Gold Replaces the Euro as the Second Most Widely Held Reserve Asset

Gold Replaces the Euro as the Second Most Widely Held Reserve Asset

As the first half of 2025 draws to a close, financial markets seem to be reflecting a sense of uncertainty as opposed to optimism.

And even though the USD Index dropped to a three-year low last week, the de-escalation of hostilities in the Middle East removed enough of the safe haven bid to push the precious metals complex lower.

However, considering the looming reciprocal tariff deadline on July 9th and increasing pressure on the US Federal Reserve to lower interest rates, it’s reasonable to expect support levels in Gold and Silver to hold and prices to move higher over a longer-term time horizon.

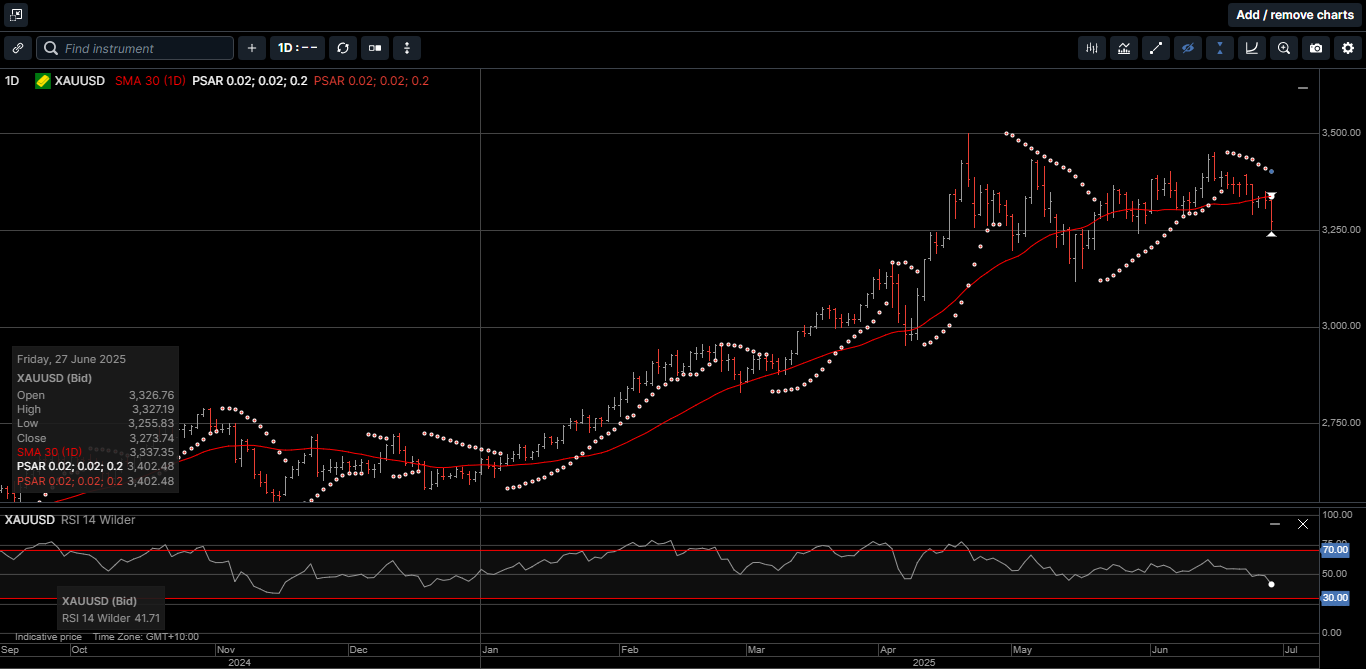

Physical Gold priced in USD fell to a one-month low at $3255.00 and finished the week 2.8% lower at $3273.00.

Gold denominated in AUD was also under pressure, posting a low at $4980.00 and closing down 3.9% at $5009.00.

Going forward, a daily close above the 30-day moving averages would improve the technical tone. Those levels are at $3337.00 and $5145.00, respectively.

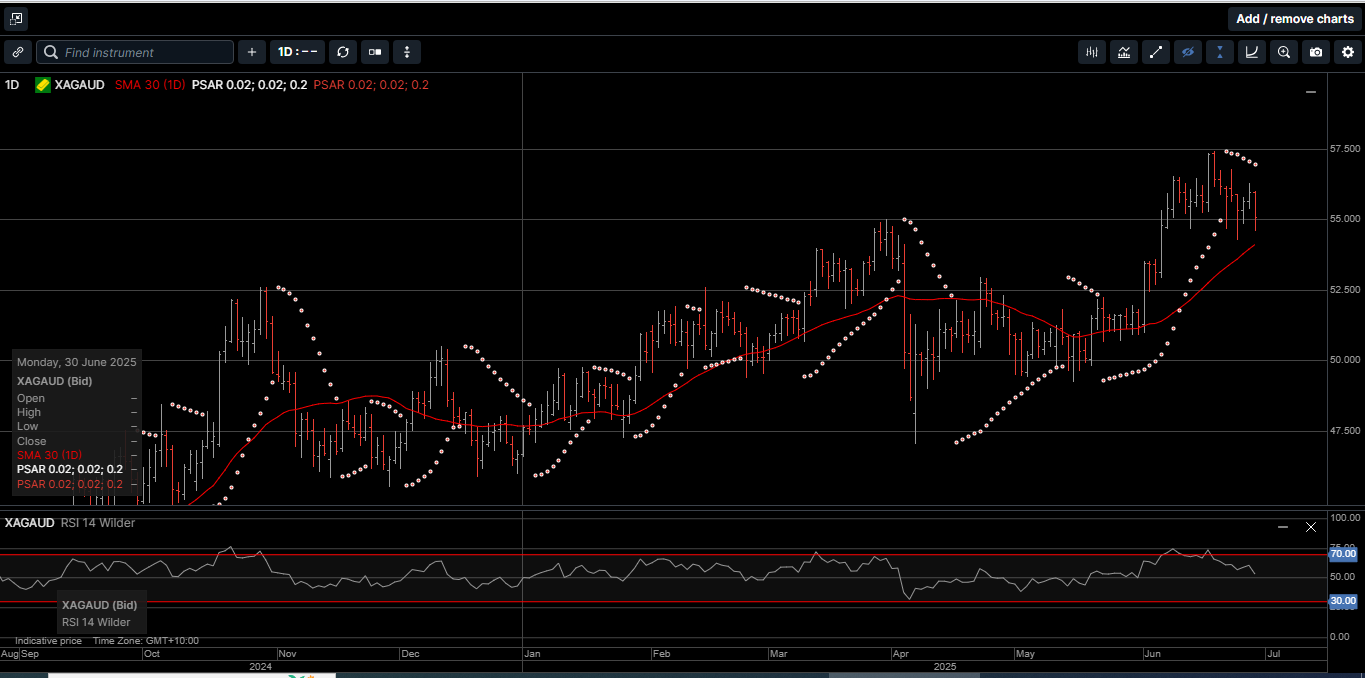

Physical Silver priced in USD traded in wide intraday ranges but finished the week pretty much unchanged at $35.98, while AUD based Silver slipped 1.4% lower to close at $55.05.

Silver prices based in both currencies have traded above their respective 30-day moving averages since May 19th, which is a bullish signal.

The Gold versus Silver ratio fell to a three-month low at 89.90 and settled at 90.90. This means it takes 90.90 ounces of Silver to equal the price of one ounce of Gold.

With many investors focused on developments in the Middle East last week, a report about the composition of global central bank reserves was largely overlooked.

The USD Index, when measured against a basket of other major currencies, has declined by approximately 10% this year and is currently trading at its lowest level since 2021.

That’s no small dip, and there may be additional downside risk due to concerns over America’s growing deficits and the ongoing fluctuations in tariffs.

Two of the biggest beneficiaries of the USD’s weakness have been Gold and Silver. Priced in dollars, the precious metals have tended to move inversely with the USD’s value.

As illustrated on Chart 1, that inverse relationship has been on full display this year, with Gold trading near $3,500 per ounce in late April before consolidating lower over the last several weeks.

Even at these elevated prices, central banks around the world have continued to accumulate Gold.

According to the World Gold Council (WGC), central bank Gold purchases exceeded 1,000 tons in each of the last three years, which is more than double the annual average of the previous decade.

In the latest indication of Gold’s rising prominence in international finance, the yellow metal has surpassed the Euro as the world’s second-largest reserve asset.

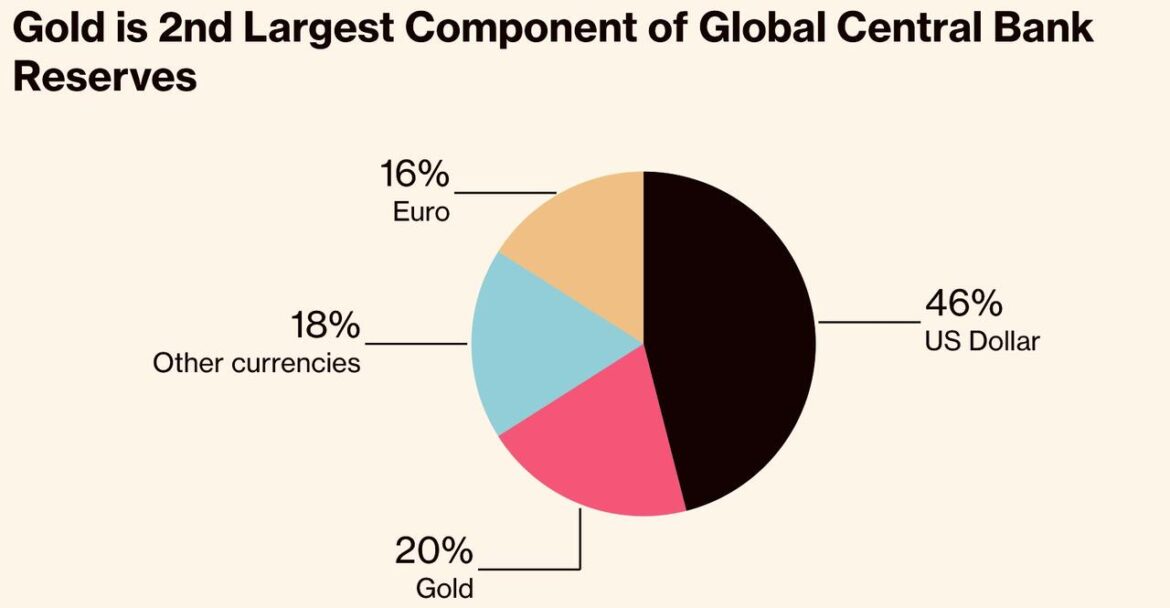

As shown on Chart 2, the USD represents 46% of central bank reserves, followed by Gold at 20%, the Euro at only 16%, while all other currencies collectively accounted for 18%.

It’s important to note this may understate the actual Gold share, given the questionable disclosure shrouding some central bank Gold-buying activity.

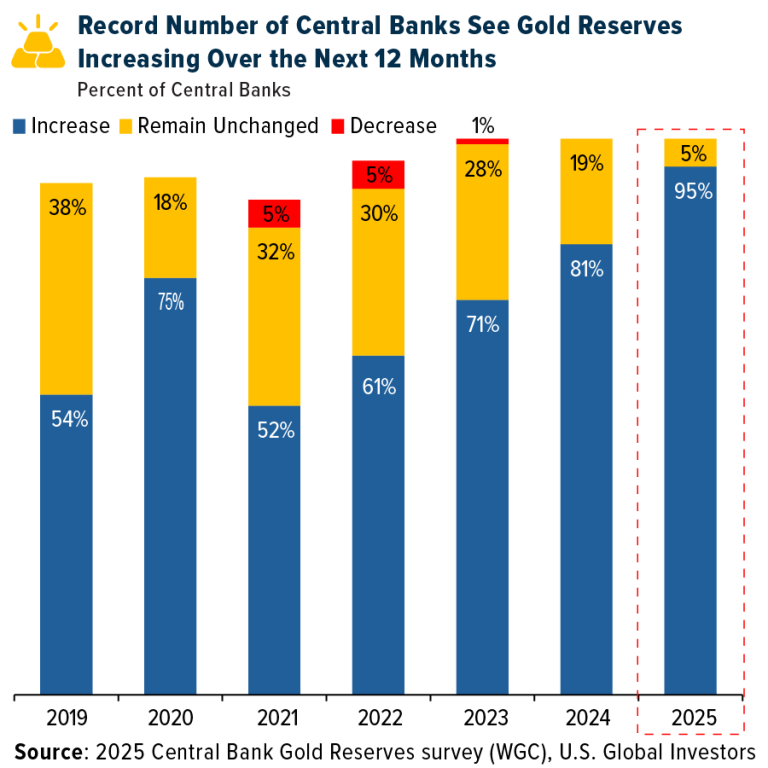

Further, as shown on Chart 3, this trend aligns with recent survey data from the WGC showing that 95% of central banks expect to increase their Gold reserves over the next 12 months.

That’s the highest figure since the WGC’s survey began.

To be clear, the USD isn’t going to lose its reserve status anytime soon. It still dominates global trade and debt markets, accounting for around half of the international transactions.

But its supremacy is gradually slipping, and the evidence is mounting.

That means investors of all levels of sophistication should think carefully about how exposed their portfolios are to paper assets or a single currency.

Just as central banks are hedging their USD exposure with physical Gold as well as Silver, individual investors may want to consider doing the same.

Gold and Silver have been the purest forms of wealth for centuries. They offer stability and diversification for investors looking to build long-term financial security.

With the recent pullback in prices, now is the time to consider adding to your physical Gold and Silver holdings before the next leg higher.

Chart 4 Gold AUD

Chart 5 Silver AUD

This publication has been prepared for the GBA Group Companies. It is for education purposes only and should not be considered either general of personal advice. It does not consider any particular person’s investment objectives, financial situation or needs. Accordingly, no recommendation (expressed or implied) or other information contained in this report should be acted upon without the appropriateness of that information having regard to those factors. You should assess whether or not the information contained herein is appropriate to your individual financial circumstances and goals before making an investment decision, or seek the help the of a licensed financial adviser. Performance is historical, performance may vary, past performance is not necessarily indicative of future performance. Any prices, quotes or statistics included have been obtained from sources deemed to be reliable, but we do not guarantee their accuracy or completeness.