THE SLINGSHOT SETUP IN PRECIOUS METALS

Precious Metals Analysis – 9 March, 2021

by David J Mitchell, Founding Partner – Auctus Metal Portfolios

To break the price levels we have long been targeting into April / May 2021, namely ‘higher highs’ in Silver, Platinum & Gold, the metal markets have had to consolidate and build a strong base.

Powerful kinetic price energy builds up when the markets overextend themselves, developing what we refer to as a ‘slingshot’, where prices fall due to no apparent negative fundamentals and price momentum takes over (herd mentality). This has effectively pushed sentiment to record lows and presents an amazing contrarian buying opportunity. Slingshot physics involves the use of stored pressurized energy to shoot a projectile at a higher and greater speed moving forwards.

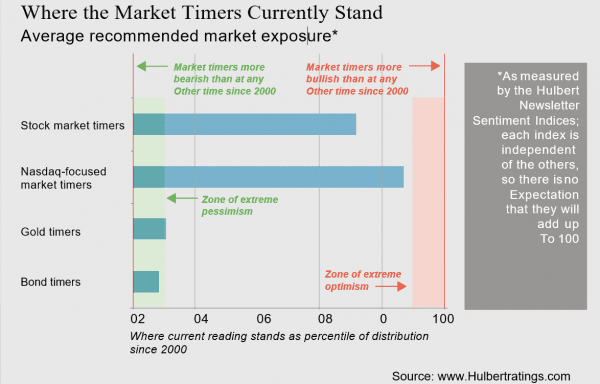

Where The Market Timers Currently Stand

Average recommended market exposure*

This chart demonstrates one of the most bearish bets that the Gold-timing community has made over the years. Only 5.6% of the HGNSI’s daily readings since 2000 have been lower than where this barometer stands currently.

Contrarians consider the prevailing sentiment to be in the “excessively bearish” zone whenever the HGNSI drops below the 10th percentile, therefore I believe the Gold market is now offering a low-risk buying opportunity.

This scenario has now clearly manifested itself in the precious metals space with the recent metal price falls driven by the sales rout in the global bond market.

From a macroeconomic standpoint, the stage has now been set for the next level of official Central Bank intervention, with the buying of long- dated duration debt for the sole purpose of launching Yield Curve Control (YCC). Once instigated, I expect it will be like lighting jet fuel underneath a rocket (precious metals) and this anticipated ‘slingshot effect’ will come into force.

During the Central Bank’s Jackson Hole Symposium in August 2020 the Federal Reserve, alongside the BOE (Bank of England) agreed upon a re- configuration of their respective mandates, namely their inflation targeting was now going to average with rates closer to 3% over a 3-year period using their highly manipulated (suppressed) CPI measurement of inflation. The Fed Chair Jerome Powell called this strategy “a flexible form of average inflation targeting” – which The Fed officials are calling FAIT (it has a telling ring to it)!

What they have essentially stated, is that they are therefore planning for inflation to run hot, whilst also setting a clear mandate in support of the growth of their balance sheets, in-line with their respective government fiscal spending plans.

This obviously supports direct government fiscal expansion and large- scale national infrastructure build-outs, designed to support considerably higher inflation rates in mitigation of what would otherwise unfold as a consequence of the catastrophic debt crisis.

Real Yields (Interest Rate Yields) are equal to Nominal Interest Rates minus Real Inflation.

Gold is being punished because the markets are seeing ‘real yields’ artificially shrink as nominal interest rates move higher, while real world inflation is not yet appearing in the CPI (inflation data). In reality, inflation is real and moving quickly higher. By way of illustration, I decided to analyse the last 4 months worth of commodity data that influences inflation directly, which also predominantly captures the significant rise in the long dated interest rates, so starting 1st November 2020 up until today:

WTI Oil: +81.6%, Wheat: +15%, Copper: + 31%, Sugar: +20%, Coal: +28%, Steel: +30%, Lumber: +78%, Olive Oil: +280%, Grains Index: + 23% and I will finish with the GSCI: +43%.

GSCI® is a composite index of commodity sector returns representing an unleveraged, long-only investment in commodity futures that is broadly diversified across the spectrum

of commodities. The index consists of 24 commodities from all commodity sectors.

Wow- no inflation there then!?

Our policy leaders presently require ‘real yields’ to be in healthy negative territory, thereby enabling the real destruction in the size / value of the debt- load by devaluing its value in currency terms (active monetary debasement). Real negative yields are extremely bullish for Gold and precious metals generally.

As the debt mountain continues to escalate, debt servicing has to remain economically viable, with higher interest rates unable to support this debt growth. Hence our global policy leaders cannot allow the interest rate yield curve to rise.

What Is Happening In The Debt Markets?

The sudden repricing of USD borrowing costs over the last 6 months (but in particular the last 5 weeks) has sent shock waves through debt markets in Europe, Latin America and Asia with interest rates rapidly tightening in regions that are still very much in severe economic distress.

The rising interest rates in the USA based on expectations of real world inflation feeding into the system is causing debt deflation pressures around the globe.

In a world where debt ratios surpass 360% of GDP, it only takes a small rise in global interest rates to inflict serious and long term economic harm.

THE COMMODITY SUPERCYCLE AND THE REVOLUTIONARY CHANGES IN GLOBAL DE-CARBONIZATION

Very Exciting News for Precious Metal Investors

A very brief description of what is a highly complex but extremely exciting horizon ahead for our investors, is the ongoing century of clean energy developments driven by environmental issues coupled with the constraints provided by the forecast commodity shortages that are essential to this new technology movement.

Not only have we squarely moved into a new and profound structural commodity supercycle (clearly predicted from a cycles perspective a number of years ago to commence between 2020 – 2021) but this far- reaching and wide-impacting paradigm shift has been supported by a revolutionary change and total re-engineering of the core energy-systems that power our world.

This is not about EV (electric vehicles) as they are in fact energy consumers that drain the system, for example electricity production that provides the energy to these vehicles that is stored in their battery packs, so effectively as a rough breakdown as of today:

- EV’s in France are 67% Nuclear and 12% Hydro

- EV’s in Germany are 24% Wind and 40% Coal & Gas

- EV’s in UK are 37% Gas, 24% Wind and 17% Nuclear

- EV’s in Canada are 58% Hydro, 18% Gas & Coal and 15% Nuclear

- EV’s in USA are 62% Gas & Coal and 20% Nuclear

- Electricity production World is 59% Gas & Coal, 16% Hydro and 10% Nuclear

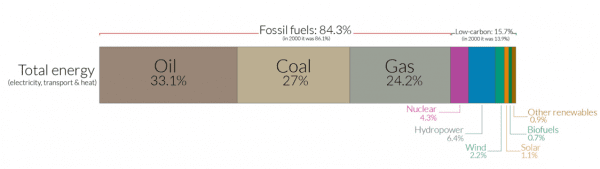

But more importantly Total Global Energy Requirements (electricity, transport & energy) is presently supplied by 84% fossil fuel carbons.

See: Country Source

Global government policy is now driven by an extremely powerful and influential green lobby with pollution policy controls pointing categorically to a de-carbonization of energy production facilities, alongside pollution control, through catalytic loadings and therefore a progressive and powerful move towards the New Hydrogen Economy (and away from carbon gas) including Solar power, Wind power, Hydropower and of course to a much lesser extent Nuclear.

Massive global governmental fiscal expansion is being driven into infrastructure builds from every corner of the world. Even The Straits Times carried a huge multi-page story on Friday 5th March, laying out Singapore’s vision for a Green and Sustainable Future and enhancing the framework around the Singapore Green Plan 2030: Read Here

I have personally not been a big fan of Gold in this particular cycle which started in 2016. Hence, over the last 4 to 5 years Gold has only comprised a very small percentage (less than 3%) of our basket of physical precious metals within Auctus Metal Portfolios

Platinum Group Metals have led this price revaluation charge (Rhodium, Palladium, Ruthenium). From the current perspective and moving forwards from today, the new clean energy revolution demands both Platinum and Silver as critical metals (along with several other commodities).

Platinum being the exclusive catalyst for Hydrogen Fuel Cells as well as the catalyst for Green Hydrogen Production (which will, in the near future, power our long-haulage trucks, ships, planes and power stations themselves) the future demand-curve for Platinum looks like a hockey stick and thus excites us tremendously.

Silver supply is being voraciously snapped up by investment demand which is competing with enormous and growing industrial demand, and at bullion dealer levels a very tight picture has developed in retail-sized products. Whilst our global network of refiners, mints and wholesalers are able to procure 1,000Toz Silver bars without issue, supply for the other retail products including coins is extremely tight and limited.

There is a plentiful supply of Gold currently, but as mentioned I am not a fan of Gold, based on our exhaustive analysis of the demand curves arising from the overall global macroeconomic capital flow picture.

We feel very strongly that the other precious metals will continue to outperform Gold on a yearly basis moving forwards. That said, we are bullish of a Gold price revaluation into 2024, but also point out that we believe silver will out perform gold over Platinum within that time frame.

Disclaimer:

This article is very much based on my opinion utilising hard research data. The information contained in our website and in this report should be used as general information only. It does not take into account the particular circumstances, investment objectives and needs for investment of any investor, or purport to be comprehensive or constitute investment advice and should not be relied upon as such. You should consult a financial adviser to help you form your own opinion of the information, and on whether the information is suitable for your individual needs and aims as an investor. You should consult appropriate professional advisers on any legal, taxation and accounting implications before making an investment.