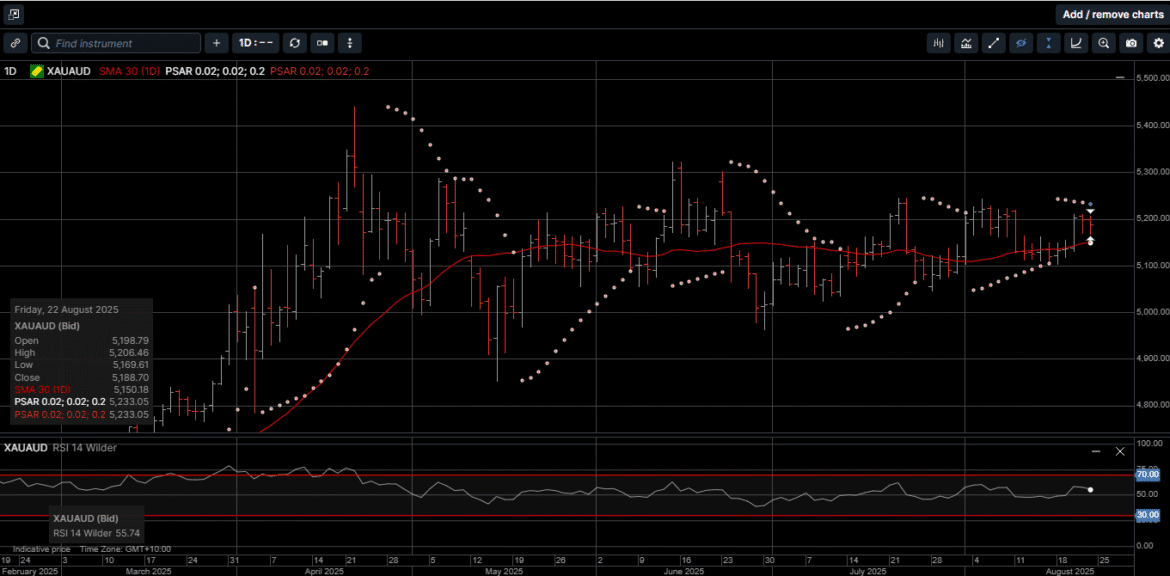

Gold denominated in AUD finished the week 1.3% higher and closed at $5188.00. The next level of chart resistance is near $5240.

Silver priced in USD posted a one-month high at $39.10 before slipping slightly to finish the week 2.3% higher at $38.90.

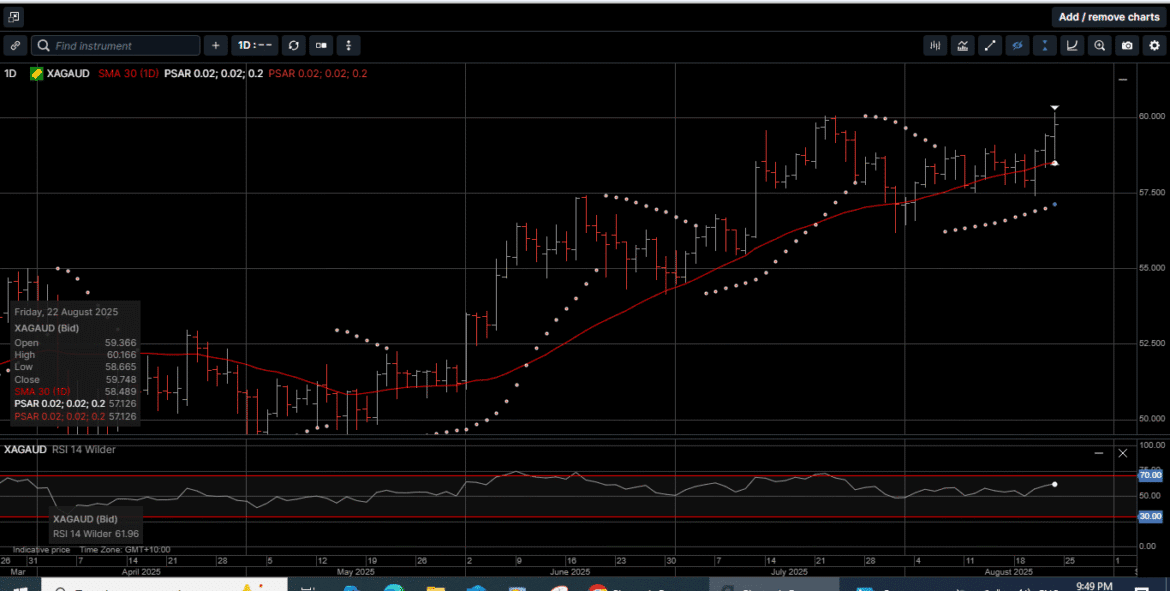

Silver based in AUD reached a new all-time high at $60.20 and closed out the week 2.4% higher at $59.75.

The internal momentum indicators for Silver in both currencies are pointing higher but are not in overbought territory, which is a bullish chart pattern.

The Gold versus Silver ratio slid to a one-month low at 86.25 in favor of Silver and closed at 86.60. This means it takes 86.60 ounces of Silver to equal the price of one ounce of Gold.

Since the ratio hit 107.10 on April 22nd, Silver has outperformed Gold by almost 20%.

Physical Platinum reached its 30-Day Moving Average near $1385.00 for the first time in a month on the way to a 1.3% gain to close at $1365.00. The $1300.00 level now looks to be a durable low and could support higher prices.

A phrase often used by Mr. Powell, as well as all FOMC officials, is that the FED has a dual mandate of maximum employment and moderate 2% inflation.

In this regard, it’s worthwhile to review three specific themes from Mr. Powell’s speech.

First, over the last 6 months, an often-repeated reason the FED has held the FED Funds rate unchanged stems from the central bank’s concerns about the implied increase of inflation due to the impact of tariffs.

Most tariff-based inflation models assume import costs would rise as firms increased prices and passed them through to consumers.

The fact that many exporters to the US have absorbed a significant amount of the tariff costs explains why the FED’s expected rise in consumer inflation has not materialized.

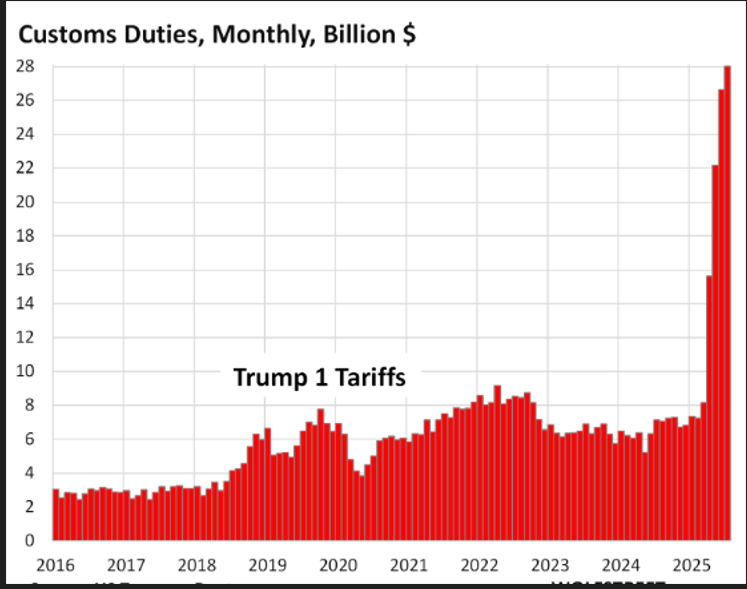

Further, as illustrated on Chart 1, the amount of customs revenue has tripled since 2024.

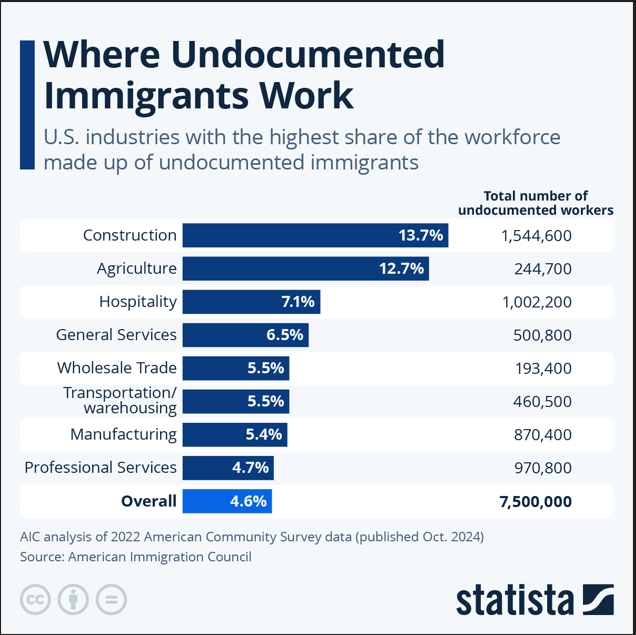

Second, the recent weakness in US job creation is more a function of a rebalancing of the Labor force as opposed to a cyclical downturn in the employment outlook.

In simple terms, as shown on Chart 2, the number of undocumented migrants who have left the workforce for various reasons including deportation this year is estimated to be over 2.5 million.

On the other side of the coin, many American firms, as well as foreign companies, have made large financial commitments to re- shore manufacturing operations back in the USA.

As such, the current weakness in job creation could bottom out early in 2026 and prevent an employment-based recession.

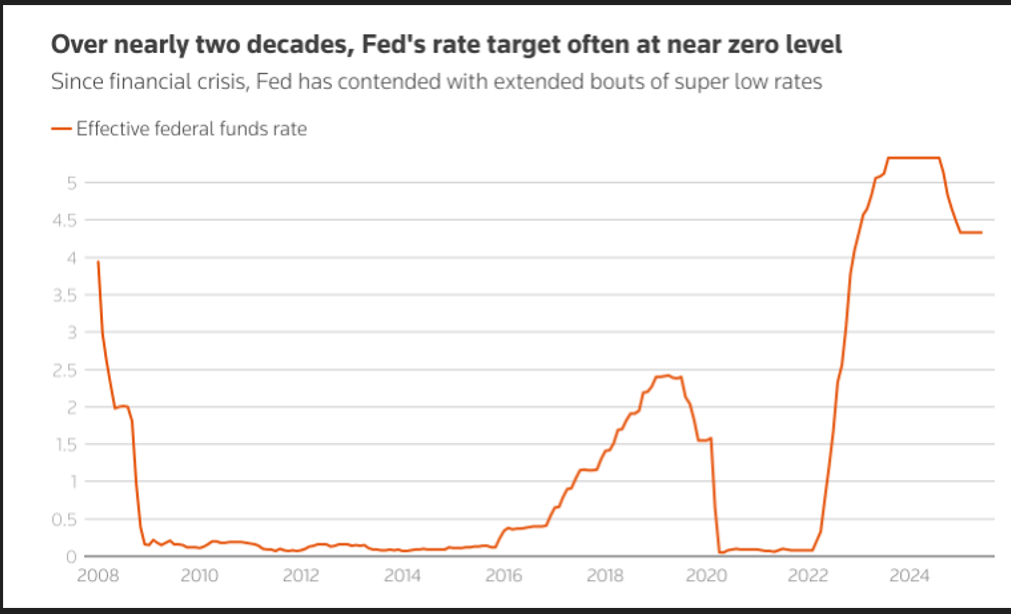

This could lead to a period of economic stagflation, which is characterized by slower growth, lower interest rates and higher prices for hard assets. Third, Mr. Powell said that the current FED

policy is “mildly restrictive” and that the neutral rate for the FED Funds is 100 to 125 basis points lower than the current 4.25 to 4.50 target band.

As shown on Chart 3, over the last 15 years, the FED Funds rate has spent quite a bit of time below the neutral rate and very close to the zero level.

From an investment perspective, we believe that an easing cycle of that magnitude would be negative for the USD and very bullish for Gold, Silver and Platinum prices.

And even though Wall Street stocks also got a boost from the FED’s pivot to easing, it appears that many investors are overweight top heavy paper assets, and underweight safe haven assets.

Gold, Silver and Platinum have acted as a store of value and secure wealth generation for hundreds of years.

The precious metals are the definition of money; precious metals cannot go bankrupt and have outperformed almost every equity index over the last two years.

With the FED on the cusp of what could be a multi-year easing cycle, now is the time to consider rebalancing your wealth creation strategy and make Gold, Silver and Platinum your cornerstone long-term assets.

Chart 4 Gold AUD

Chart 5 Silver AUD

This publication has been prepared for the GBA Group Companies. It is for education purposes only and should not be considered either general of personal advice. It does not consider any particular person’s investment objectives, financial situation or needs. Accordingly, no recommendation (expressed or implied) or other information contained in this report should be acted upon without the appropriateness of that information having regard to those factors. You should assess whether or not the information contained herein is appropriate to your individual financial circumstances and goals before making an investment decision, or seek the help the of a licensed financial adviser. Performance is historical, performance may vary, past performance is not necessarily indicative of future performance. Any prices, quotes or statistics included have been obtained from sources deemed to be reliable, but we do not guarantee their accuracy or completeness.